Week in review

- U.S. inflation falls to 3.1% y/y in November

- Australian unemployment rate rises to 3.9%

- U.S. Fed, Bank of England and European Central Bank hold on rates

Week ahead

- Bank of Japan policy meeting

- RBA minutes of December policy meeting

- Eurozone consumer confidence

Thought of the week

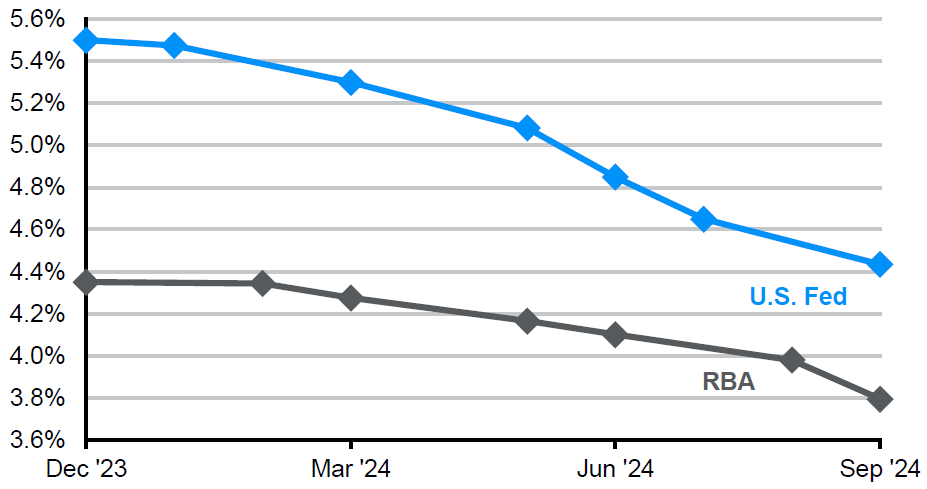

Christmas doves were out last week as economic data pointed towards lower inflation and policy rhetoric to looser monetary policy in 2024. In the U.S. consumer and producer inflation figures showed a moderation in pricing pressures. The U.S. Federal Reserve was more dovish and on balance committee members now anticipate three rate cuts next year, up from two in September. Meanwhile, the Australian unemployment rate rose to 3.9% and is 0.4%pts higher than its cycle low. Leading indicators also point to a gradual easing of wage pressures as the unemployment rate rises. Bond yields have fallen sharply, and equities rallied hard in the prior weeks as 2024 gains are brought forward. The risk is now a reversal in market sentiment should any economic data now miss, but investors can take solace in the fact that both stocks and bonds tend to do well after the passing the policy peak.

Market implied policy rates for Australia and the U.S.

Expected policy rate at coming central bank meetings

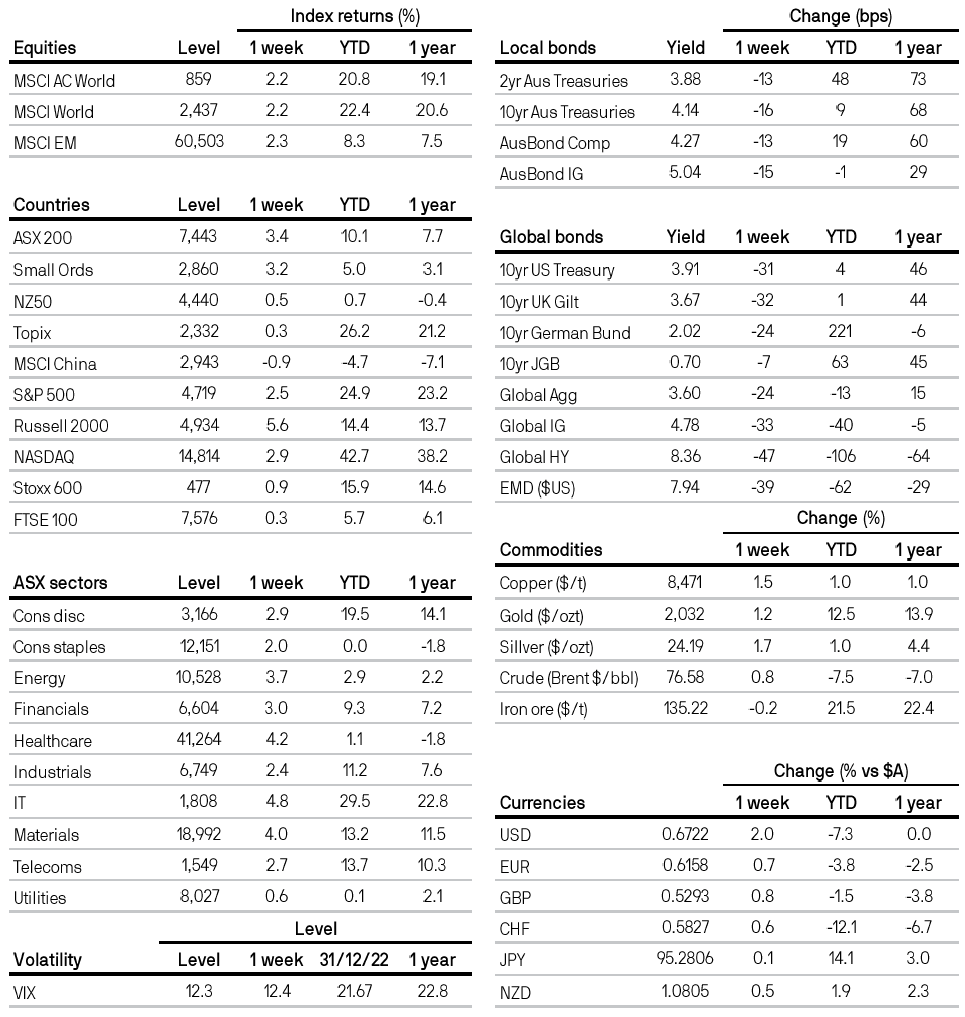

Market data

Source: FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 15/12/23.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5