Week in review

- Australia CPI inflation picks up to 1.2% q/q

- Eurozone composite PMI falls to 46.5

- U.S. real GDP expands by 4.9% q/q annualised in the third quarter

Week ahead

- U.S. FOMC rate decision

- Australia retail sales for September

- U.S. nonfarm payrolls

Thought of the week

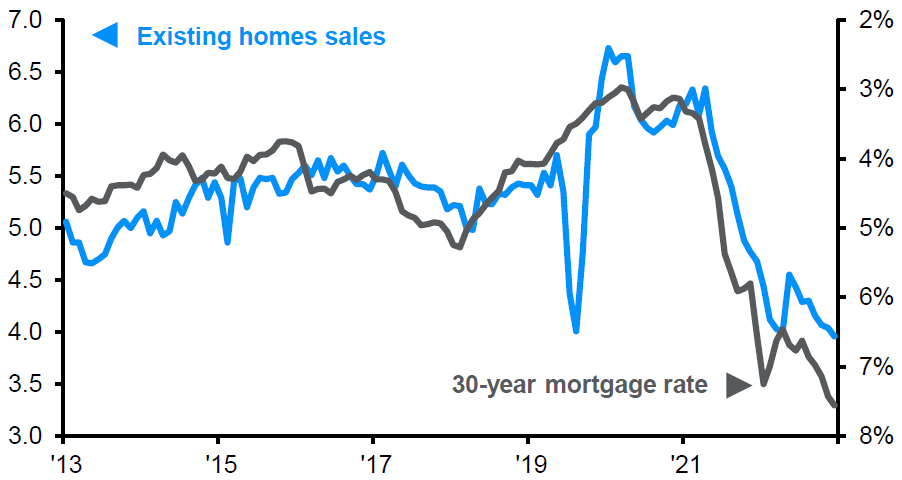

Data from the U.S. last week suggest the economy is yet to feel the real impact of higher rates helping to push bond yields back towards 5%. The PMI for manufacturing and services sectors ticked above 50, the level that separates expansion from contraction, in October and new home sales also rose reversing an earlier decline. However, the weakness in the economy is real and the outlook for economic activity in the quarters ahead is much weaker. Mortgage applications in the U.S. are at a multi-decade low as the 30-year fixed mortgage rate moved close to 8% this month. This is impacting existing home sales, which represent a much large share of total home sales, which have plummeted (see chart). U.S. households may be insulated from higher rates given the much longer fixed rates they enjoy than in Australia, however, the housing market is still locked up with few willing to sell in this environment.

Higher rates cooling the U.S. housing market

Units, millions

Source: FactSet, Mortgage Bankers Association, U.S. National Association of Realtors, J.P. Morgan Asset Management. Data reflect most recently available as of 27/10/23.

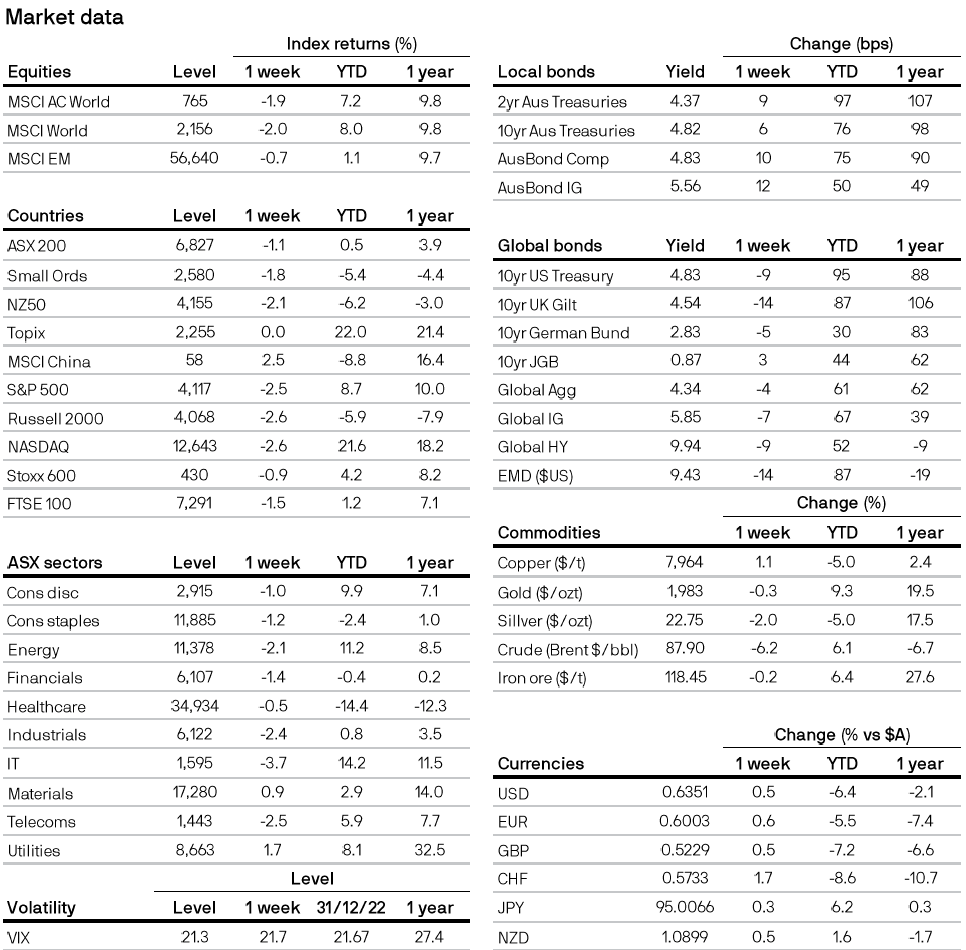

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5