An improving growth outlook in Europe and Japan, as well as equity markets that trade at lower multiples closer to long-run averages, opens the door to broader diversification opportunities in global equity markets.

The U.S. outlook has dominated the market narrative for much of this year given the strength in returns. However, a more balanced outlook for global growth, a cyclical uplift in the European economy and structural changes in Japan create an environment for improving returns in developed markets outside the U.S. at better relative valuations.

The European region has recently recovered from a recession, and the turn in the economic cycle supports a more constructive market outlook. The combination of fading energy costs and a robust labor market should support consumption growth via rising real incomes. Meanwhile, improving yet low growth and falling inflation have given the ECB credence to start the policy easing cycle, which could help stimulate growth.

The improving economic backdrop is gradually being matched by improving earnings expectations. Full-year earnings for 2024 remain subdued at 4.5% year-over-year, but earnings growth expectations have increased, and earnings revision ratios have started to trend higher.

In Japan, the structural shift in the economy away from deflation and toward improving nominal growth, coupled with corporate governance changes aimed at increasing the value of corporate businesses, should continue to support equities throughout the year.

Broad-based wage growth set against a tight labor market could create a virtuous cycle of rising real wages and consumption spending. At more than 5%, the 2024 spring wage negotiations resulted in the largest increase in wages in more than three decades for major enterprises in Japan1.

More recently, consumption has been soft given the weaker currency and rising cost of imports. This remains a risk to the outlook. However, currency weakness has also boosted exports, lifting the outlook for corporate earnings. We expect the JPY to reverse some of this year’s weakness as the rate differential with the U.S. narrows.

An improved nominal growth outlook has historically translated to stronger corporate earnings. 2024 earnings growth has seen steady improvement since late 2023. Stronger earnings coupled with healthy cash balances could lead to increased capital investments that could potentially enhance future returns.

An improving growth outlook in Europe and Japan, as well as equity markets that trade at lower multiples closer to long-run averages, opens the door to broader diversification opportunities in global equity markets.

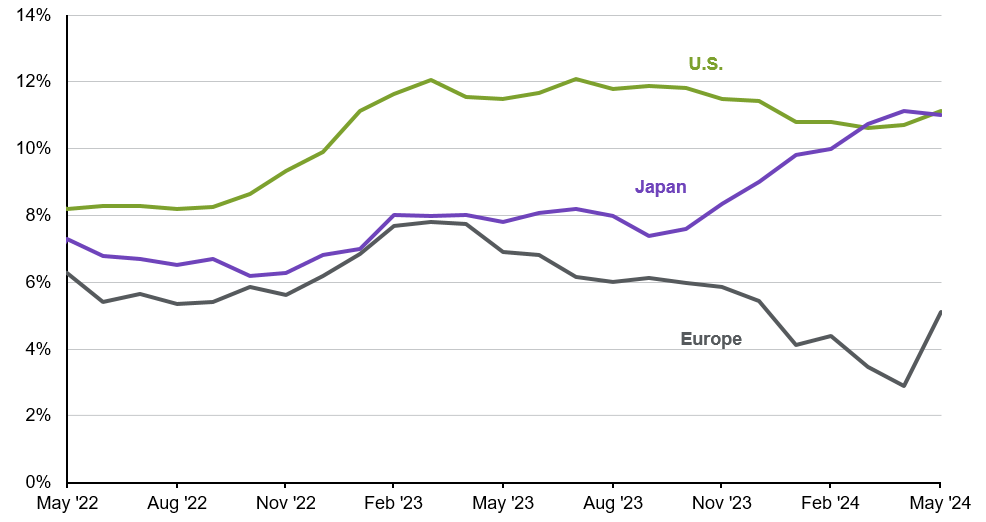

2024 earnings expectations have been rising for non-U.S. markets, driven by an improving economic outlook

Exhibit 8: 2024 Earnings per share growth estimates

Consensus estimates, year-over-year

Source: FactSet, MSCI, Standard & Poor's, J.P. Morgan Asset Management. Data are as of 31/05/24.

1Source: Reuters. Data as of 05/06/24.