Week in review

- U.S. CPI inflation falls to 3.0% y/y

- Australia consumer confidence index rose to 81.3

- Chinese CPI inflation fell to 0.0% y/y in June

Week ahead

- China 2Q real GDP

- RBA policy meeting minutes

- Australia labour market report

Thought of the week

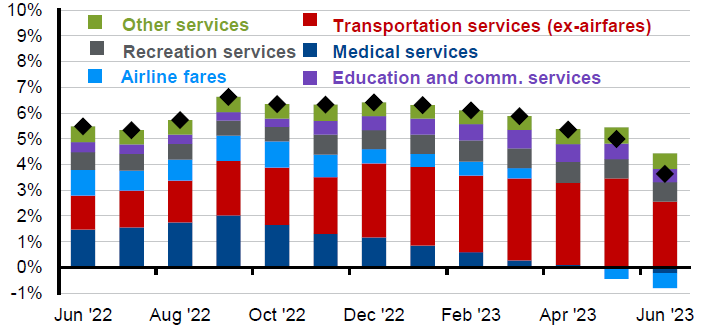

U.S. inflation was weaker than expected in June adding to the soft-landing narrative. Headline inflation came down to 3.0% y/y and core inflation was 4.8% y/y. This is good news as the disinflationary pulse continues. However, it’s unlikely to be enough to reverse the current course of another rate hike by the Federal Reserve (Fed) later this month. Increasingly the Fed has focused on a ‘super-core’ measure of inflation that shows price changes in services excluding shelter. The pace at which this index rose last month was 3.6% y/y, a big drop from the 5.0% in the prior month. Perhaps the most relevant for the Fed is that it isn’t wages that are driving this measure of inflation or tight labour markets, but transport excluding airfares. That is new and used car prices, vehicle repair costs and insurance. The price of vehicles and associated costs have been boosted recently given that production has returned and the supply issues during COVID has resolved. Now that headline inflation is at 3% there may be an expectation that the Fed may ease up on hikes after July, but the challenge of getting to 2% means near-term cuts are unlikely.

Transport costs are main driver of U.S. ‘super-core’ inflation

Year-over-year

Source: BLS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 14/07/23.

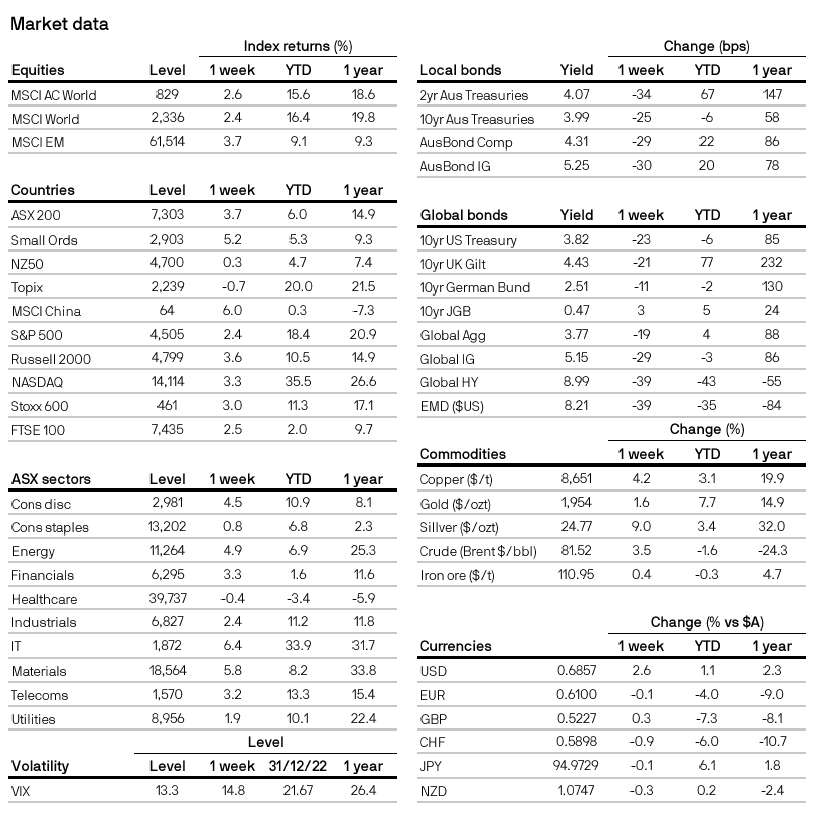

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467a72