Week in review

- PBoC cuts 1-year loan rate 10bps to 3.45%

- U.S. PMI composite slips to 50.4

- Eurozone PMI composite falls to 47.0

Week ahead

- Australia retail sales for July

- Australia monthly CPI inflation report

- U.S. nonfarm payrolls and labour market report

Thought of the week

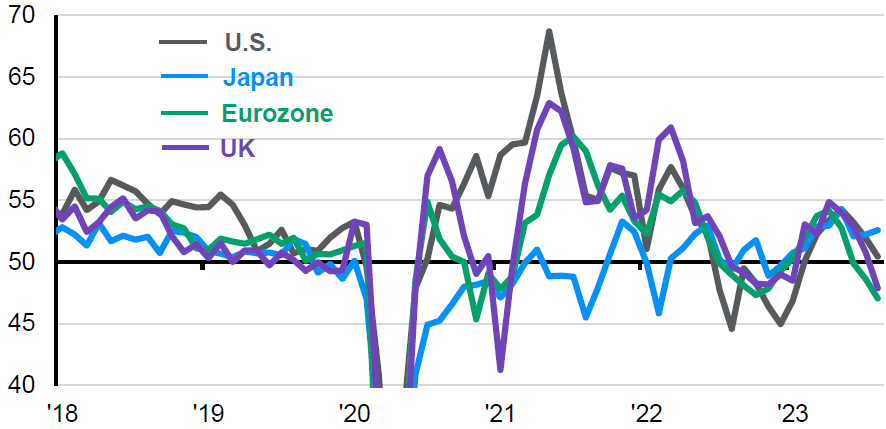

There was little good news in the release of the closely followed Purchasing Managers’ Indices (PMI) last week. This key piece of economic data ticker lower across most major developed markets, except for Japan. The PMI is influential given its strong correlation with economic growth and the weaker figures bring into question the strength of the current economic outlook. A reading below 50 suggests a contraction in economic activity in the months ahead. The PMI figures can be split into those related to the services industries and those of the manufacturing sector. The PMIs have highlighted the divergent path for these two parts of the global economy. The assumption was that the gap between the two indices would narrow as the boost services ran out of steam and manufacturing activity started to pick-up. However, the sinking PMI services have more than offset any improvement in the manufacturing side of the equation. The U.S. Federal Reserve was already expected to take a breather on the rate hiking cycle at its September meeting and given the downbeat reading on the European economy, the European Central Bank is increasingly likely to join them.

Disappointing economic data points to central bank pause in September

Purchasing Managers’ Index - Composite

Source: Markit, J.P. Morgan Asset Management. Data reflect most recently available as of 25/08/23.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5