Week in review

- Australian inflation 3.8% y/y in December

- Australia business conditions index rises 2%pts

- FOMC holds policy rate at 3.50-3.75%

Week ahead

- RBA official cash rate

- Eurozone CPI inflation

- U.S. ISM manufacturing

Thought of the week

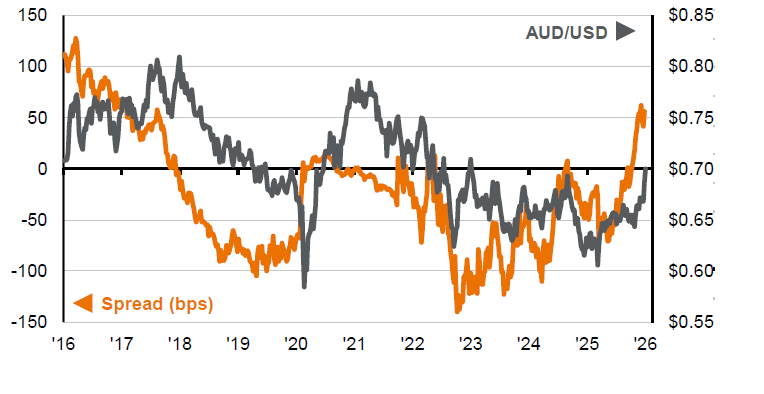

The December inflation report is likely to compel the RBA to back up their hawkish stance with a rate hike this week. In contrast, the U.S. Fed has indicated its next move is likely lower. This movement in rate differentials is supporting the Australian dollar, which has broken through 70 cents against the greenback for the first time in three years. A robust outlook for the Australian and global economies, sustained commodity demand, and ongoing USD hedging by large domestic investors are providing additional support for the Aussie. However, there is no certainty that either the Fed or the RBA will deliver the policy changes currently priced in by the market. The Fed is likely to proceed cautiously with easing, particularly if economic resilience persists. Similarly, the RBA may be slow to tighten further, especially if underlying inflation pressures moderate in the coming months. These factors could cap the upside for the currency.

Rate differentials suggest the AUD well supported

Australia less U.S. 2-year government bond yield

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 30/01/26.

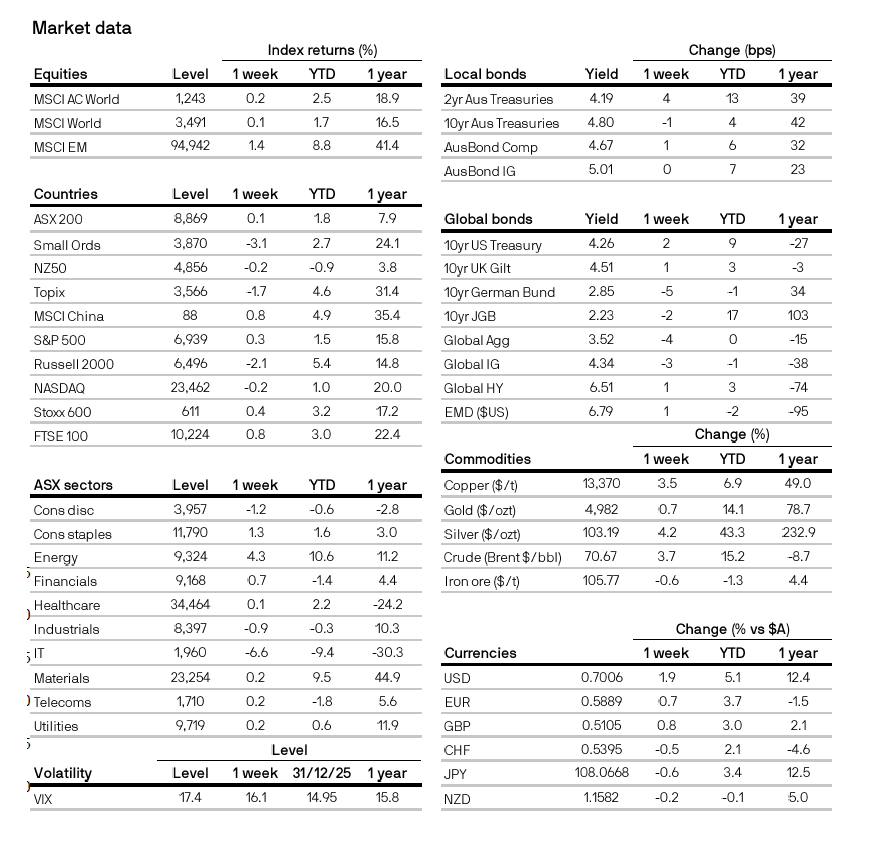

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

Material ID: 95e655c0-f9d9-11e8-bfcc-8e0bde0598ff