Week in review

- RBA holds cash rate at 4.1% in June

- Australia housing finance rises 4.8% m/m

- U.S. job openings fell to 9.8 million for May.

Week ahead

- China CPI inflation

- Australia business and consumer confidence

- U.S. CPI inflation

Thought of the week

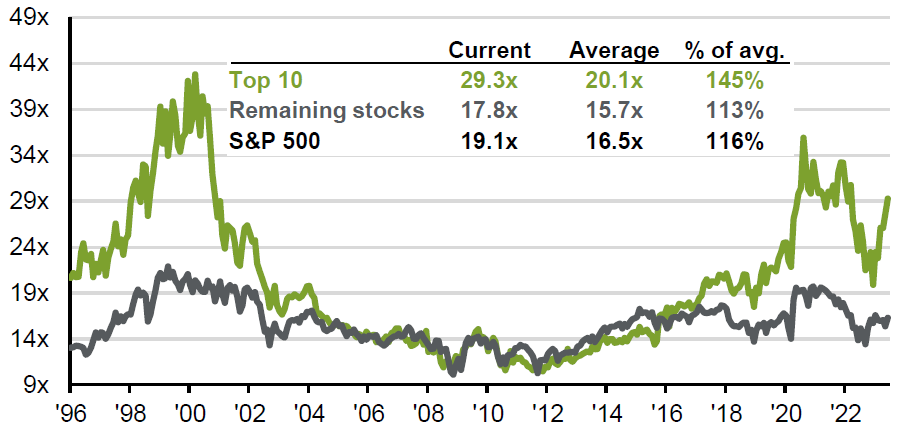

Risk assets have looked on the bright side in the first half of the year. Equity markets moved higher led by tech and AI-related stocks. But can this AI-generated Goldilocks scenario continue? Central banks are not done tightening rates, core rates of inflation remain sticky, business spending plans are depressed, and key business surveys have been softening. Still, labour markets are tight, and this is supporting wage growth and as headline rates of inflation come down it could create a modest tailwind for consumption. The U.S. is the epicenter of recession concerns but also the diverse market action. The top ten mega-cap names are now trading at valuations 45% above average, while the rest of the market is trading at a modest 13% rich (see chart). This is creating a serious concentration risk but also an opportunity for the segments of the market that have been left behind as the dispersion in valuations continues to widen and it could be a stock-pickers dream. The downside risks to growth mean a defensive tilt in portfolios, but the opportunity in areas outside of the tech rally should not be overlooked.

The S&P 10 vs. the S&P rest

Forward P/E ratio of S&P 500 by 10 largest companies

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Data reflect most recently available as of 07/07/23.

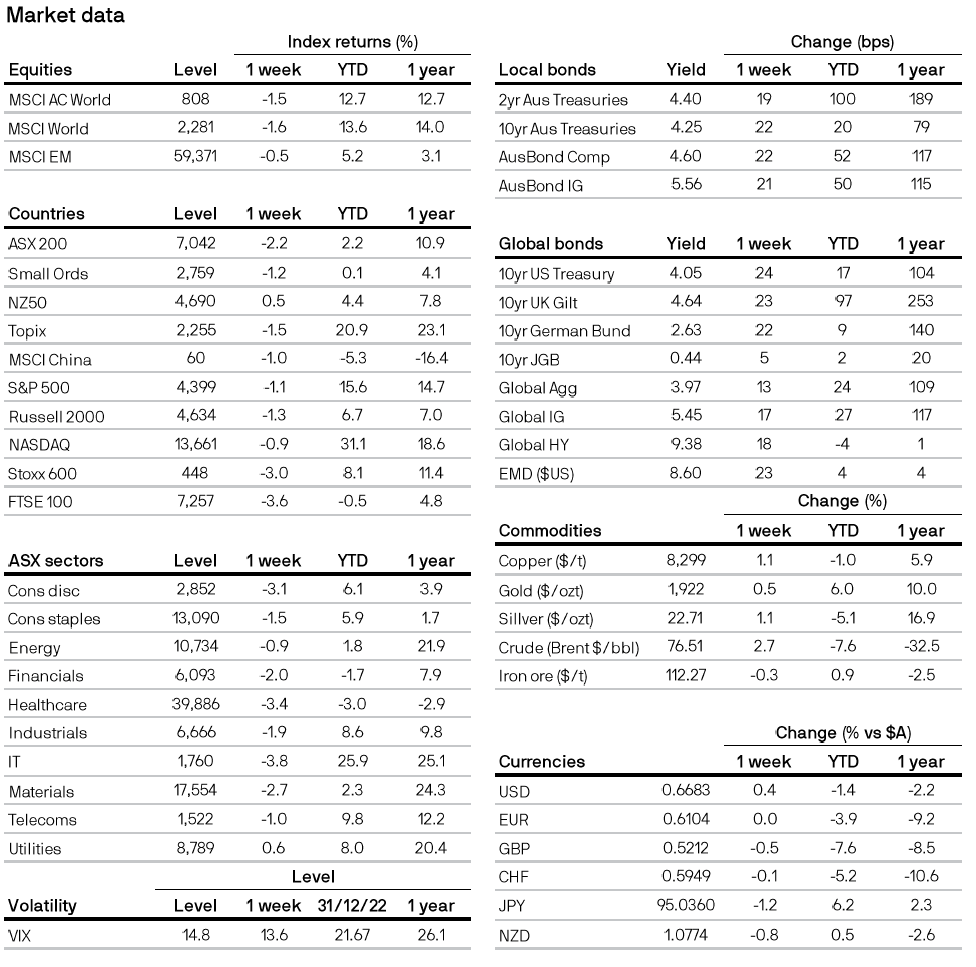

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467a72