Central banks in the region are not in a hurry to cut policy rates ahead of the Fed, owing to the fact that interest rate differentials between the U.S. and Asia are currently the widest seen in decades.

The moderation in price pressures in recent quarters has brought inflation within the official inflation target range across most parts of Asia. However, central banks in the region are not in a hurry to cut policy rates ahead of the Fed, owing to the fact that interest rate differentials between the U.S. and Asia are currently the widest seen in decades. As a result, capital outflows from Asian markets have contributed to the weakening of domestic currencies against the U.S. dollar (USD). As the USD remains resilient, investors may be less inclined to take on foreign exchange (FX) risks associated with investing in Asian local currency assets. Year-to-date, some Asian currencies have fallen to multi-year lows against the greenback. Notably, the Taiwanese dollar and Korean won were down 5.0% and 4.9%, respectively, from the start of the year.

In the near term, markets could continue to reprice the “higher for longer” backdrop, leaving U.S. long-term yields moving sideways. This could stoke higher volatility in asset prices and financial conditions in Asia. Coupled with the ongoing local currency depreciation, these factors could raise the bar for policy easing by central banks in the region.

That said, monetary authorities can still leverage other policy tools like direct intervention in FX markets or keeping front-end rates elevated relative to policy rates. In certain cases, some central banks could resort to hiking policy rates, as was the case in April by Bank Indonesia to preserve financial stability. Investors should remain mindful of the risk that persistent strong growth and sticky inflation in developed markets could result in policy rates staying higher for longer, thereby generating weaker capital inflows into emerging market economies and delaying the start of the monetary policy easing cycle on this side of the world.

In the medium term, the start of the Fed rate cut cycle could be the turning point for Asian assets, potentially generating positive returns through stronger capital inflows and alleviating pressure on Asian currencies. In addition, the concomitant weakening in the USD is likely to create space for Asian central banks to cut benchmark rates at the turn of next year.

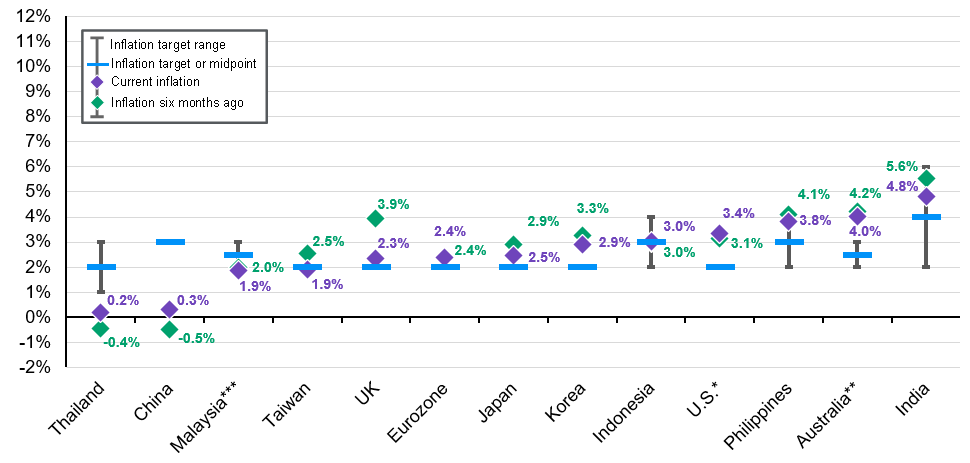

Inflation has settled within central banks’ target ranges across most Asian economies

Exhibit 4: Inflation and central bank inflation targets

Year-over-year change