Week in review

- Australia unemployment rate at 3.9%, in line with expectations

- China 4Q and 2023 real GDP growth was 5.2% y/y

- U.S. PPI weaker than expected at -0.1% m/m

Week ahead

- ECB rate announcement

- U.S. real GDP

- Australia NAB business confidence

Thought of the week

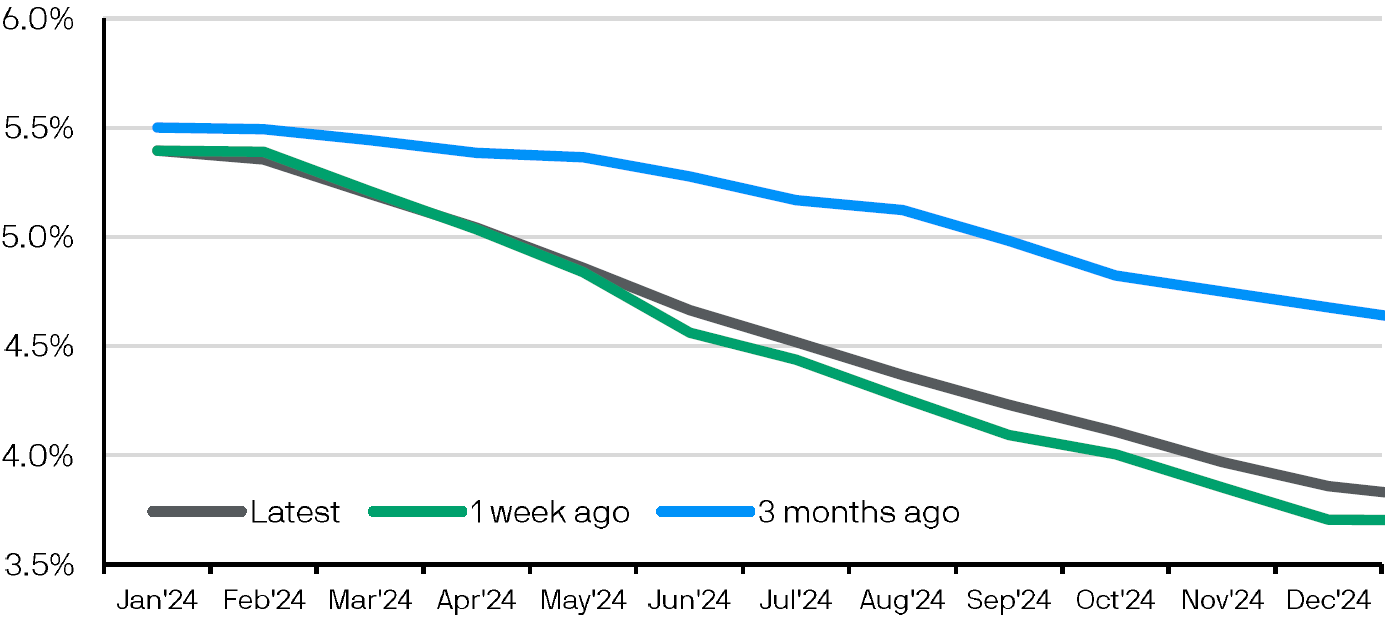

In the past few weeks, Fed speakers have vocally pushed back against markets’ expectations of the timing and magnitude of rate cuts. Notably, on Tuesday, Fed Governor Waller (a voter) noted that rate cuts will have to be “carefully calibrated and not rushed”, and that “there was no reason to move as quickly or cut as rapidly as in the past”. On the day, market expectations shifted slightly from expecting 160bps cuts in 2024 to 150bps, and currently stands at 140bps, which is still twice as much as the Fed’s dot plot. Fed speakers perhaps almost feel obliged to pushback, given how financial conditions have eased, with the 10Y Treasury yield having declined nearly 100bps from its October peak. Of course, the speed of cuts currently priced is not unprecedented. But out of the 7 monetary easing episodes in the past 35 years, only 3 times did the Fed cut more than 150bps within 12 months, but they were all recessionary periods. Of course, the level of rates the Fed cuts from is also a factor to consider, but with the current strong labor market and a soft landing priced into financial markets, it is indeed hard to see such a rapid pace of Fed cuts warranted this year.

Market expectations of rate trajectory in 2024

Based on forward rates on overnight indexed swaps

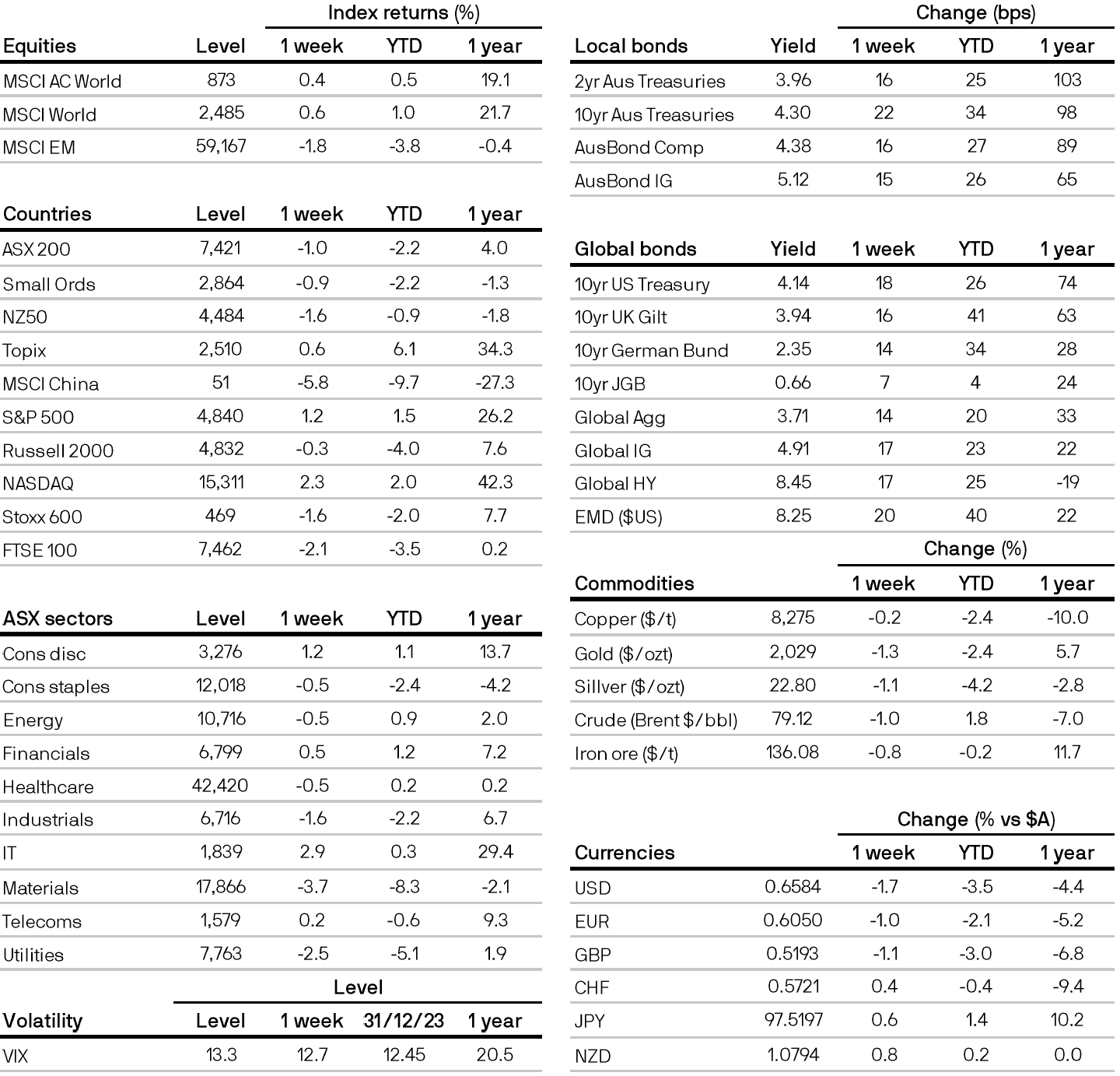

Market data

Source: Bloomberg, J.P. Morgan Asset Management. Data reflect most recently available as of 18/01/24.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5