Week in review

- Australia monthly CPI inflation -0.4% m/m in May

- Australia retail sales 0.7% m/m for May.

- U.S. consumer confidence rises to 109.7

Week ahead

- RBA official cash rate

- U.S. Job Openings and Labour Turnover survey

- U.S. Non-farm payrolls

Thought of the week

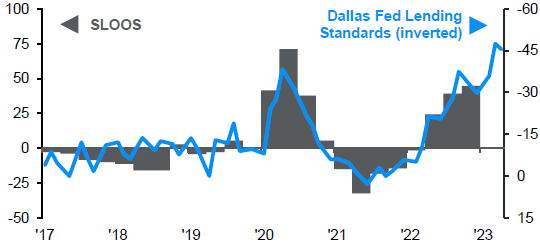

Building a case for a U.S. recession is getting a little more difficult after last week’s data. For the most part the economic releases in the last week suggesting things in the world’s largest economy continue to be better than thought. Consumer confidence improved and corporate capex intentions ticked higher. Add to this the consolidation in the U.S. housing market and a consumer that may soon start to benefit from real positive wages and calls for a recession are being wound back. However, these incremental improvements have a long way to go to offset the sharp rise in interest rates and the worsening credit conditions. The widely watched Senior Loan Officer Opinion Survey (SLOOS) isn’t that timely but is a reliable indicators of bank attitudes towards lending and lending standards are at their tightest since the onset of the pandemic. Last week another timelier survey from the Dallas Fed suggested that lending standards are only becoming more restrictive. This slow grind down in the economy may take longer than expected, shifting the timing of a recession further into the future rather than removing it altogether.

Lending standards keep ratcheting higher in the U.S.

Index

Source: Dallas Federal Reserve, U.S. Federal Reserve, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 30/06/23.

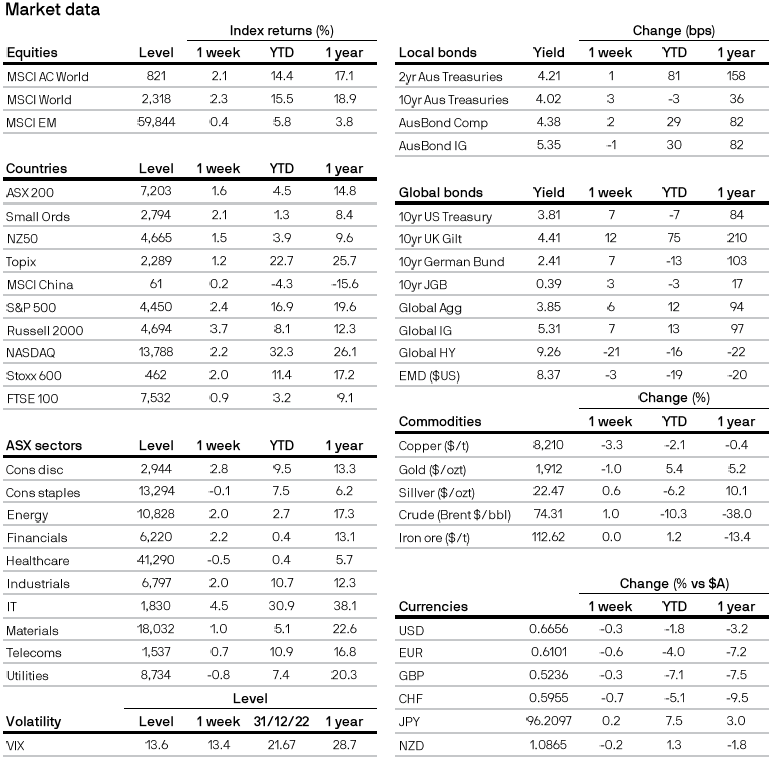

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5