Week in review

- Australia’s business conditions improve

- U.S. CPI inflation surprises to upside at 3.2% y/y for February

- NZ retail spending fell 1.8% in February

Week ahead

- RBA official cash rate

- Australia labour market report

- U.S. FOMC meeting

Thought of the week

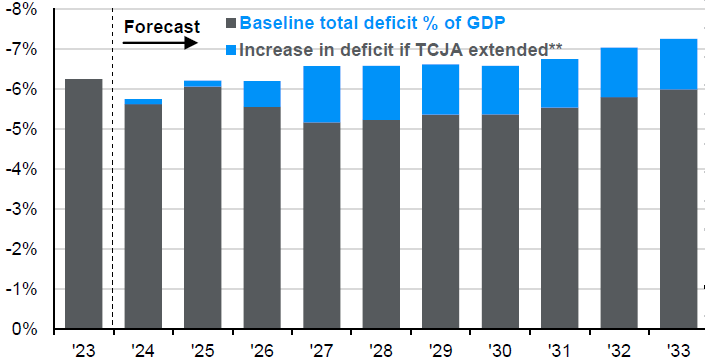

They say a week is a long time in politics, the next eight months may feel like an eternity in the lead up to the November U.S. Presidential election. One policy debate gaining traction is taxes. During his first term, former President Trump passed the Tax Cuts and Jobs Act which lowered both corporate and personal tax rates. To pass this legislation the tax cuts were to be temporary, expiring in 2025. It’s possible that regardless of whoever is elected to the White House that these tax cuts, in some form or another, are extended adding to the deficit. The risk is that the market revolts, demanding higher yields on government debt. Given the size and depth of the U.S. Treasury market and the stability of the U.S. economy however, we would downplay this outcome. Markets don’t like uncertainty and there is plenty of uncertainty in politics. It’s the economic cycle that has a greater influence on market returns than who’s in the White House.

Increase in U.S. federal deficit if the Tax Cuts and Jobs Act is extended*

% of GDP, 2024 – 2033, impact based on CBO Baselines Forecast

Source: CBO, J.P. Morgan Asset Management. *Estimates are based on the Congressional Budget Office's (CBO) "The Budget Outlook and Economic Outlook: 2024 to 20234." **Assumes the following provisions from the TCJA are extended: changes to individual income tax provisions, higher estate and gift tax exemptions, changes to the tax treatment of investment costs, and maintaining certain businesses tax provisions going into effect in 2023.Data reflect most recently available as of 15/03/24.

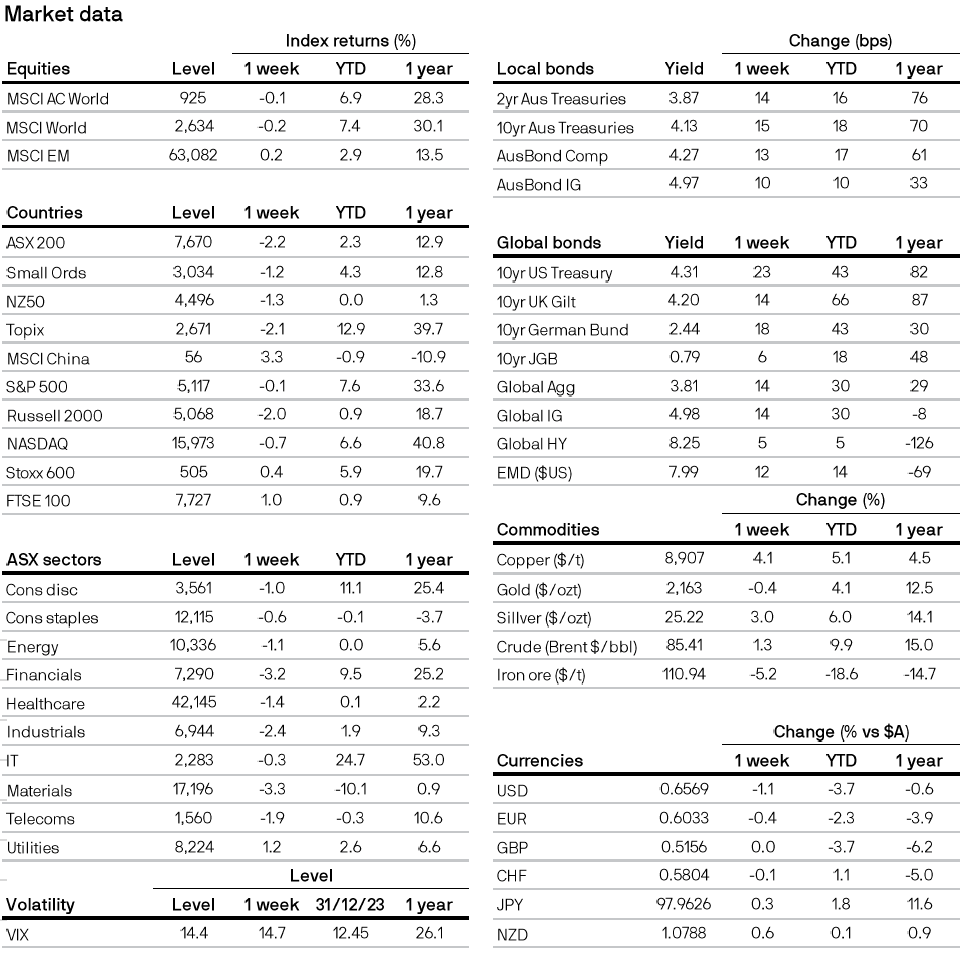

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5