We anticipate another rate cut from the Fed in the first half of 2026 but believe that many other central banks are finished with rate cuts for this cycle.

In Brief

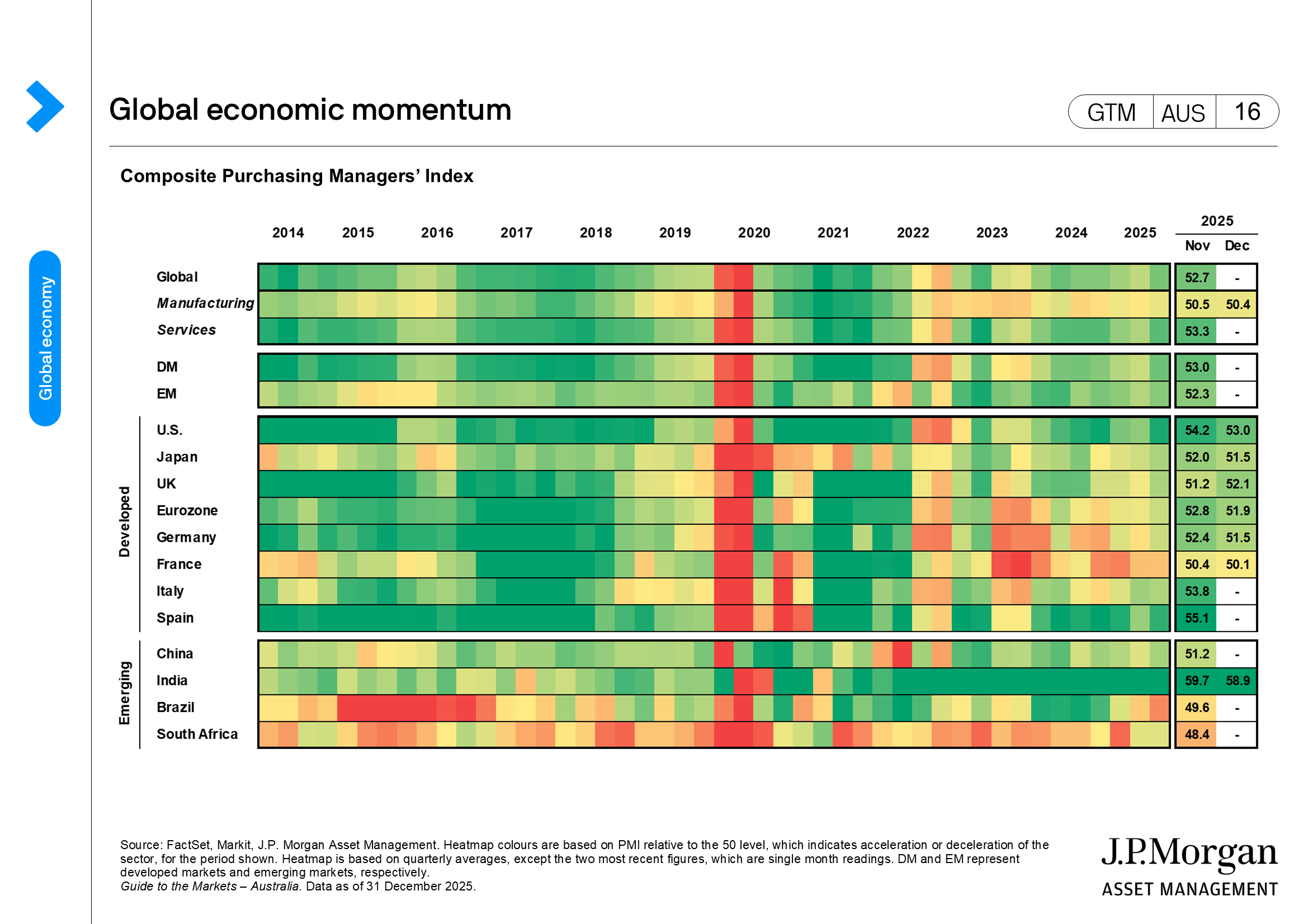

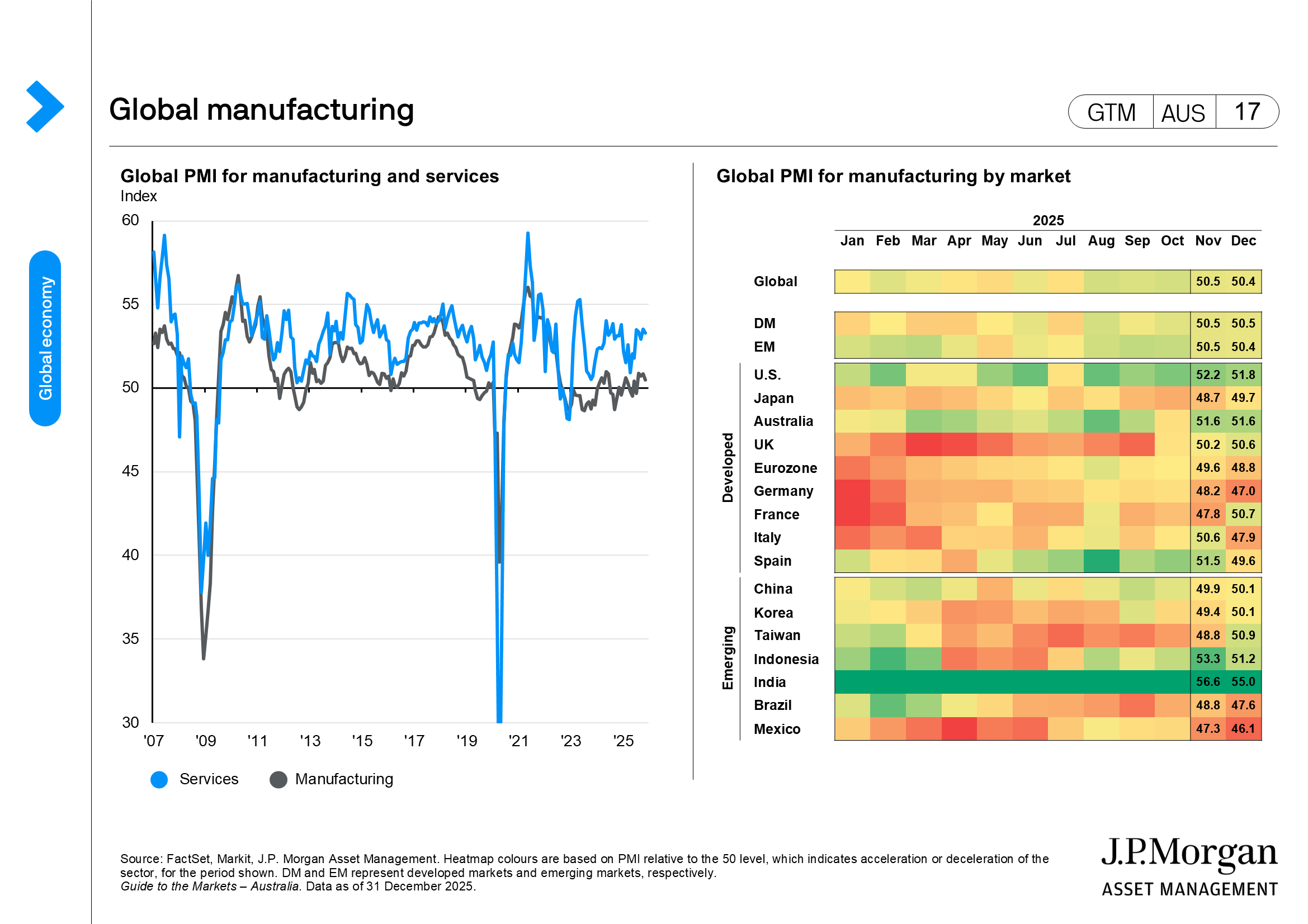

- Global equities rallied over the month, with some markets hovering near record highs. However, AI-related concerns remain as tech-heavy U.S. indices lagged the rest of the world.

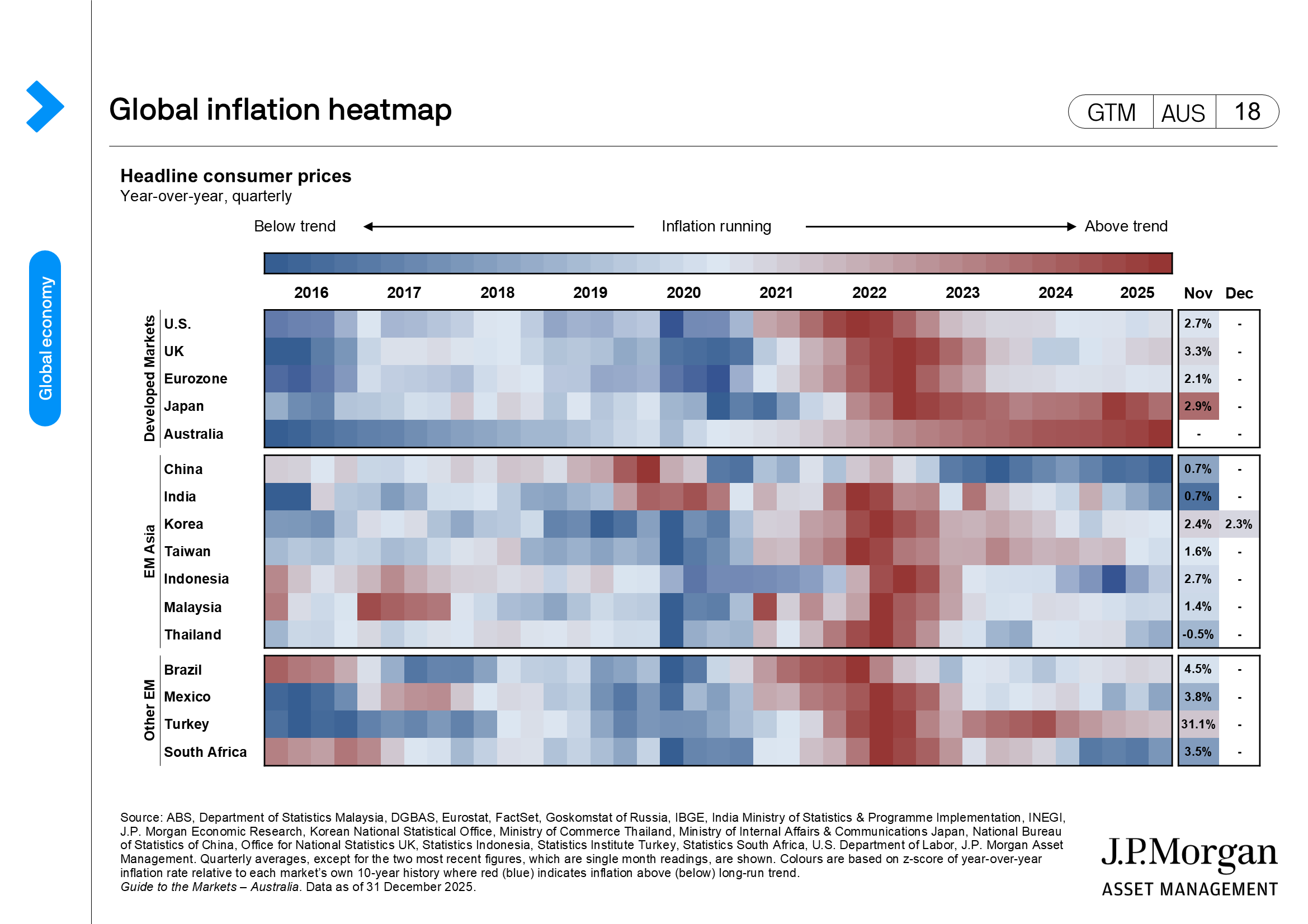

- Central banks face a tough task in balancing soft labour markets and stickier inflation. Many have come to the end of this easing cycle, but it is too early to call for hikes.

- Silver’s surge outshines gold’s new record highs but suggests a tone of caution even as risk assets continue to rise.

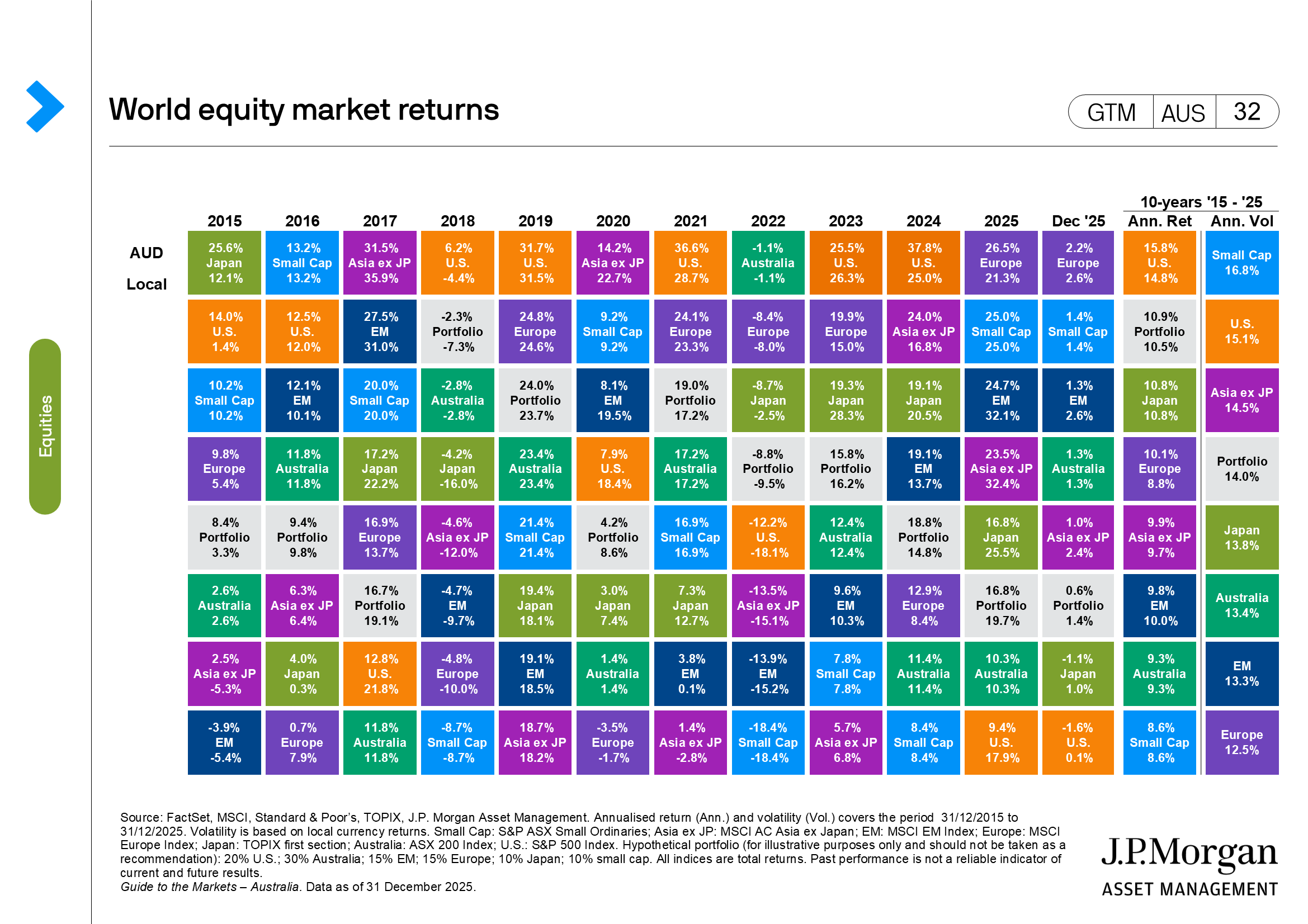

Investors were in a festive mood in December as the MSCI All Country World Index advanced 0.8%, propelled by a robust 2.6% gain in the EM basket. The U.S. lagged global peers, with investors focused on concerns around rising concentration and valuation risks. The S&P 500 slipped 0.1% for the month, while the tech-heavy NASDAQ declined 0.5%, despite both indices posting strong gains for the year—17.9% and 21.1%, respectively. European and Asian markets fared much better: the MSCI Europe climbed 2.6%, Japan rose 1.0%, and Korea stood out as a regional leader with a 10.4% monthly gain. Closer to home, the ASX 200 delivered a moderate 1.3% return (total returns in local currency terms).

Central banks remained in the spotlight in December. The U.S. Federal Reserve (Fed) met market expectations by cutting the policy rate by 25 basis points (bps) to 3.50-3.75%. While the meeting was less hawkish than anticipated, there was increased dispersion in views among committee members, and the subsequent meeting minutes revealed the notable disagreement about whether the Fed should prioritise persistent inflation or a softer labour market.

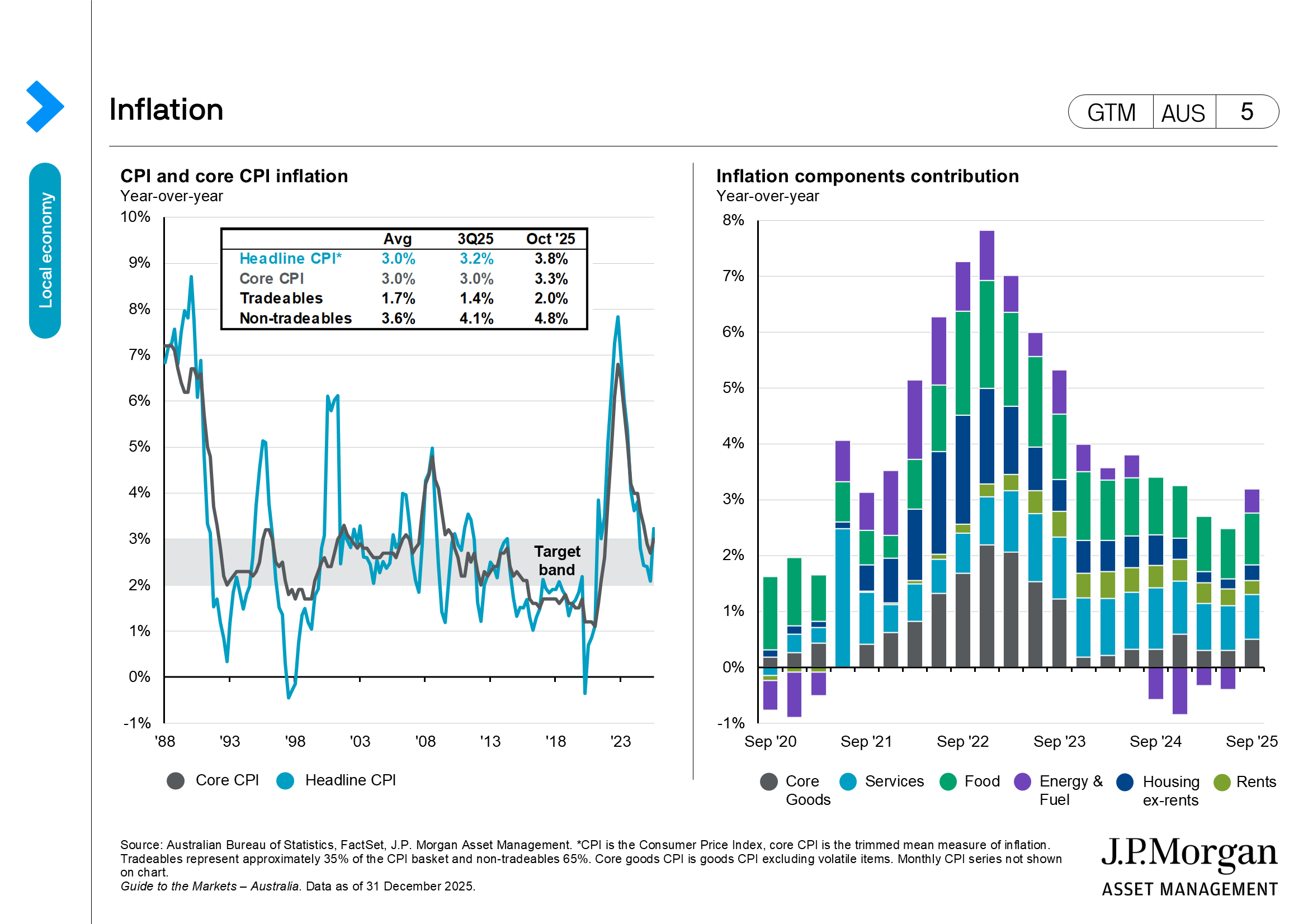

We anticipate another rate cut from the Fed in the first half of 2026 but believe that many other central banks are finished with rate cuts for this cycle. Policymakers in Australia, Canada, the Eurozone, and New Zealand are reconsidering further easing, given inflation that is at or above target and a supportive growth outlook. The Reserve Bank of Australia’s (RBA’s) decision to hold in December, despite signs of underlying weakness in the labour market, underscores the bank’s commitment to achieving its inflation mandate. However, we disagree with the market shift toward pricing in rate hikes in 2026.

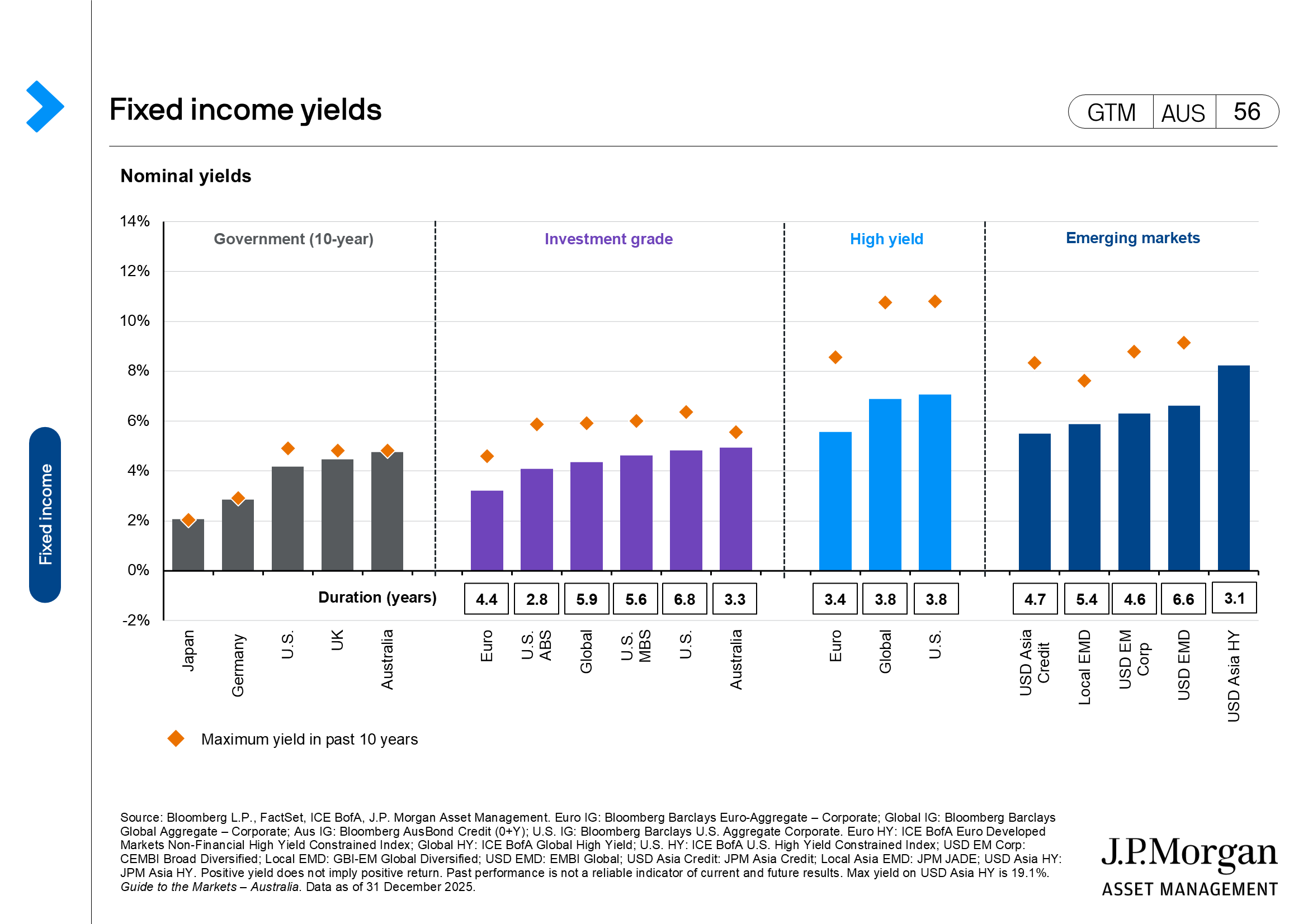

The repricing of policy expectations, combined with upside surprises in economic data, led to a sharp rise in government bond yields in December. The yield on the Australian 10-year bond increased by 23 bps to 4.75%, its highest level in over two years. Japanese 10-year yields rose a similar 25 bps, while the U.S. 10-year Treasury yield climbed 15 bps to 4.17%. Although the rise in yields weighed on returns, higher yields are now more attractive for income, and the return of a negative stock-bond correlation enhances the role of bonds as portfolio diversifiers.

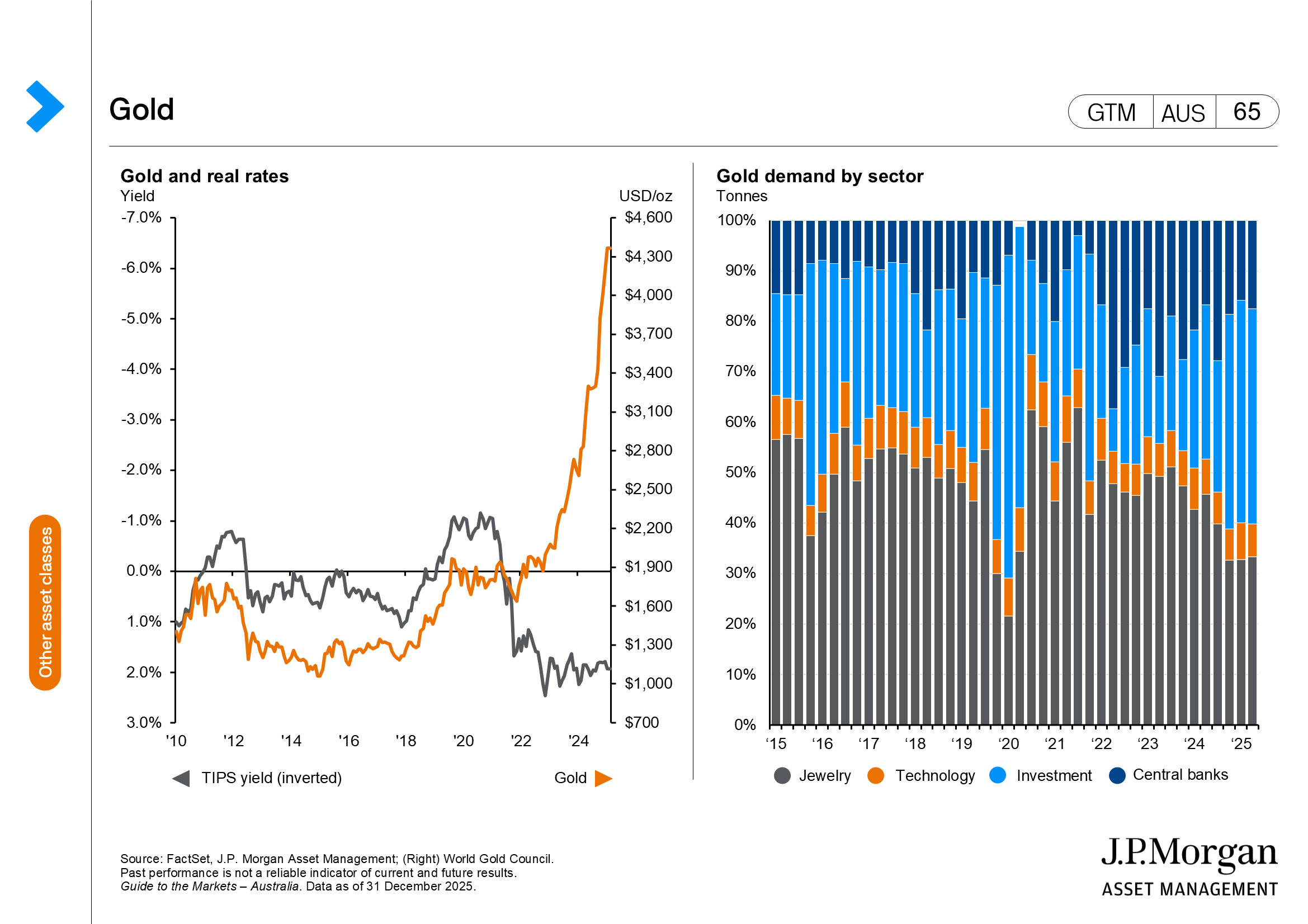

Expectations of U.S. rate cuts, ongoing geopolitical risks, and the desire for broader portfolio diversification have driven the gold price this year. The precious metal reached another record high in December, gaining 4.2% over the month. Notably, some of gold’s luster has transferred to silver, which soared nearly 34% in December to a record high of almost USD 84/oz. This surge was fueled by rising industrial demand, its designation as a critical mineral by the U.S., and supply shortfalls.

Australian economy

- The RBA kept the cash rate at 3.60% at its December meeting. The tone of the meeting and subsequent minutes continued the skew towards a more hawkish policy committee evident in November. There was even discussion of the conditions that may lead to a rate hike in 2026, with the persistent above-target inflation and the declining level of spare capacity in the economy being obvious catalysts. The market has shifted to price in up to two rate hikes in 2026; however, this may be premature as the RBA watches how the new consumer price index (CPI) data series evolves and remains patient on the policy setting.

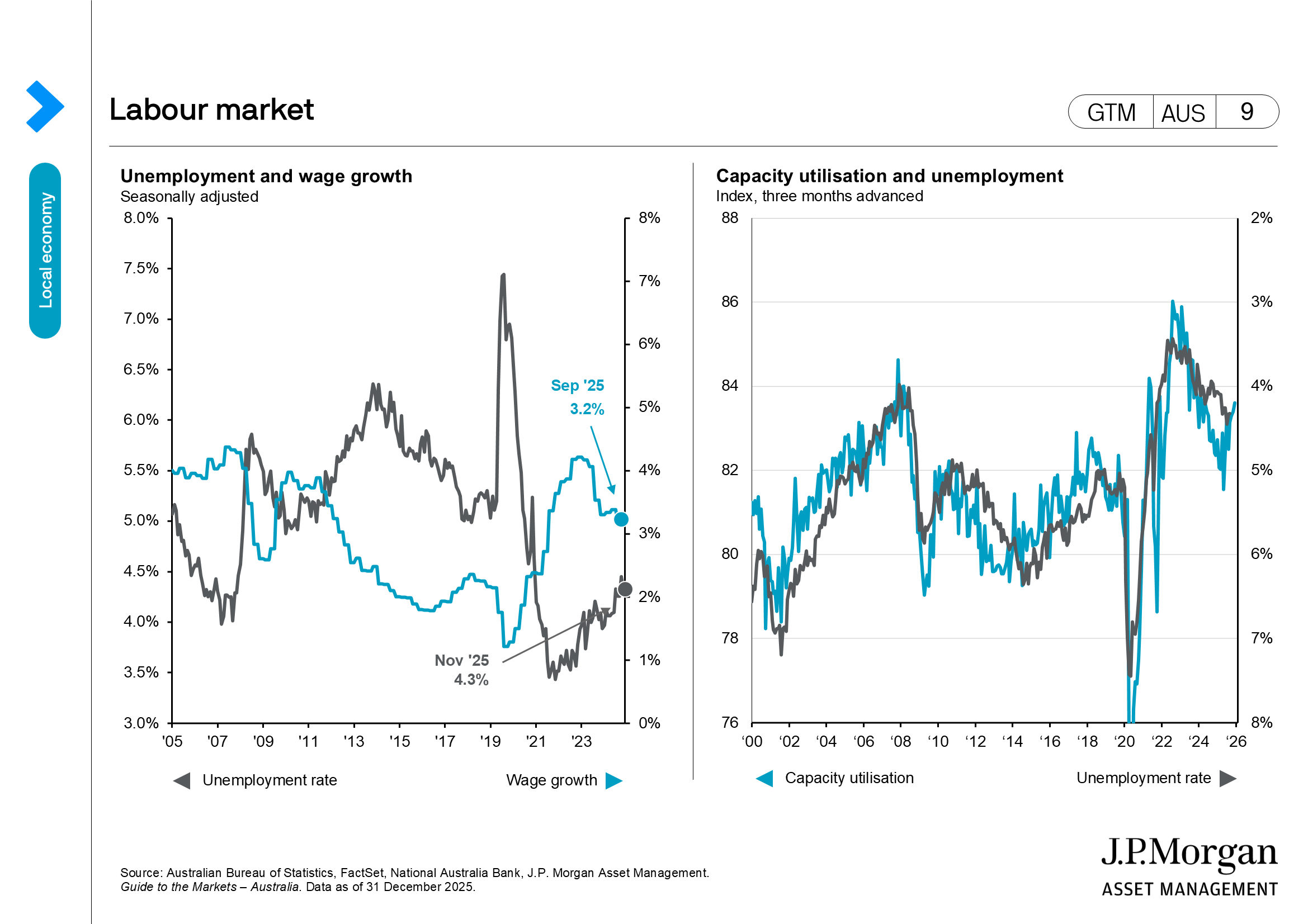

- The unemployment rate held steady at 4.3% in November, marginally below consensus expectations. The unchanged figure was the result of both a decline in employment (-21,000) and a fall in the participation rate and suggests underlying labour conditions were softer.

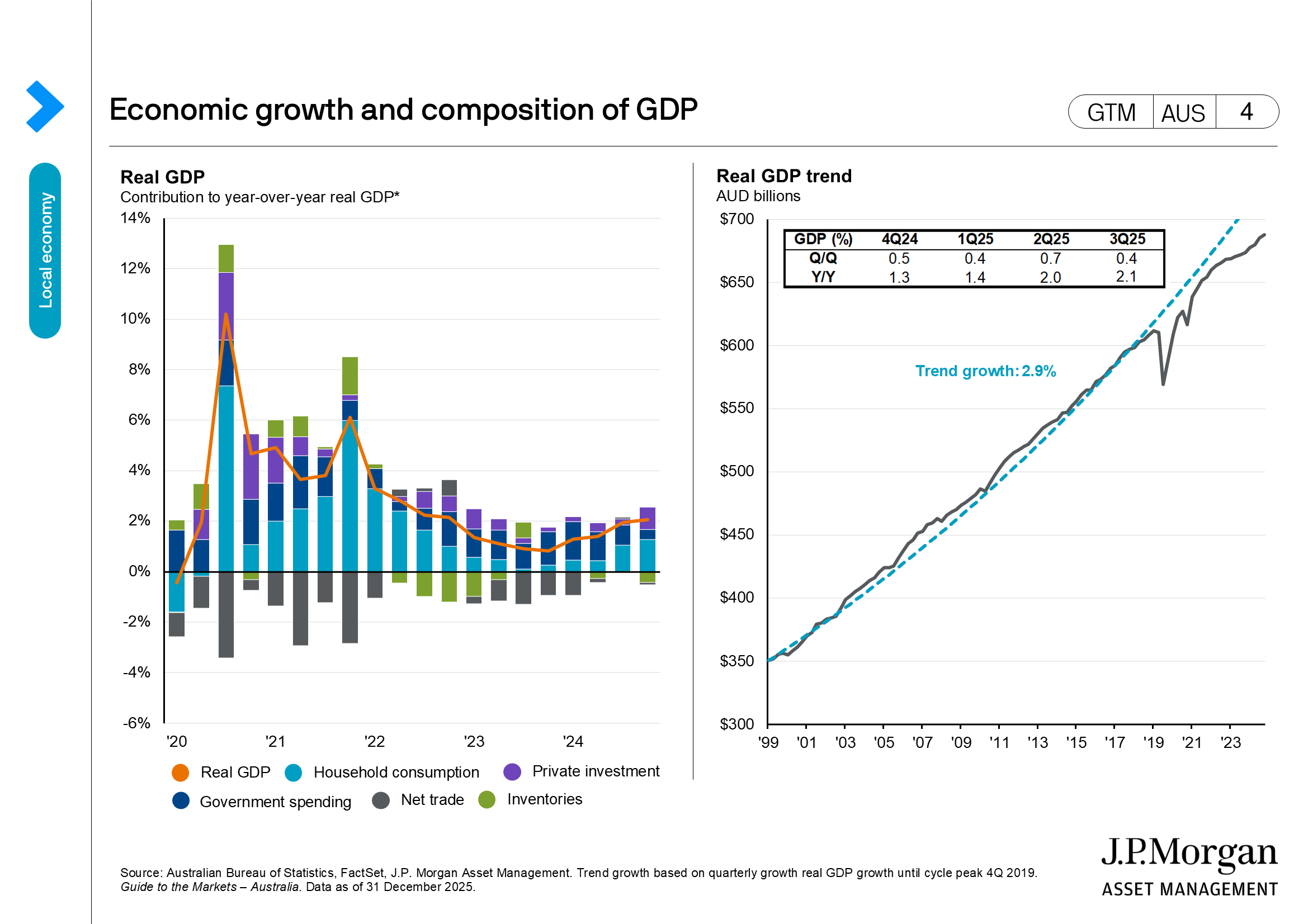

(GTM AUS page 9) - Real gross domestic product (GDP) rose by less than expected 0.4% quarter-over-quarter (q/q) (2.1% year-over-year (y/y)) as inventories proved to be a larger drag on the economy. However, household consumption and public and private demand remained robust. While productivity growth is tracking the long-run average at 0.8% y/y, real unit labour costs actually declined, which suggests that the recent pickup in inflation is not solely a story of labour input costs.

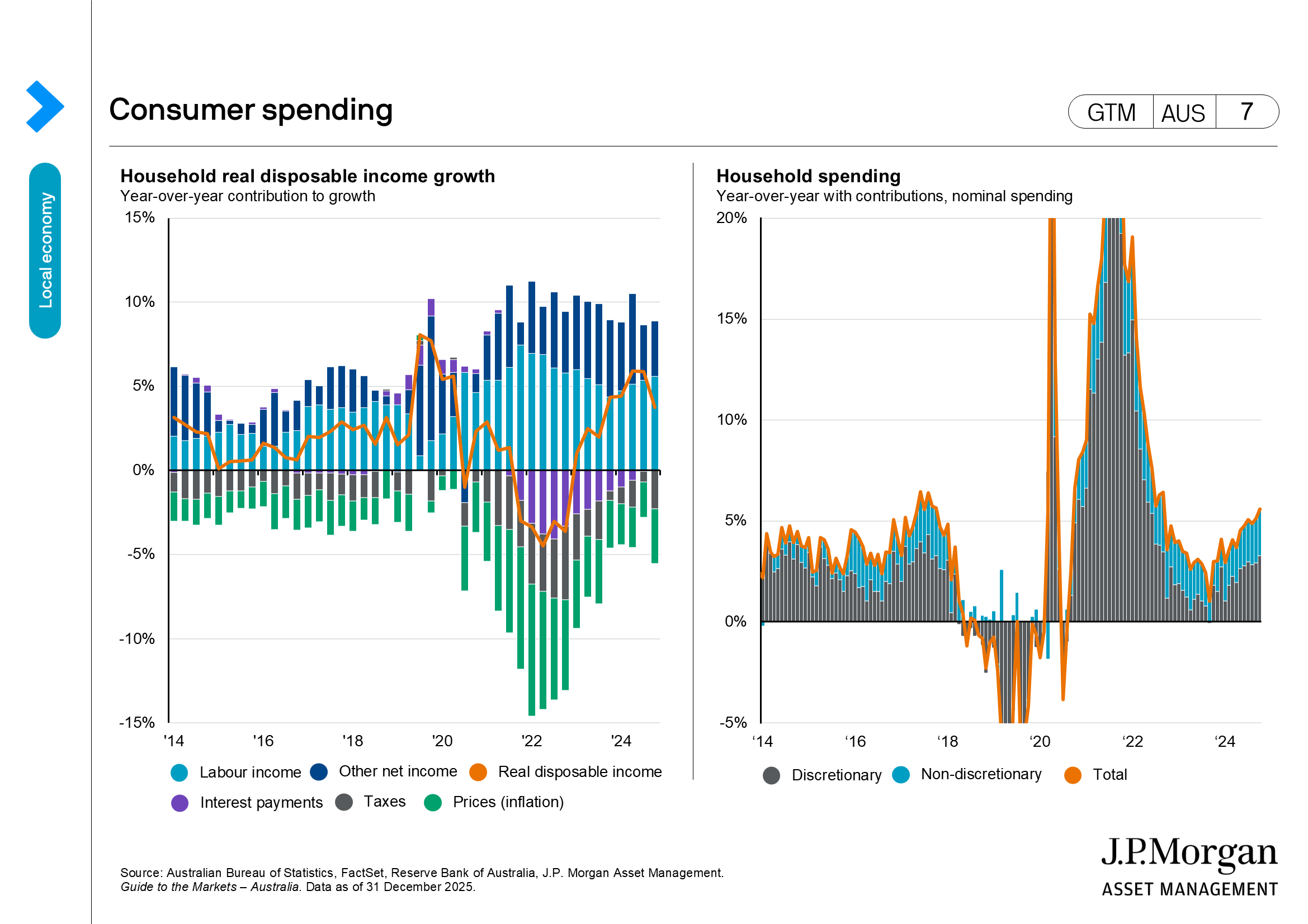

(GTM AUS page 4) - Household spending jumped by 1.3% month-over-month (m/m) in November, driven by stronger activity in the goods sector. This likely reflects front-loading of consumption around periods of retail discounting and may be partially unwound. However, this does bode well for the 4Q consumption component of GDP.

(GTM AUS page 7) - Business conditions declined in November and likely reflect the hawkish shift by the RBA. The details of the index show most of the underlying components are tracking near long-run averages and that the economy is ticking along close to potential.

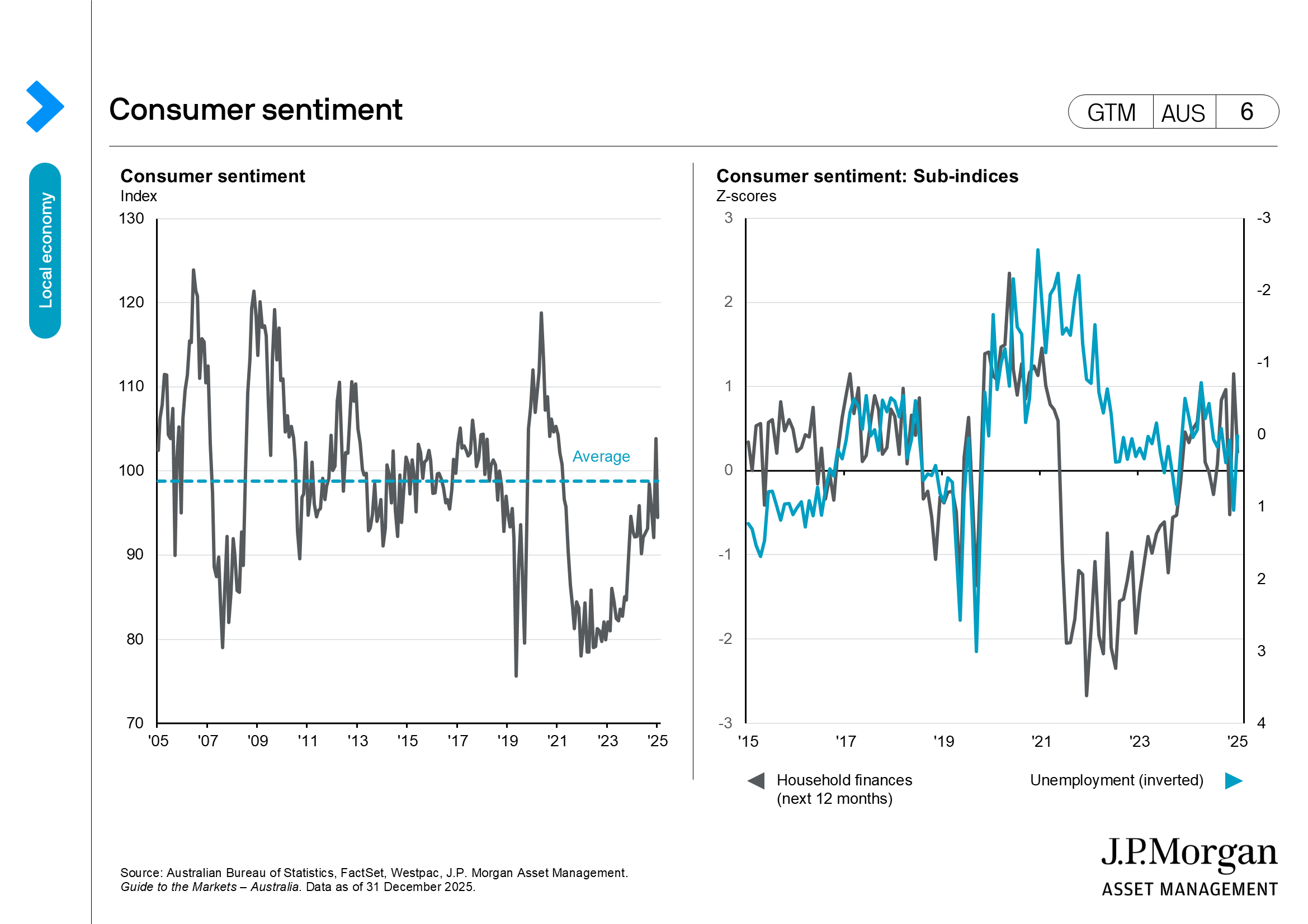

(GTM AUS page 8) - There was a similar situation with consumer confidence, which fell in November, reversing the October surge and putting it back into pessimistic territory.

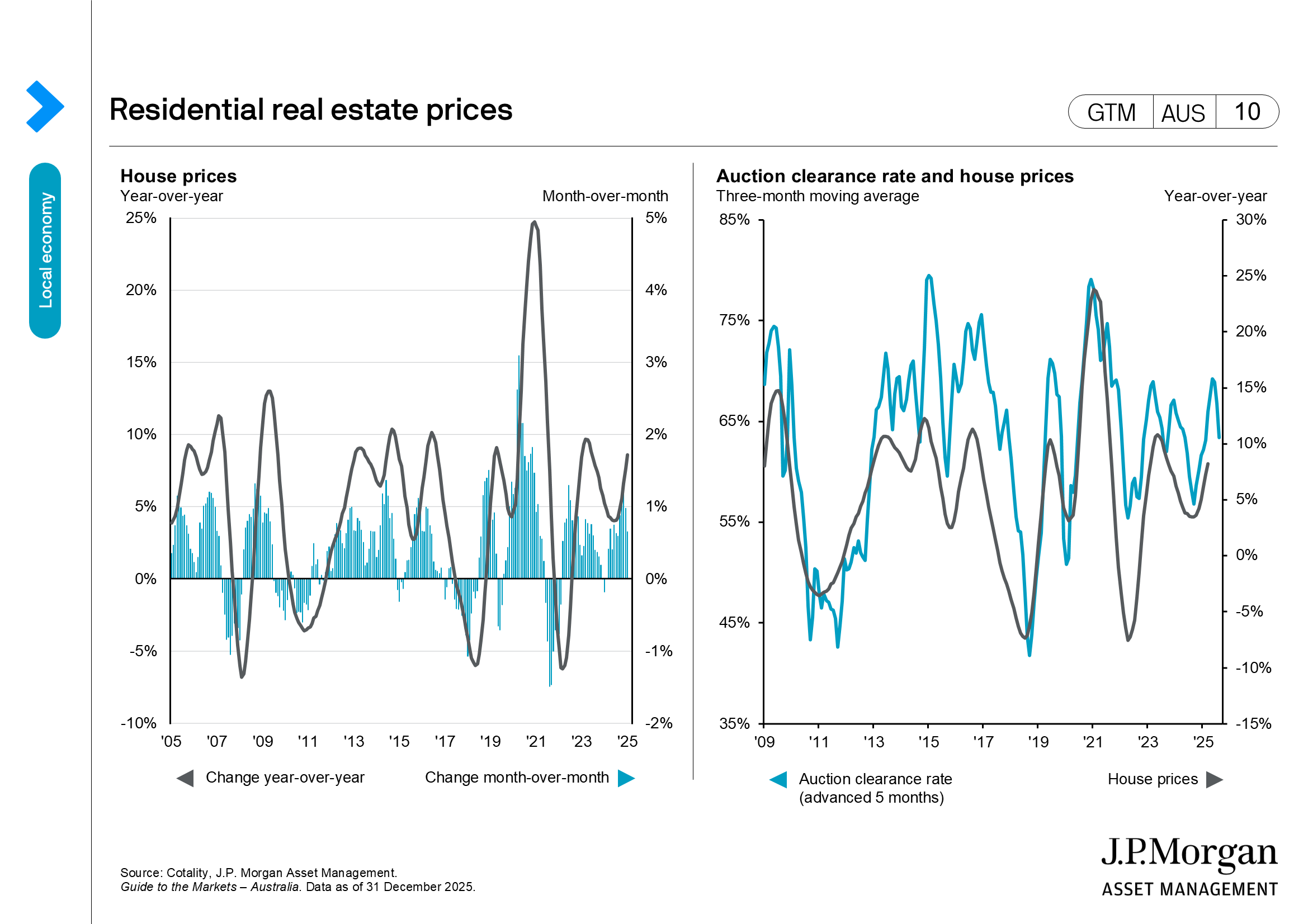

(GTM AUS page 6) - House price growth moderated in December, as capital city house prices rose 0.5% m/m or up 8.2% y/y. Prices in Sydney and Melbourne fell, while mid-sized capital cities experienced gains between 1.6-1.9% m/m.

(GTM AUS page 10)

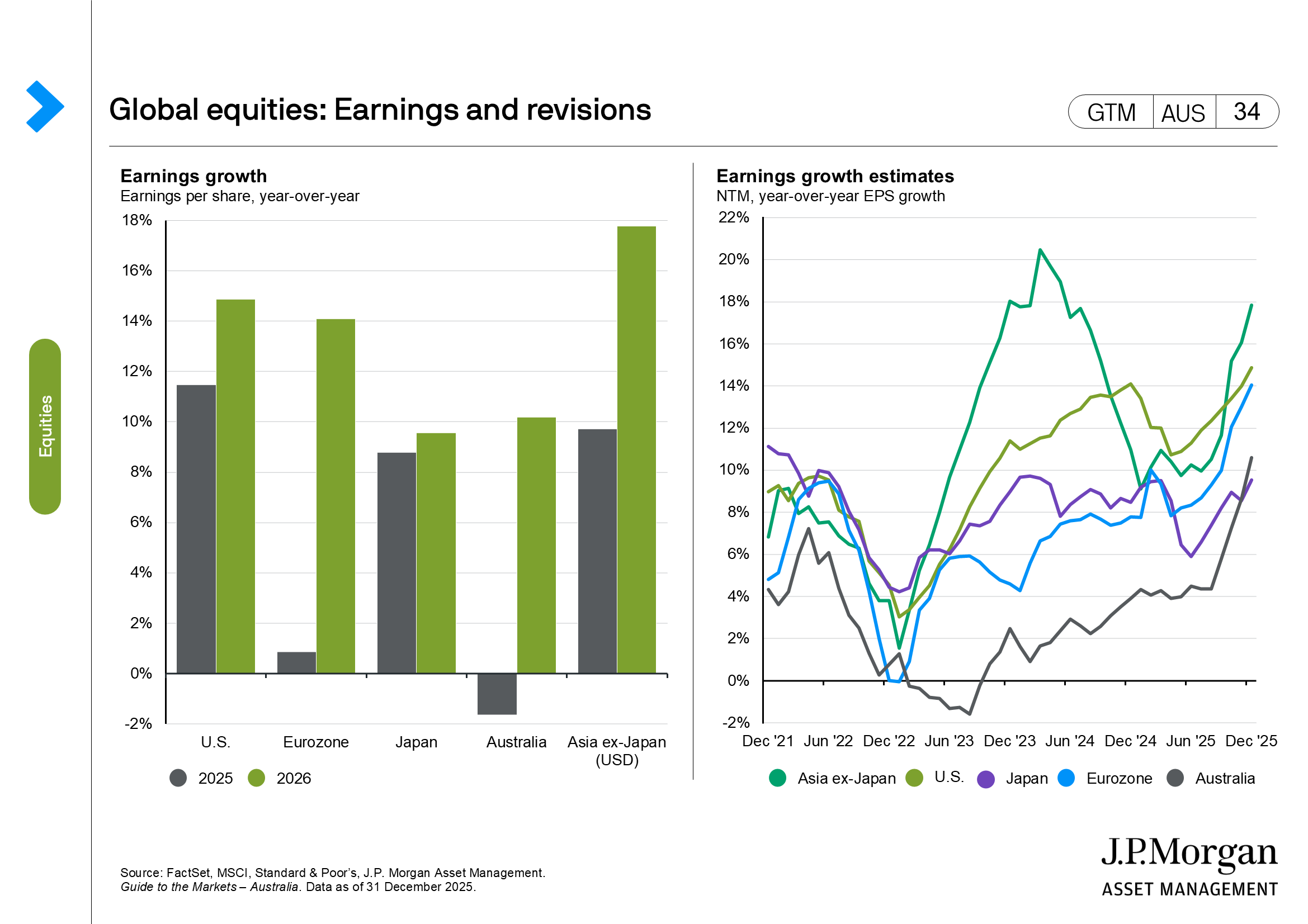

Equities

- The ASX 200 gained 1.2% in December, partially reversing November’s loss as the rotation towards the materials sector helped to offset losses elsewhere. Only three sectors rose over the month, with materials (+6.6%) leading, followed by financials (+3.4%) and REITs (+0.8%). The worst performers were IT (-8.7%), healthcare (-7.2%), and communication services (-3.1%).

- Global equity markets were positive in December, and non-U.S. markets led the way as global diversification was a key theme for investors. Concerns over concentration risks in the U.S., as well as the ability to deliver on large capex investments, added to investor nerves. Emerging Asia was a stand-out as the Asia ex-Japan index rose 2.4%. Asian markets have performed well given the revaluation in China and the tech dominance of Taiwanese and Korean markets. The MSCI Korea returned 96.5% in 2025.

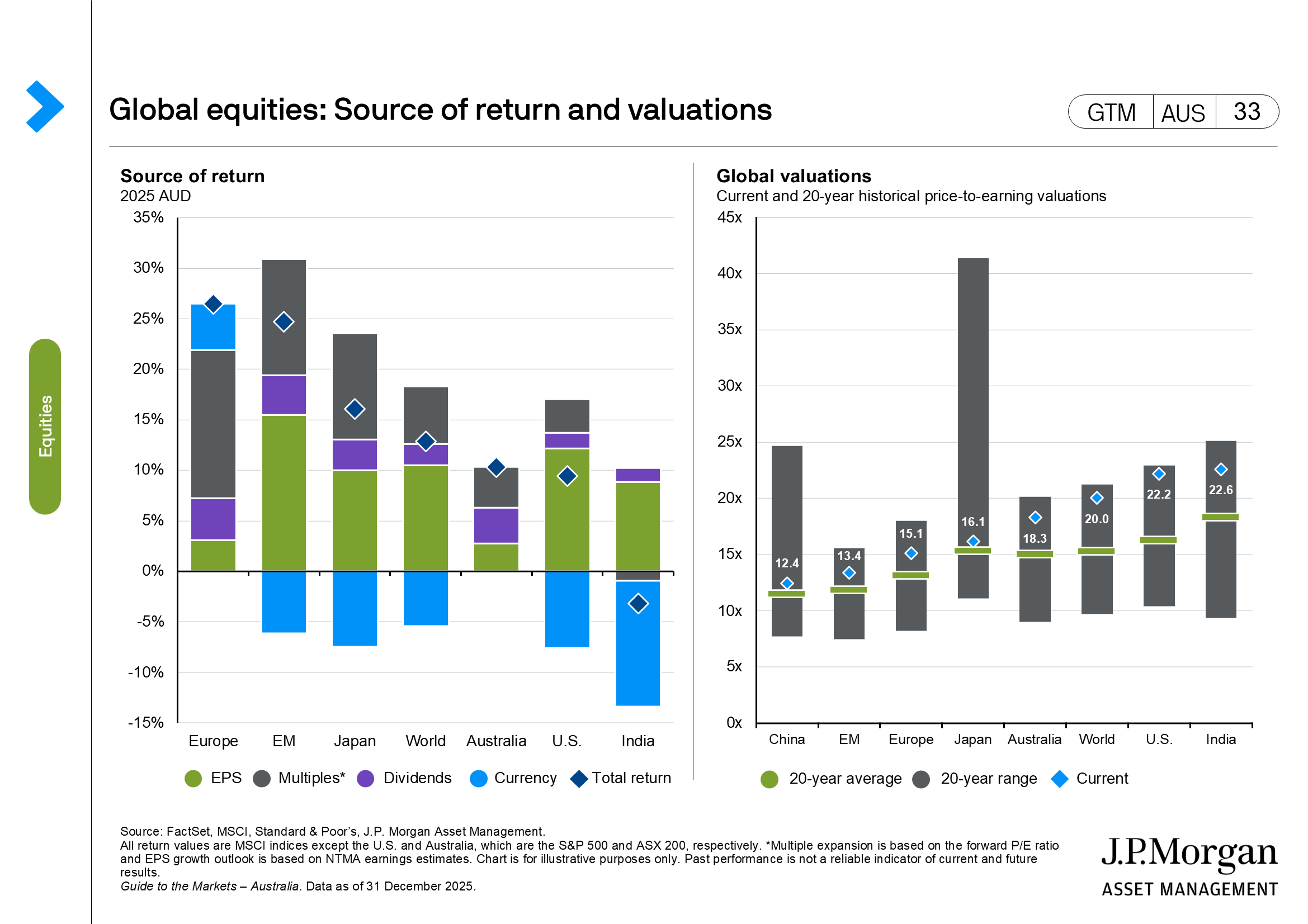

(GTM AUS page 32) - Equity valuations have come off year-to-date highs even as they remain above long-run averages. The forward price-to-earnings (P/E) ratio for the S&P 500 was 22.2x, MSCI Europe at 15.1x, MSCI Japan at 16.1x, and the ASX 200 at 18.3x.

(GTM AUS page 33)

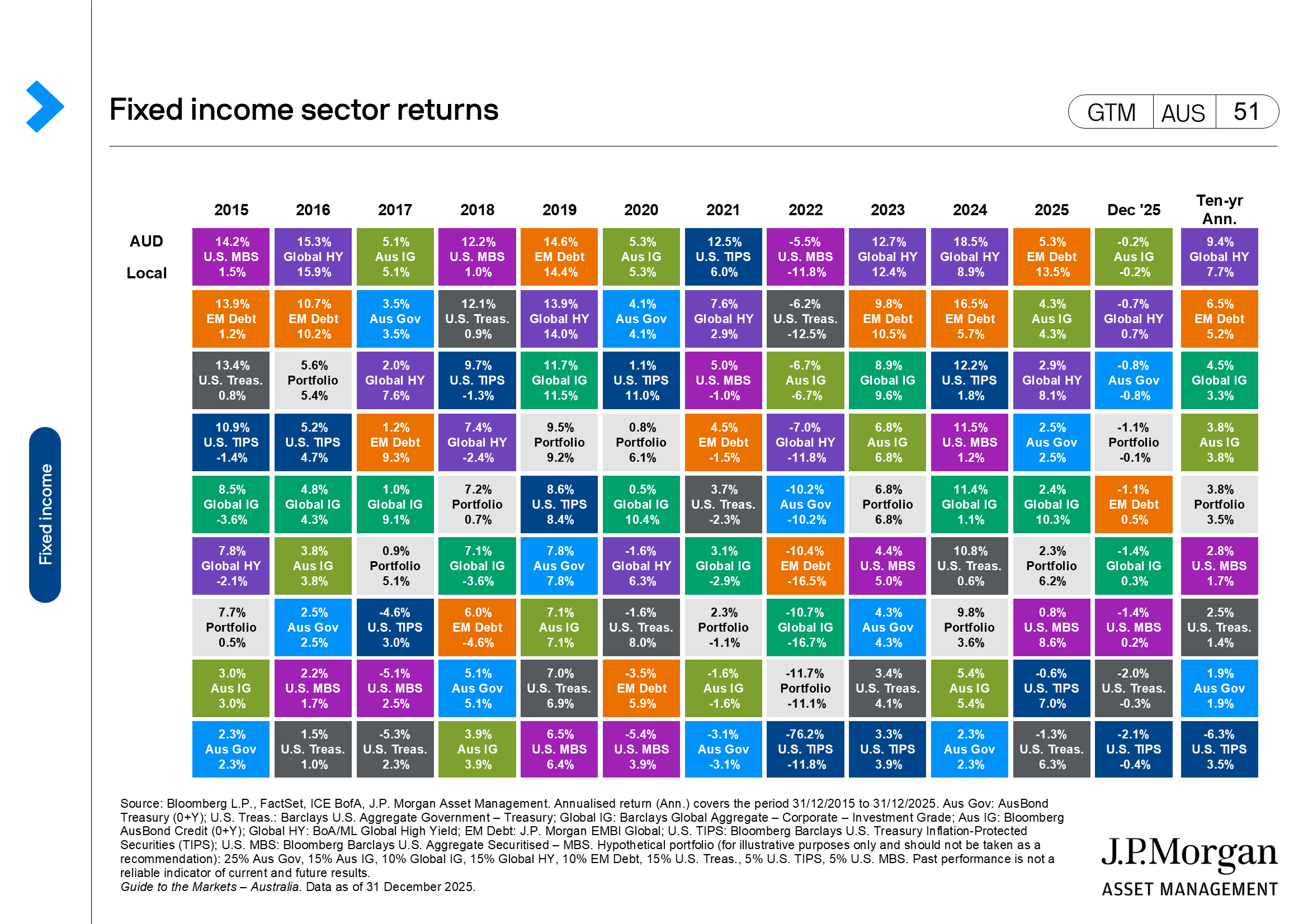

Fixed income

- It’s been a tricky year for fixed income investors, and yields rallied higher in December. It was difficult to pin down one driving force for the move higher in yields. The repricing of the rates outlook globally, a rate hike by the Bank of Japan, stickier inflation, and a better growth outlook all added to pressure on 10-year bond yields. Australian 10-year yields rose to 4.75%, and a similar-sized move saw Japanese yields lift to 2.07%.

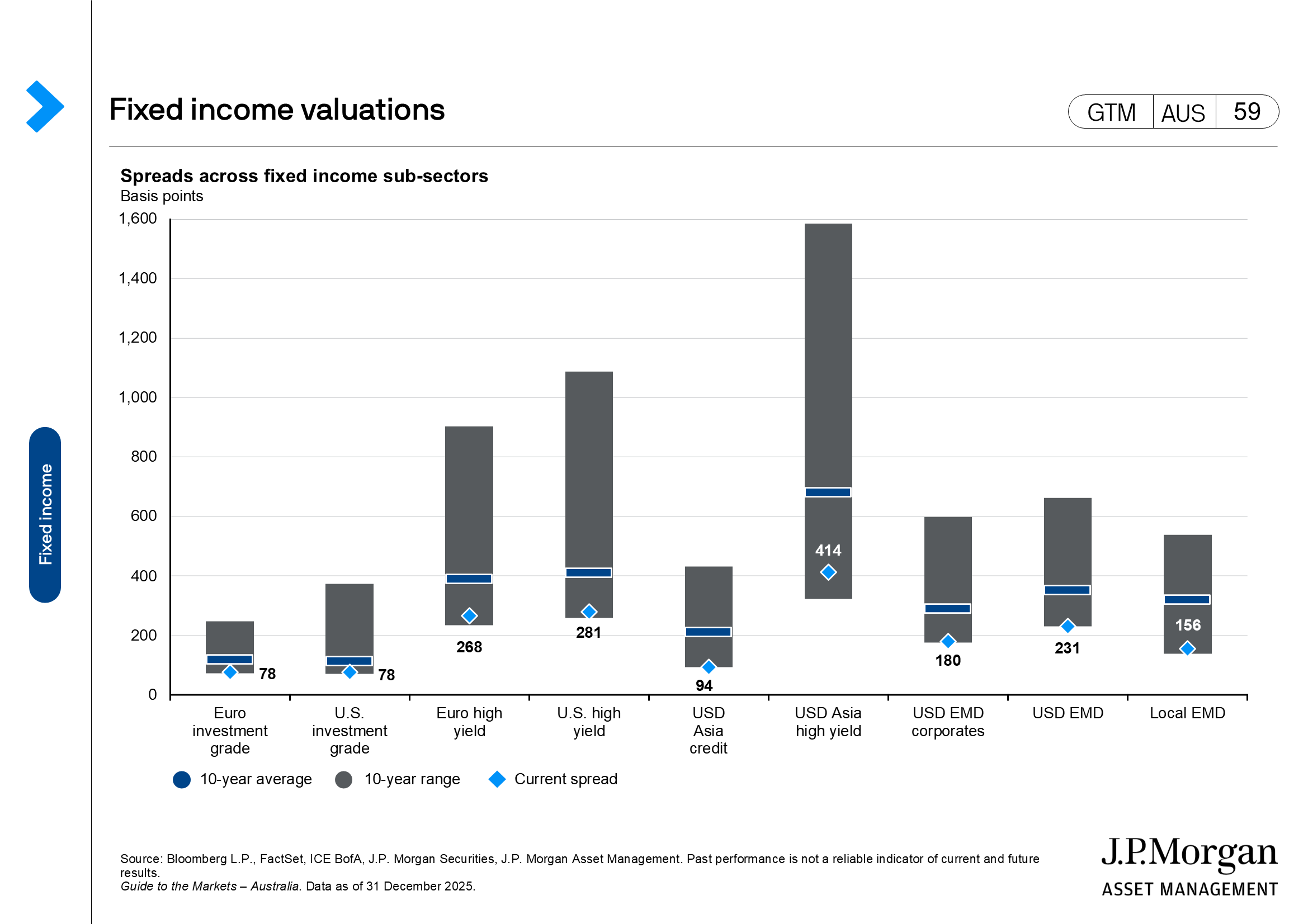

(GTM AUS page 52) - Spreads on both investment-grade (IG) and high-yield bonds remain at the bottom of their 10-year range as solid fundamentals and generally supportive economic backdrop add to demand for credit. The movement higher in yields did create a drag, and U.S. IG fell 0.2%, while high-yield was 0.6% higher.

(GTM AUS page 59)

Other assets

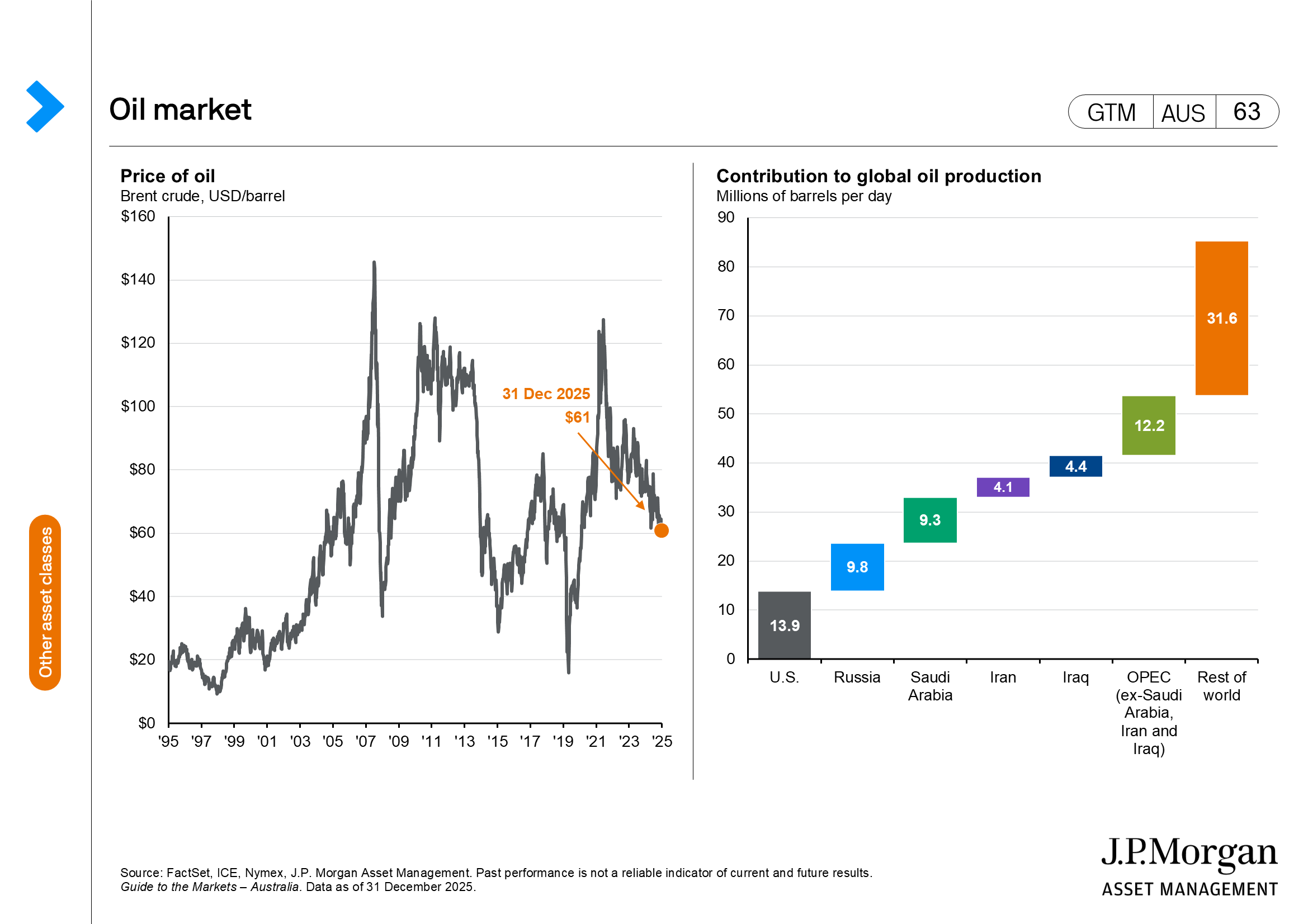

- Crude prices continued to fall as supply restrictions eased. WTI crude oil fell by 1.9% per barrel. The supportive economic backdrop, as well as some supply disruptions, helped to lift industrial metals over the month. Copper gained 13.6% and nickel was up 12.4%. However, the big mover was silver, which rose 34% in December and gained nearly 150% in 2025, surpassing the 67% rise in gold price.

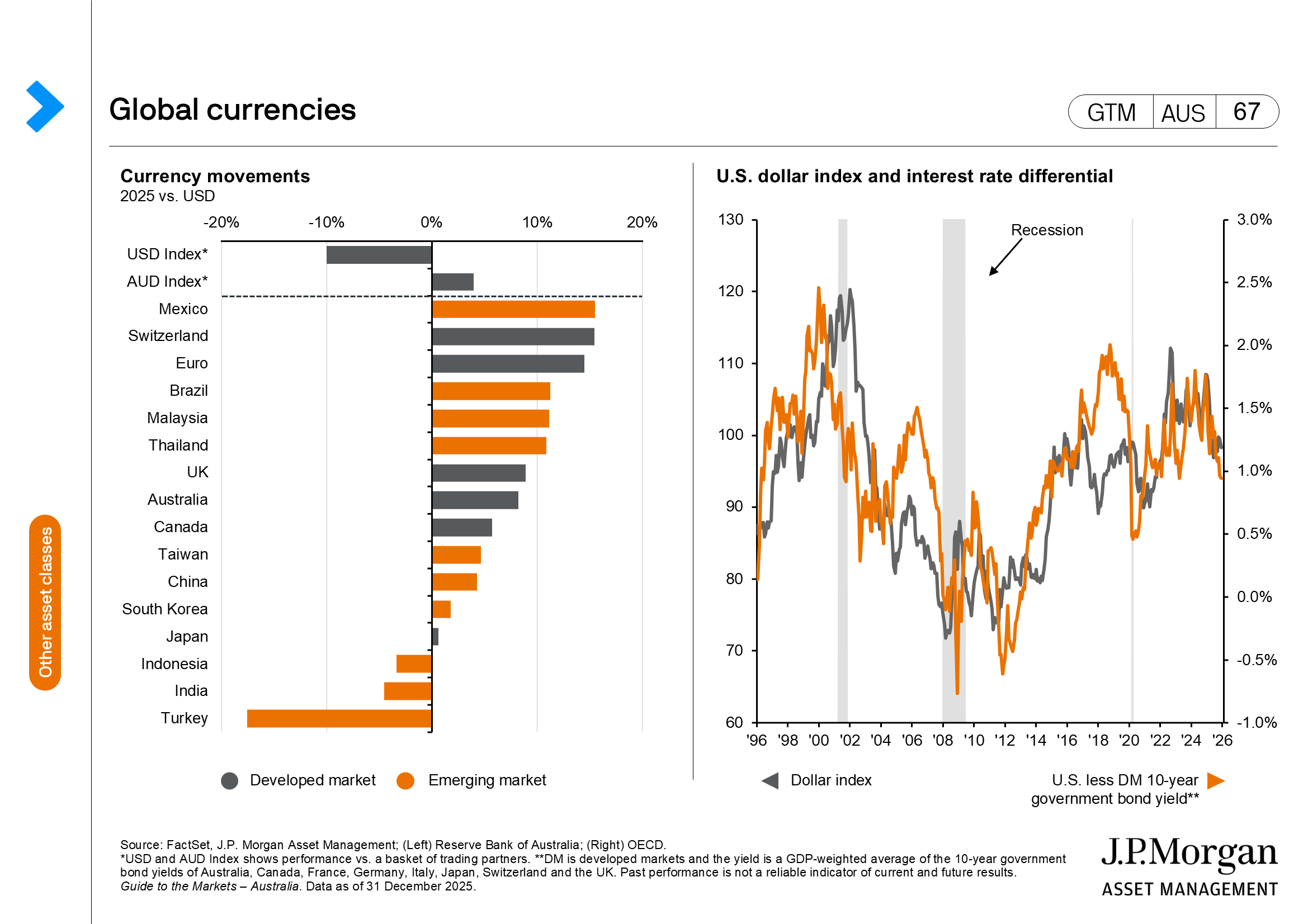

(GTM AUS page 63, 65) - The U.S. dollar (USD) lost against major partners in December, and the U.S. Dollar index fell 1.1% in December. The euro (1.2%), Swiss franc (1.4%), and British pound (1.5%) were the main beneficiaries. The Australian dollar gained 1.7% against the USD. Heading into 2026, it may be difficult for the USD to repeat the 10% decline it experienced in 2025, but ongoing concerns about central bank independence and the fiscal outlook may keep the greenback weak.

(GTM AUS page 67)