Week in review

- Australian unemployment rate slightly higher at 3.8% in March

- U.S. retails sales much stronger at 0.7% m/m

- China 1Q real GDP stronger at 5.3% y/y

Week ahead

- Eurozone and U.S. PMIs for manufacturing and services

- Australia CPI inflation

- U.S. 1Q real GDP

Thought of the week

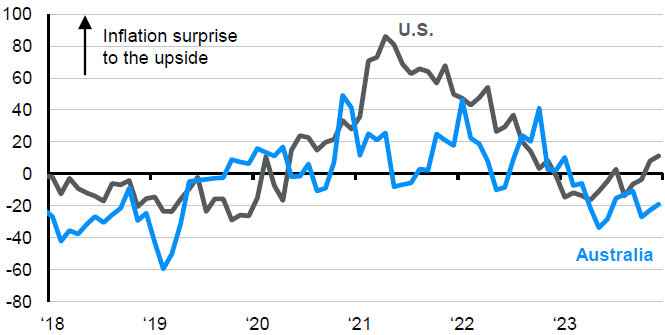

The no-landing scenario of the U.S. economy is gaining more attention as inflation has proved sticky. In this scenario the economic expansion continues, the unemployment rate remains low, but inflation stays above the Fed’s target and Fed maintains a high hold on rates (or even hikes). Our view is that the economy is still coming into land and the runway looks wider given supportive growth and an expectation that the pace of inflation falls this year. The trouble with a plane that doesn’t land is that it will eventually run out of fuel. High for long rates creates a rising risk that a recession comes later, as the lagged impact of tighter policy weighs on the economy. The near-term risk is that the market continues to price out rate cuts in 2024 and yields rise back to, or above, the 5% level seen last year. Investors may want to brace for some short-term turbulence, but not lose sight of the runway.

Inflation surprising to the upside in the U.S. is a risk to markets

Citi Inflation Surprise Index

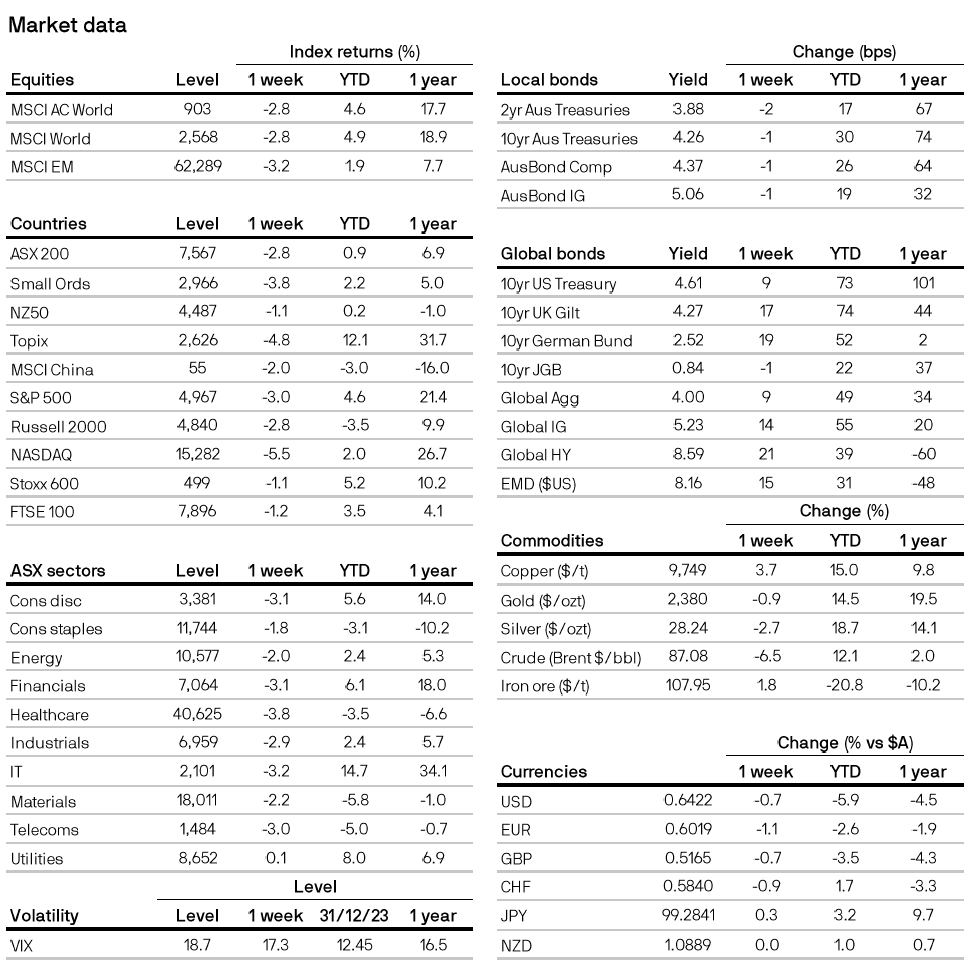

Market data

Source: FactSet, Citi, J.P. Morgan Asset Management. Data reflect most recently available as of 19/04/24.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5