Week in review

- Australia retail sales rose 2.0% m/m

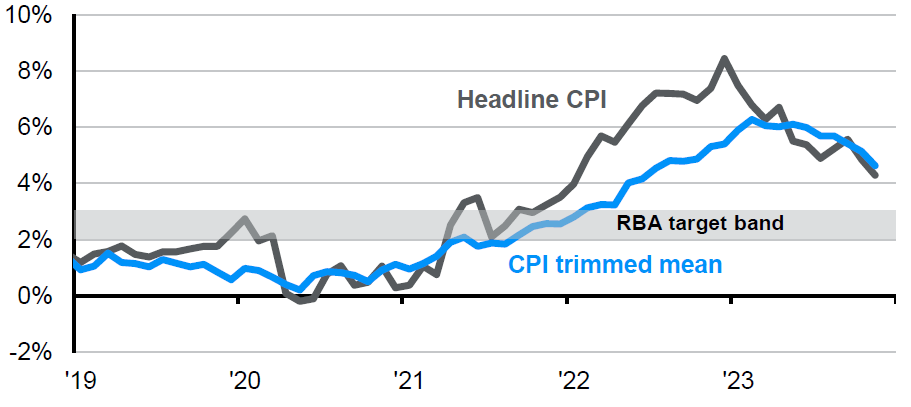

- Australia headline CPI eased to 4.3% y/y, core CPI declined to 4.6% y/y

- Australia building approvals rose 1.6% m/m

Week ahead

- U.S. retail sales, housing starts

- UK CPI, core CPI

- Australia unemployment rate

Thought of the week

Australia headline CPI rose 0.3% month-over-month (m/m) in November, bringing the year-over-year (y/y) measure to a near two year low of 4.3%. Core inflation, the trimmed mean, rose 4.6% y/y down from 5.3% y/y in October. The softening in inflation print has reinforced market expectations that the Reserve Bank of Australia (RBA) would not need to raise rates any further. Market reaction was rather muted as the futures market have been pricing in a no hike in February for quite some time now. On 3 month over 3 month annualized basis, headline CPI is still at 3.8%, so while inflation is moving in the right direction lower, it is moderating at a gradual pace. As such, the conversation around rate cuts is still arguably premature. Rental prices are still rising, increasing 6.6% y/y in November, reflecting low vacancy rates and a tight rental market. In addition, the consumer market remains robust, with retail sales rising 2.0% m/m in November, above market expectations, albeit with some distortions related to the Black Friday sales taking place in late November. The good thing is that there are further signs of the labor market cooling off, and the fade away of holiday spending should help keep inflation in check.

Inflation moderating but still above RBA’s target band

Year-over-year change

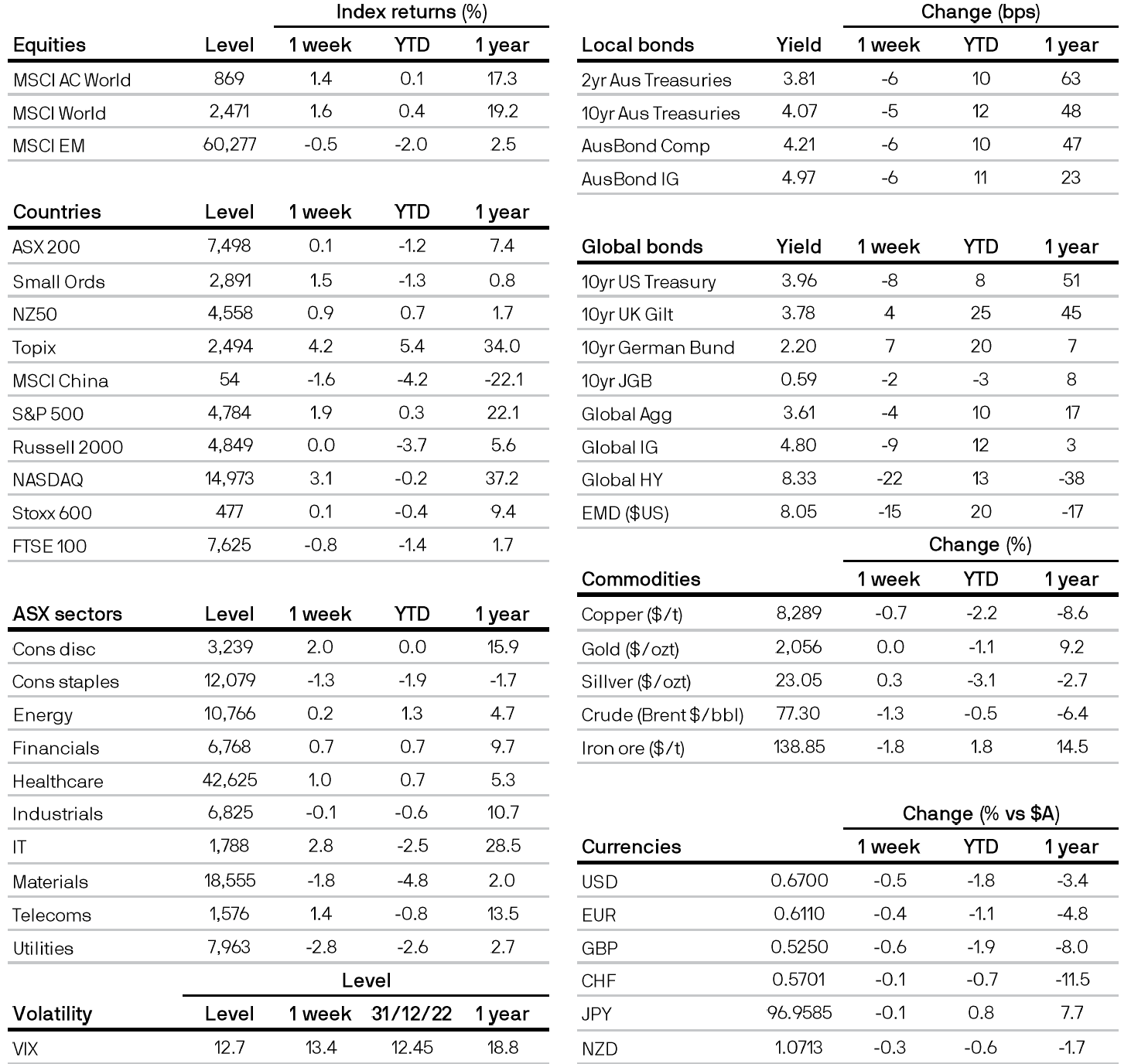

Market data

Source: FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 13/01/24.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5