Week in review

- Australian GDP 2.1% y/y for 2Q ‘23

- RBA holds rates at 4.1%

- Eurozone retail sales -1.0% y/y

Week ahead

- Australia business and consumer confidence

- U.S. CPI inflation

- Australia labour market report

Thought of the week

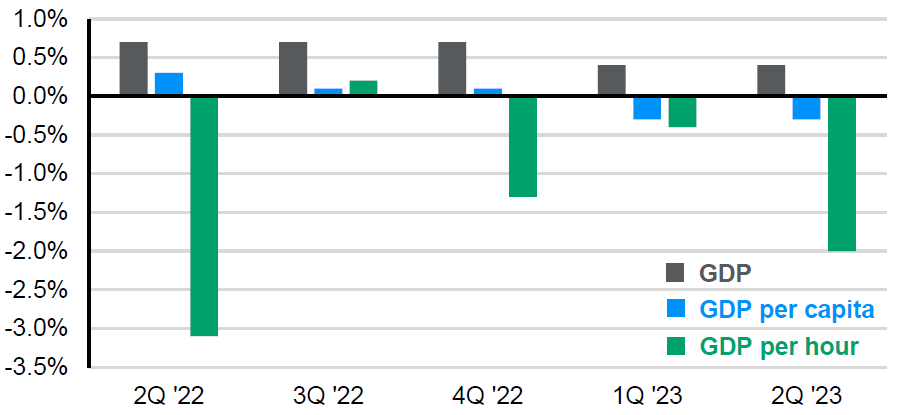

Australia’s economy expanded roughly in line with expectations at 0.4% q/q in the three months to June, and growth was revised up in prior quarters. In aggregate this is positive for the outlook and suggests the economy is more resilient to higher rates, but there is more than one way to measure economic activity. As the chart shows, GDP per capita (or economic output per person) has been negative for two quarters because the population has been expanding as net migration levels increase. Similarly, GDP per hour (or economic output for every hour worked) has been contracting for the past three quarters. This measure of the economy captures the weakening in productivity which can limit future growth. So what to make of these measures of growth? First, the economy in aggregate is doing okay and the tighter monetary policy is proving to be a drag rather than an anchor on activity. However, there are more of us in Australia and apparently we are less effective as a group leading to falling productivity and increasing hours worked. Ironically, this can create inflation pressures and the RBA has been looking for a rise rather than a fall in productivity.

Australia is growing, but were not very efficient

Real GDP measures, quarter-over-quarter

Source: ABS, J.P. Morgan Asset Management. Data reflect most recently available as of 08/09/23.

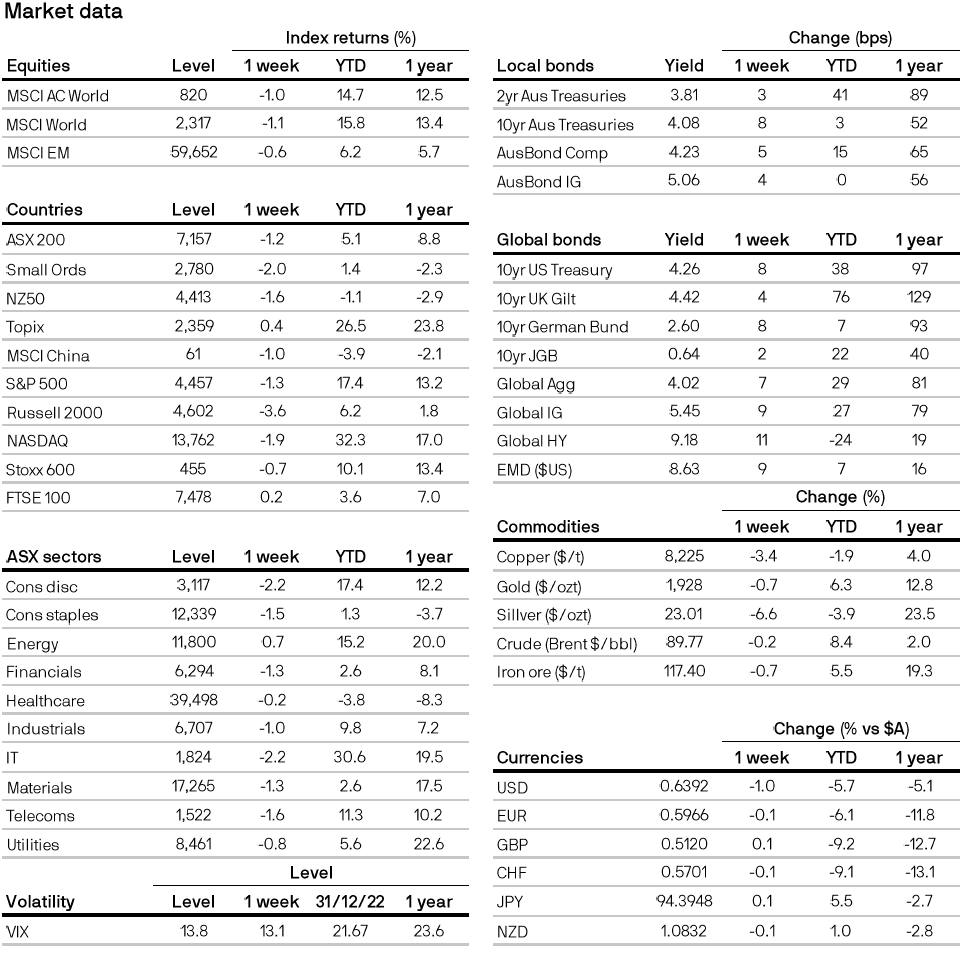

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5