Week in review

- Australia’s real GDP 0.2% q/q or 1.5% y/y in 4Q ‘23

- ECB holds rates at 4.5%

- U.S. ISM services softer at 52.6 for February

Week ahead

- Australian business and consumer confidence

- ECB policy meeting

- U.S. Nonfarm payrolls

Thought of the week

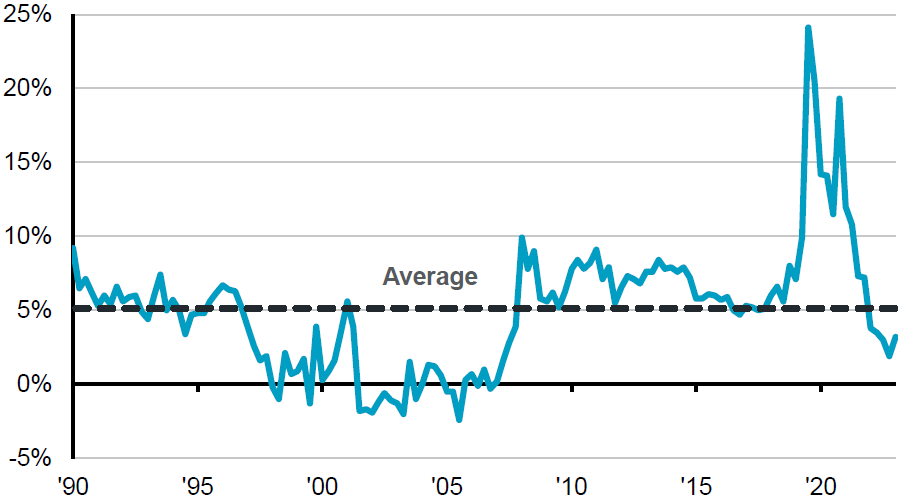

From the first quarter of 2023 to the last quarter the Australian economy slowed from a 2% annualised pace of growth to just 0.8%. This should not be a surprise given the impact that higher interest rates have had on the economy and the time taken for them to be felt in the ‘real world’. Household consumption accounts for approximately half of the Australian economy and the squeeze on household finances may start to ease from here. Falling inflation means real incomes will be higher, the labour market is moderating not collapsing, tax cuts are coming from mid-year and the outlook for further rate hikes has diminished. The savings rate has also ticked higher to 3.2%. While still low by historical standards, the increase does create more of a buffer against future drags. This diminishes the risk of further economic weakness, and the final quarter of 2023 should represent the low point for growth in the economy.

Household savings rate turned higher, improving the buffer against future drags

% of disposable income

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 08/03/24.

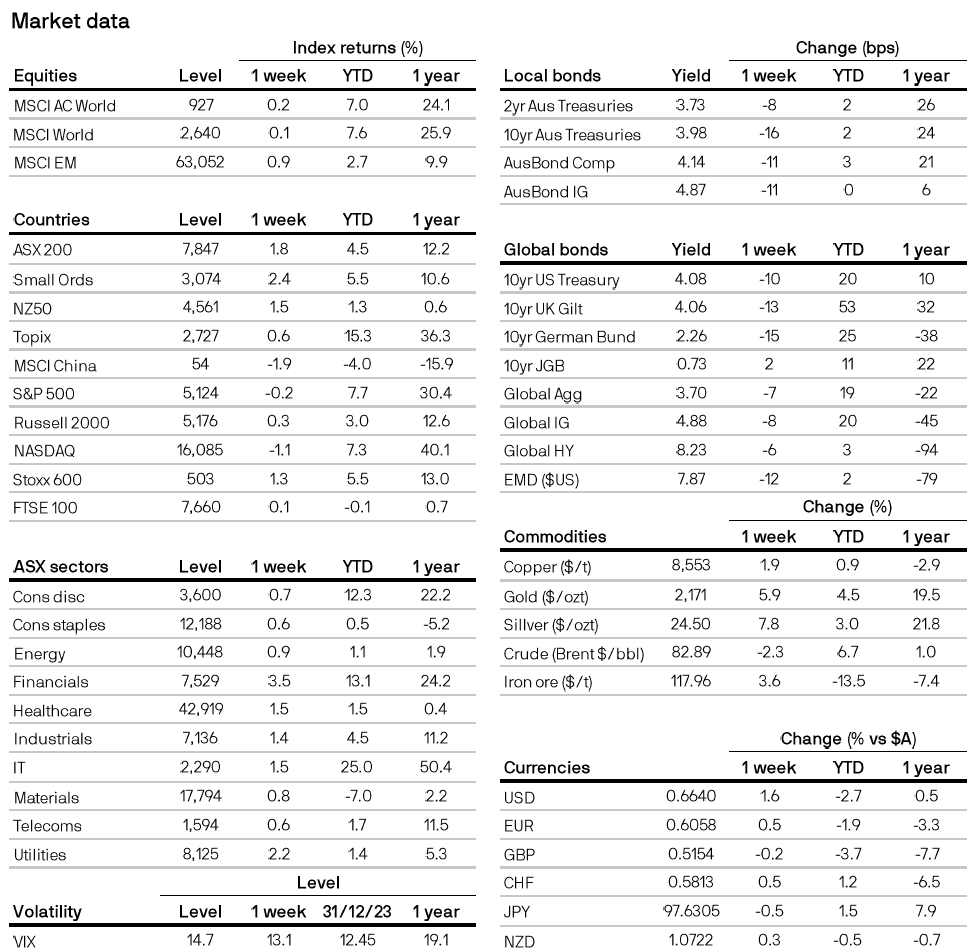

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5