Week in review

- Australia inflation falls to 6.0% q/q in 2Q

- U.S. Federal Reserve raises rates by 25bps to 5.25-5.50%

- Eurozone composite PMI falls to 48.9

Week ahead

- RBA policy rate decision

- U.S. nonfarm payrolls and labour market report

- Australia building approvals and housing finance

Thought of the week

The Chinese government made the right noises last week when it came to supporting what has turned into a feeble economic recovery. The property market has remained weak given there has been little credit support for property developers and buyer confidence fragile in the absence of further support measures. This has created issues for local governments that rely on land sales and taxes to fund spending and debt repayments. Meanwhile, overall household consumption has remained subdued given the negative wealth effects from the fall in property prices and limited employment opportunities. The outcome of the Politburo meeting was for greater fiscal and monetary stimulus, further easing of measures limited activity in the housing market and perhaps more credit support for developers. Further support is likely to come from a step up in local government bond issuance to fund infrastructure spending. While the official statement was light on details, economic activity in China should accelerate in the second half of 2023 as it moves to reach the 5% growth target. However, the spillover effects on the rest of the world look rather limited.

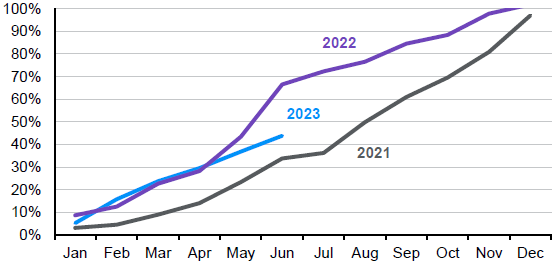

Local government bond issuance has been running below 2022 levels

Local government bond issuance as share of full year quota

Source: CEIC, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 28/07/23.

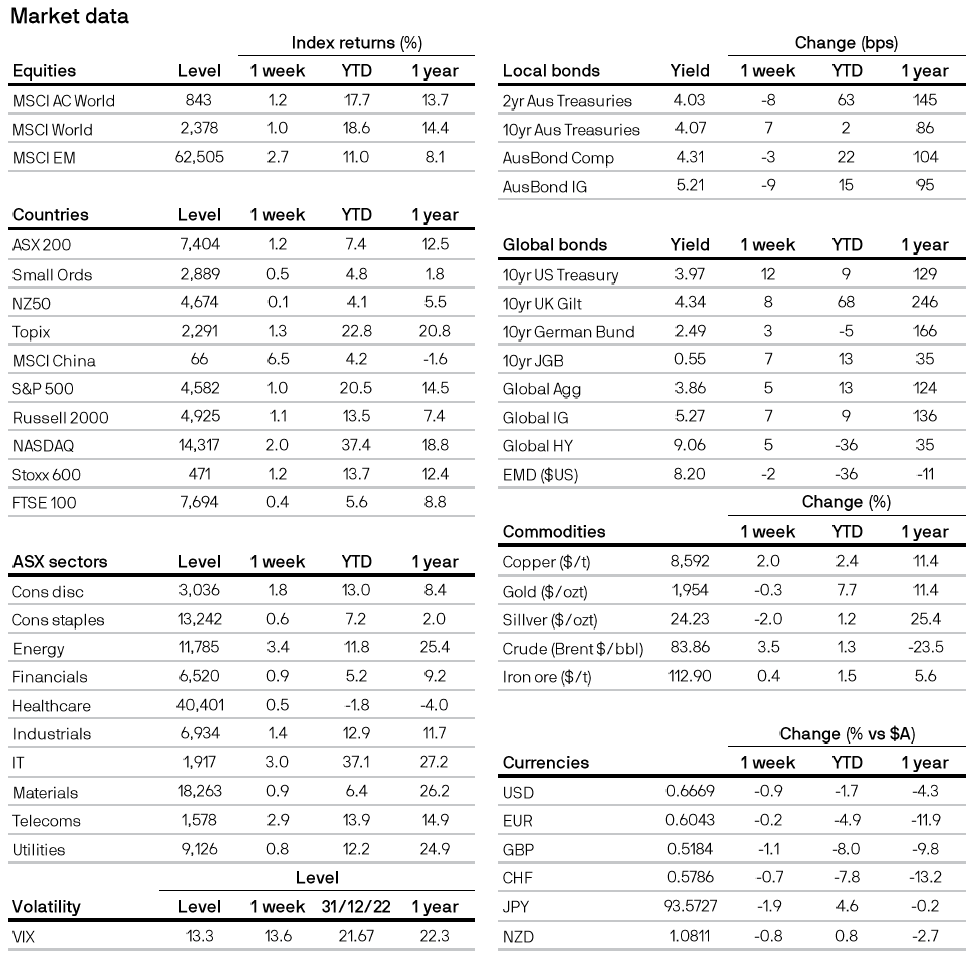

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5