Week in review

- Australian wage price index rises to 4.3% y/y

- Composite PMI falls in the U.S. and Japan, rises in Europe

- RBA minutes maintain the balanced view

Week ahead

- Australia monthly CPI inflation

- RBNZ policy meeting

- Eurozone and Japan CPI inflation

Thought of the week

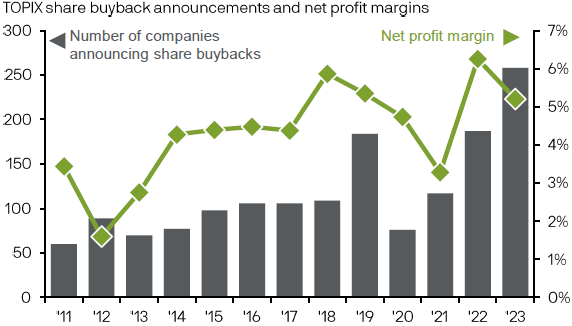

U.S. equities aren’t the only ones that can make record highs. The Japanese Nikkei equity index just surpassed its 1989 peak, despite the economy experiencing a soft start to the year after technically entering a recession in the second half of 2023. The Purchasing Managers’ Indices for manufacturing and services both fell in January. It may appear that the market is dislocated from the economy given the divergence in performance. However, investors may be taking a more constructive view on the structural improvements in the economy and market. A positive outcome on inflation and wage growth would allow the Bank of Japan to finally exit negative interest rate policy easing pressure on financial companies. Meanwhile, the Tokyo Stock Exchange actions to improve corporate governance and shareholder value are also starting to work as cash rich companies start to invest or return capital to shareholders.

Japan’s high cash corporate balance sheets are being put to work

Source: FactSet, TOPIX, J.P. Morgan Asset Management. Data reflect most recently available as of 23/02/24.

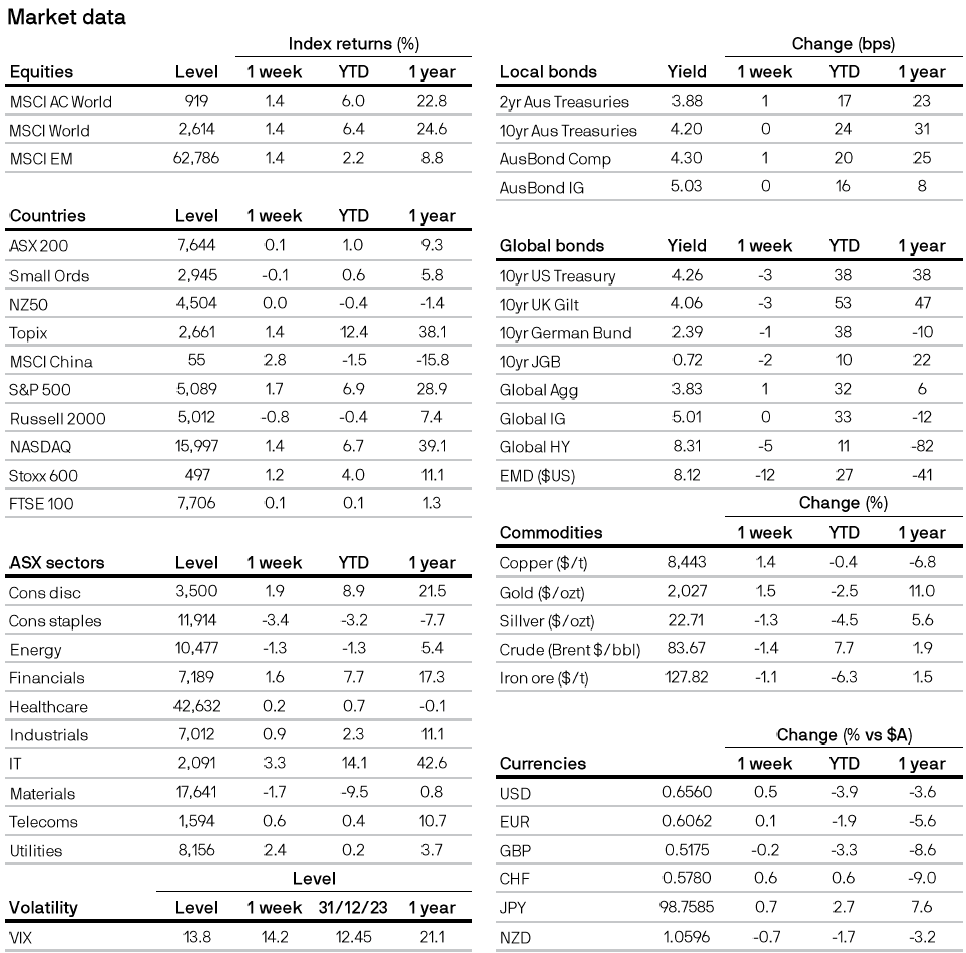

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5