Week in review

- Australia retail sales -0.20% m/m for October

- Australia monthly CPI inflation 4.9% y/y for October

- China PMI manufacturing rises to 50,7

Week ahead

- RBA policy rate meeting

- U.S. nonfarm payrolls

- Australia 3Q real GDP

Thought of the week

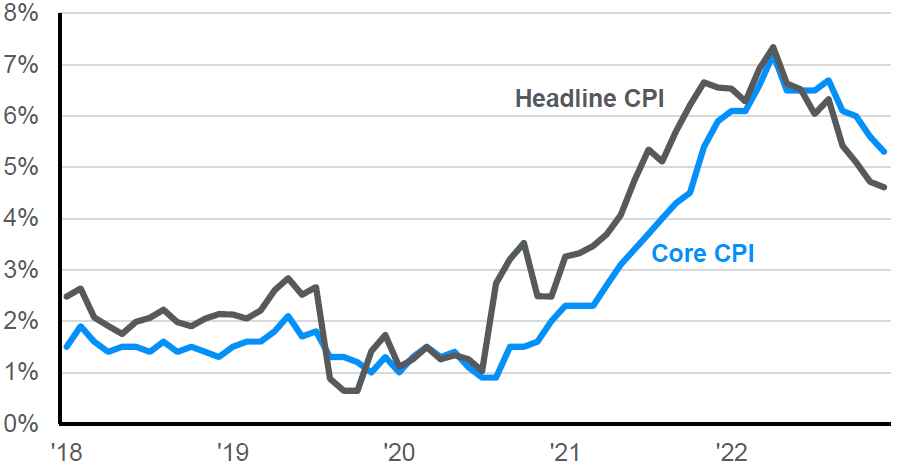

One month doesn’t make a trend, but it does help. The monthly inflation series for Australia was weaker than expected for October rising by only 4.9% y/y and well down on the 5.6% from the prior month. The short history of the monthly inflation series means that it can be prone to revisions and focuses on goods rather than services. Some distortions remain given the impact of government subsidies to address the cost of living. The weaker print may suggest some easing in the hawkish tone from the RBA recently, but the underlying rate of inflation didn’t moderate as much and the shift in the narrative towards domestic driven inflation pressures will do little to ease the tightening bias held by the RBA. Our view is that inflation pressure will continue to recede, but not in a straight line. This should keep the RBA on hold in 2024 rather than having to hike rates further.

Australia inflation heading in the right direction, but is if fast enough?

Monthly CPI inflation change year-over-year

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 30/11/23.

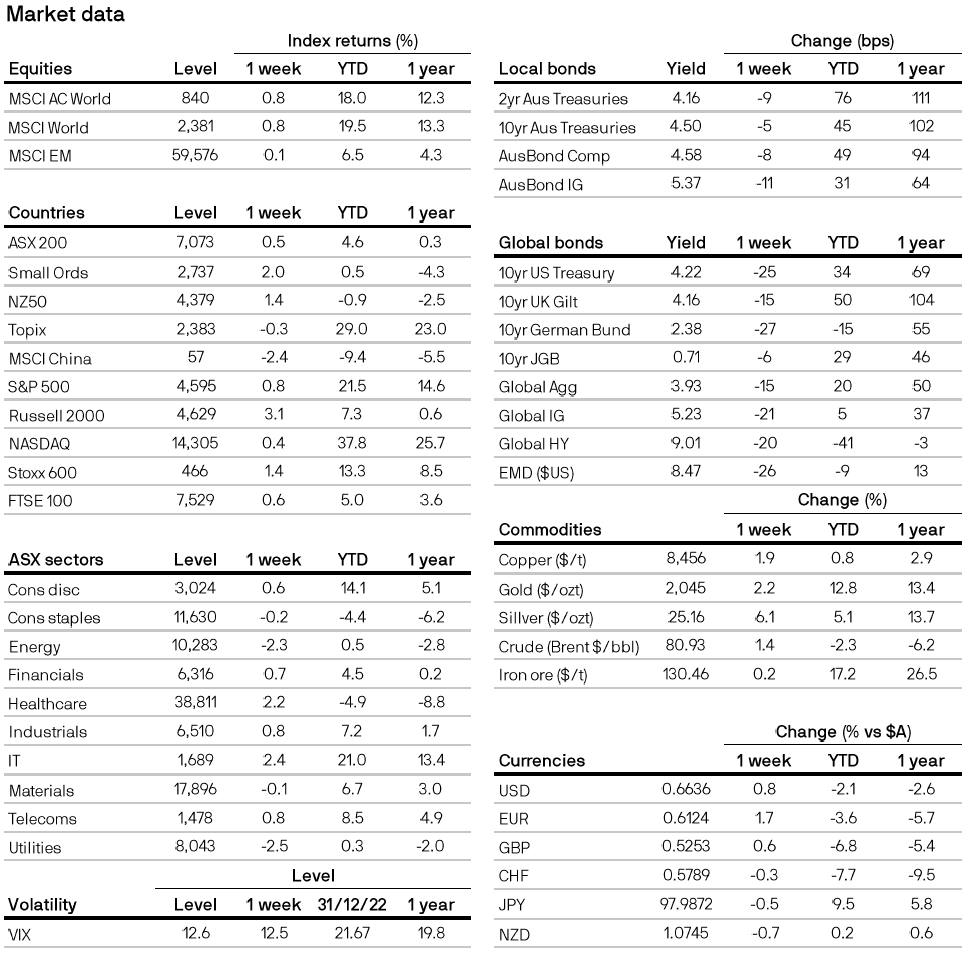

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period. Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5