Week in review

- RBA hikes cash rate by 25bps to 4.35%

- China back in deflation as CPI inflation falls 0.2% y/y

- Eurozone retail sales fall 2.9% y/y in September

Week ahead

- Australia business and consumer confidence

- Australia unemployment rate

- Australia wage cost index

Thought of the week

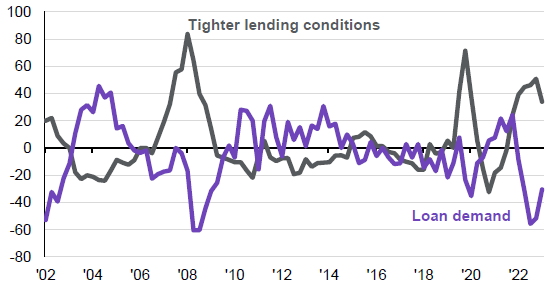

More U.S. data out last week suggests that the risk of imminent recession is falling. The Senior Loan Officers Opinion Survey showed a marginal shift down in the tightness in lending standards and a small pick up in demand compared to the prior quarter. This tightness in lending indicates that the Fed’s rate hikes are having an impact and banks are becoming more discerning on the quality of borrowers and their ability to repay loans. But when compared to Europe the majority of lending in the U.S. still happens though public debt markets rather than bank lending channels. This suggests that the Fed would not want to see yields on government bonds fall too far and financial conditions start to ease just when its policy tightening was starting to have an impact. The bad news is good news narrative that has seen equities rally and yields fall in the past week could turn quickly if the bad news is not bad enough for the Fed to be done with hiking.

U.S. lending conditions remain tight and demand for loan weak

Net % of respondents, Senior Loan Officers Opinion Survey

Source: FactSet, U.S. Federal Reserve, J.P. Morgan Asset Management. Data reflect most recently available as of 10/11/23.

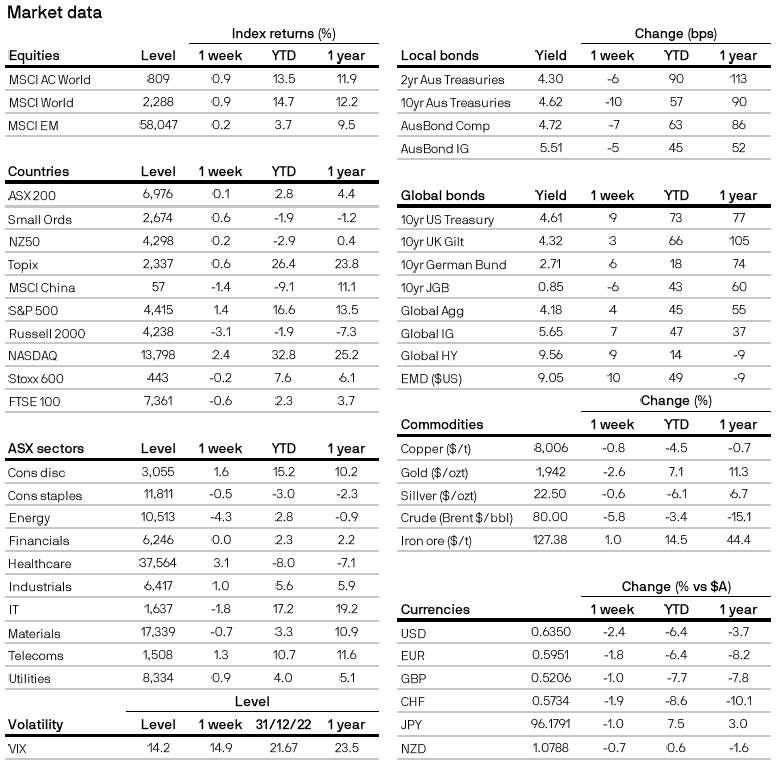

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5