Week in review

- Australia surveyed business conditions rose to +13 in August, above long-term average of +6, but surveyed consumer sentiments fell 1.6% m/m

- U.S. August headline and core CPI grew 0.6% and 0.3% m/m respectively

- China headline CPI inflation returned to positive territory in August at 0.1% y/y

Week ahead

- U.S. Fed rate decision

- Japan core CPI

- Taiwan industrial production and export orders

Thought of the week

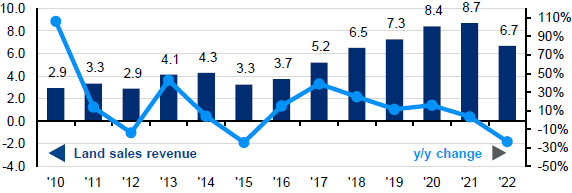

China’s local government financing vehicles (LGFV) total debt ballooned in the past years to what the IMF currently estimates to be 9.1tr USD. Over the pandemic, local government expenses shot up due to the implementation of mass testing and lockdowns. On the revenue side, sluggish economic growth has dragged tax revenue and the property downturn led to a sharp drop in land sales, a major revenue source for local governments. Instead of carrying out countercyclical fiscal policy, local governments are now cash-strapped and pulling back on spending, further impairing growth. The central government has a tough job of balance when thinking about intervention. On one hand, since 2015, the government has been trying to avoid blanket bailouts to prevent a moral hazard. However, the systematic risks could be detrimental without state support. If a default is allowed to occur, it could lead to rating downgrades and spreads widening across other LGFV and SOE bonds, sending ripple effects across the Chinese bond market. So far, state banks have been injecting liquidity and restructuring loans to support LGFVs as a backstop, but what’s more hopeful is the recently-announced debt swap program where provincial governments can raise 139bn USD of bonds to repay LGFV debt. This is a small step in the scale of the problem, but nonetheless provides an emergency lifeline for struggling LGFVs and demonstrating the state’s willingness to support.

Land sales revenue

CNY trillion

Source: Wind, Citi Research, J.P. Morgan Asset Management. Data reflect most recently available as of 14/09/23.

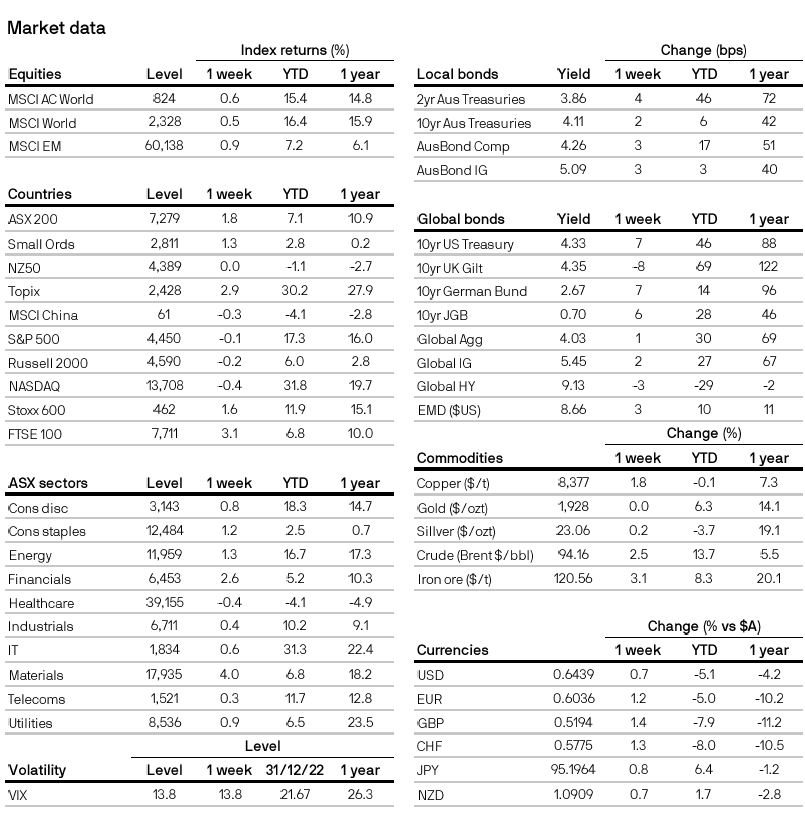

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5