Week in review

- China PMI manufacturing rises to 50.8

- U.S. job openings fall to 8,790k

- U.S. non-farm payrolls 216,000

Week ahead

- Australia retail sales

- Australia monthly CPI inflation for November

- Australia building approvals

Thought of the week

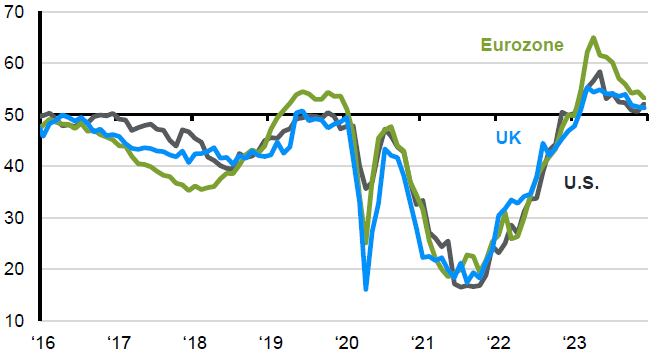

The enthusiasm, or lack of it, in markets last week no doubt reflected the attitudes of many returning to the office after the festive break. The market run-up into year-end was fueled by speculation of early rate cuts and fading inflation. However, the release of the FOMC meeting minutes put some dampener on rate cuts by March, and geopolitical risks in the Middle East and the impact on supply chains are looking uncomfortably familiar. Falling goods and energy prices have been a tailwind to lower inflation in recent months but a rise in prices from supply disruption may be an underappreciated risk to the 2024 outlook. Measures of shipping freight costs have started to rise and the delivery times sub-index of the manufacturing PMI declined further in December. Our base case is for inflation to fall further in 2024 and allow central banks to ease policy, but a high degree of uncertainty remains on timing.

PMI supplier delivery times not yet a warning, but slipping further

PMI manufacturing, falling value suggests longer delivery time

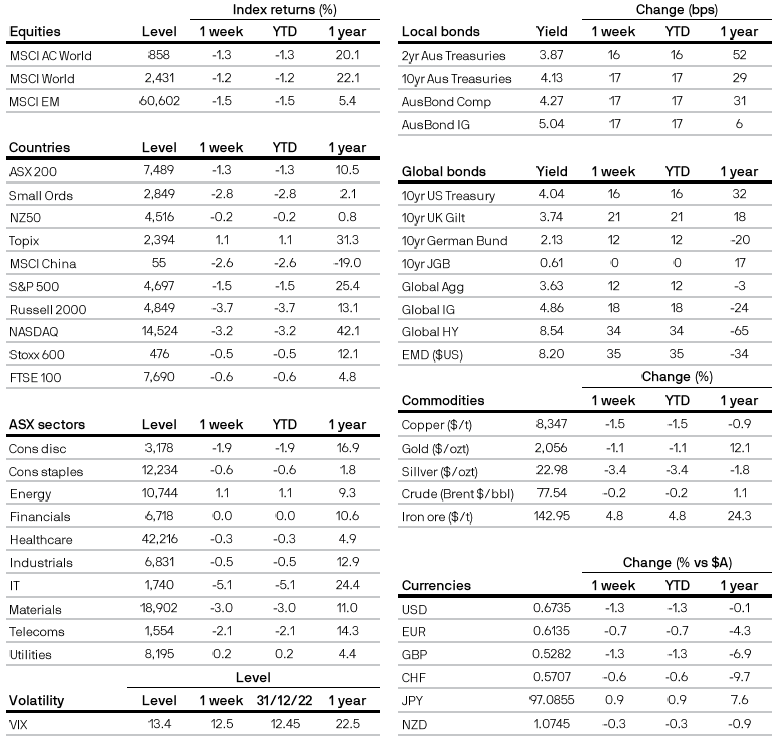

Market data

Source: FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 05/01/24.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5