Week in review

- Australian CPI inflation 4.9% y/y for July

- Australian retail sales 0.5% m/m in July

- U.S. GDP growth 2.1% q/q annualised in 2Q

Week ahead

- RBA policy meeting

- Australia real GDP 2Q23

- Eurozone retail sales for Jul

Thought of the week

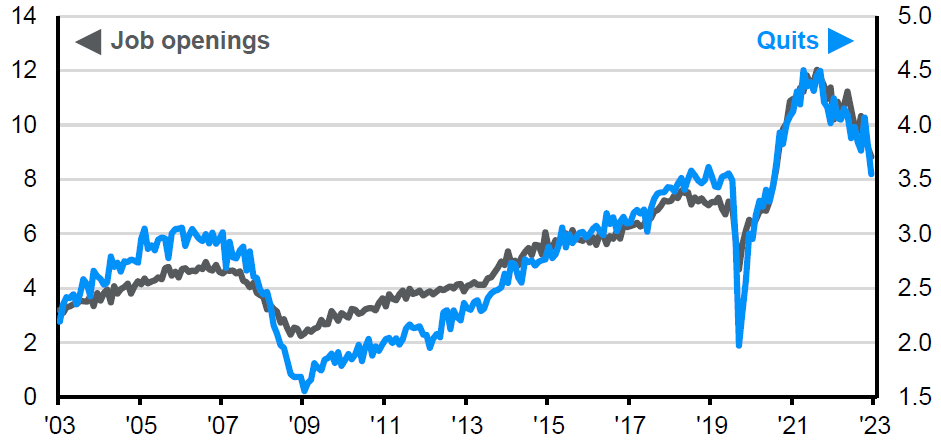

The U.S. labour market’s extreme tightening is showing further signs of easing. The Job Openings and Labour Turnover (JOLTs) report last week showed a further decline in both the number of job openings and the number of people quitting their current job. The quits level is now very close to where it was prior to the pandemic. For job openings, the figure is also well down on the 12 million jobs being advertised back in March 2022 at 8.8 million. While this is an improvement in the U.S. labour market, it simply means that the imbalances between supply and demand are less obvious rather than having been removed. The Fed recently highlighted that a slowing in the improvement in the labour market could be a reason to justify another rate hike. The JOLTs report alleviates this argument for now and further reason for the Fed to implement a hawkish skip in September. The market seems to agree and yields on U.S. Treasuries have been retreating from the recent highs. We see the bond market as being on sale and further run-up in yield an opportunity to add to core fixed income positions.

U.S. labour market is looking less imbalanced

Thousands

Source: BLS, J.P. Morgan Asset Management. Data reflect most recently available as of 01/09/23.

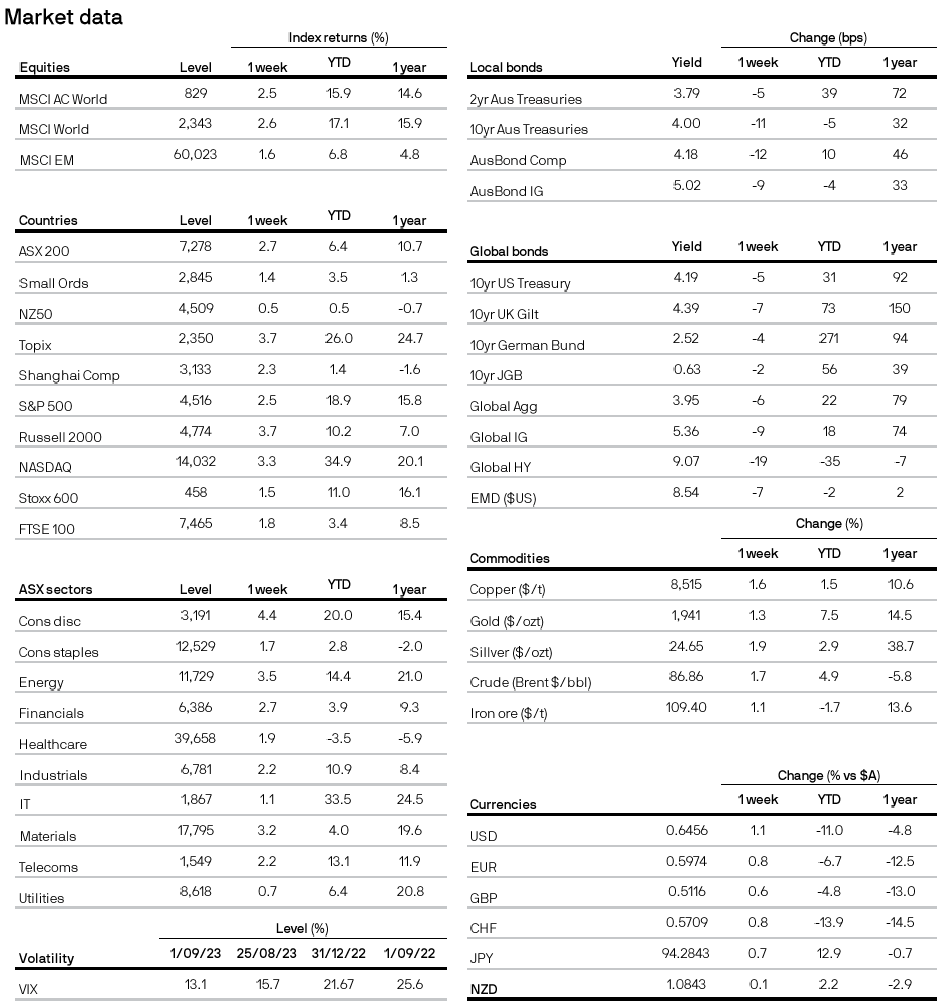

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5