Week in review

- Australian unemployment rate rises to 4.1%

- U.S. CPI inflation stickier at 3.1%y/y

- Australia business conditions declines to 6.3

Week ahead

- RBA policy meeting minutes

- U.S. FOMC meeting minutes

- Composite PMIs for U.S. and Australia

Thought of the week

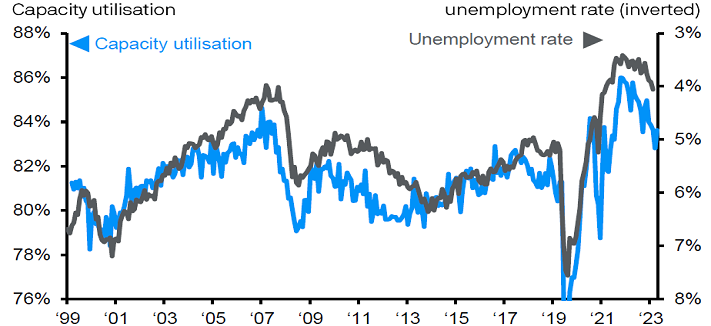

There was some sticker shock to the January labour market report for Australia as the unemployment rate jumped to 4.1%, its highest in two years. However, economic data releases for January in the past few years have been impacted by strong seasonality effects. In the case of the employment data January has become a month when fewer people are active in the labour market. This may be because summer means more time off for many workers or that covid-19 effects are still lingering in the data. In prior years, January was the month when restrictions on mobility and working were the highest. January may be a blip and the unemployment rate may fall again in February, but the trend is for further weakness in the labour market. Forward-looking indicators of the labour market, such as vacancies or surveys of how much capacity companies have, suggest a higher unemployment rate by year end.

Further easing in the Australian labour market to come

Source: ABS, FactSet, NAB, J.P. Morgan Asset Management. Data reflect most recently available as of 16/02/24.

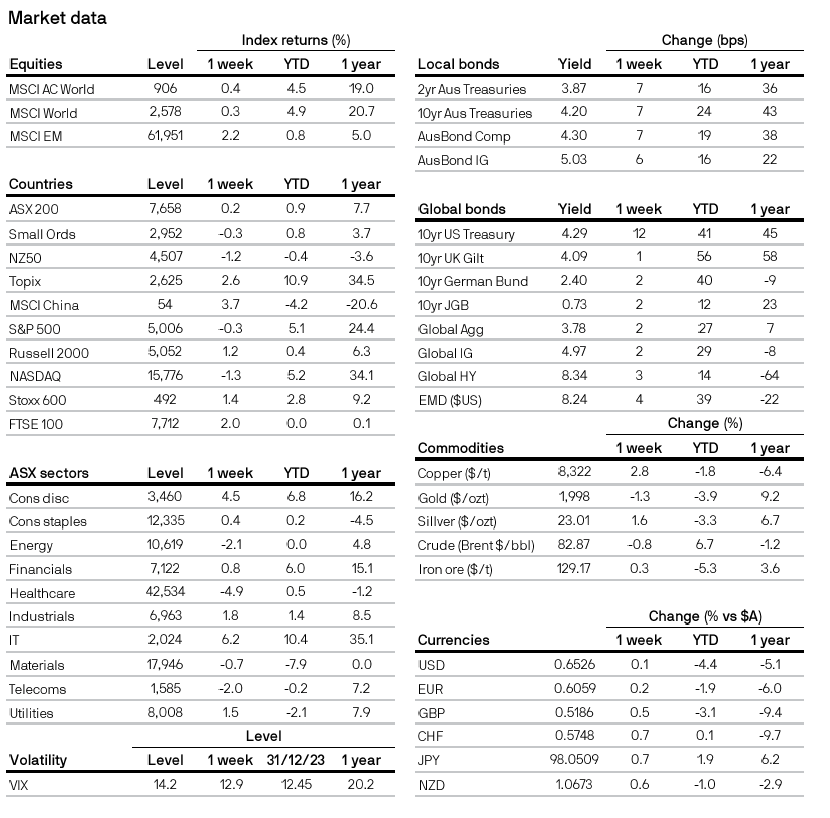

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5