Week in review

- U.S. CPI inflation 3.7% y/y in September

- Australian consumer confidence ticked higher to 82.0

- Australia business conditions fell to 10.6 from 14.0

Week ahead

- RBA policy meeting minutes

- Australia labour market report

- China 3Q real GDP

Thought of the week

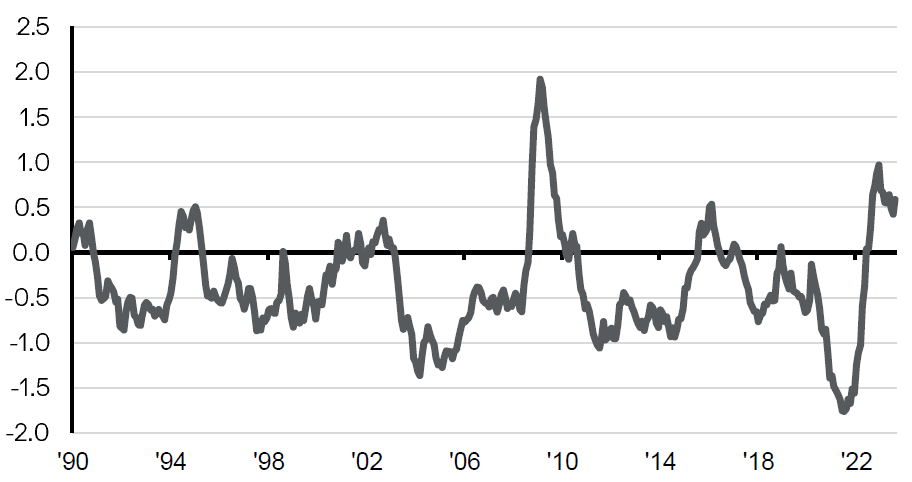

Yields on U.S. Treasuries have eased back from their recent highs as the market focus shifted to whether the U.S. Federal Reserve really needs to hike rates next month, or if again at all this cycle. Several members of the Fed’s rate setting committee have outlined how the rise in yields and repricing of higher for longer in rates has led to a tightening in financial conditions, mitigating the need for the Fed to take further action. A case of working smarter not harder by the Fed. However, it can become a little chicken and egg. As long as the market pricing continues to push rate cuts into the future, then the Fed does not need to hike rates. If the market brings forward these expectations, then the Fed is more likely to hike rates to get the same outcome and kept conditions tight. This may be an unnecessary argument as the tightening in financial conditions are having a lagged impact and we expect cooling growth in the quarters ahead.

Financial conditions have increased as rate cuts are priced

U.S. Federal Reserve Financial Conditions Index

Source: U.S. Federal Reserve, J.P. Morgan Asset Management. Data reflect most recently available as of 13/10/23.

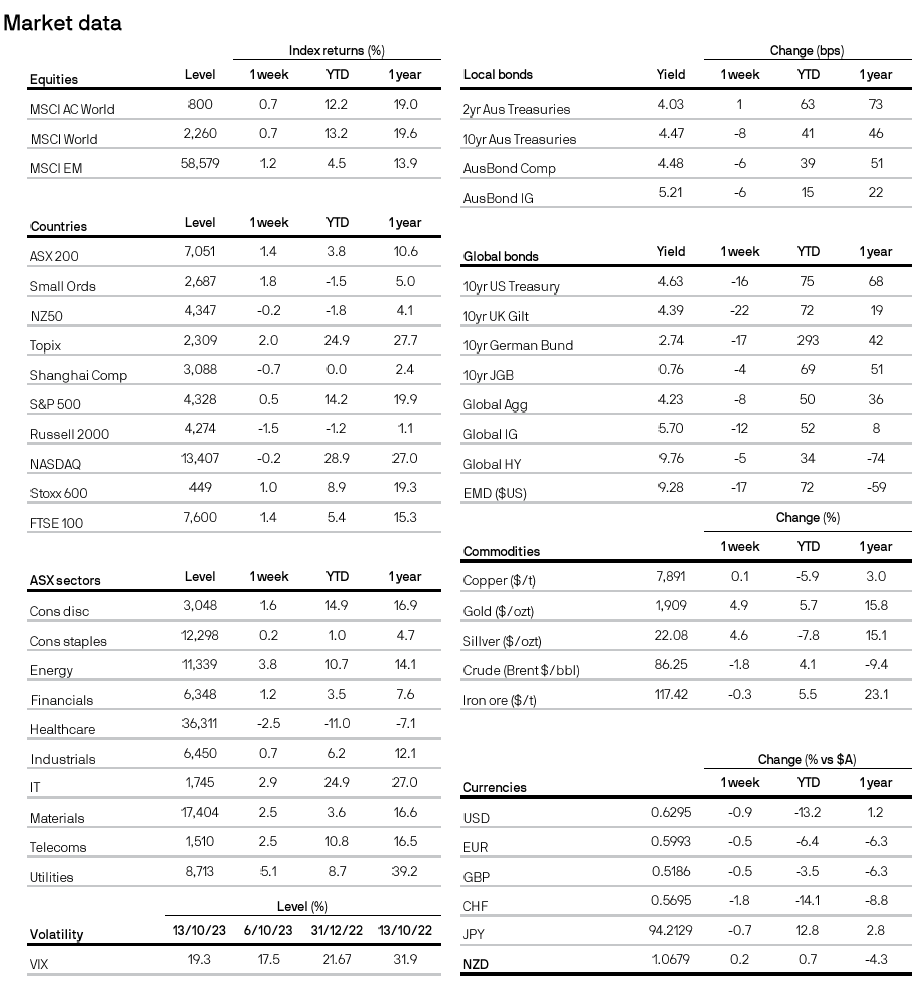

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5