Week in review

- RBA policy minutes show a balanced view on rates hike

- Bank of England raises cash rate by 50bps to 5.00%

- U.S. housing starts surge 21.7% m/m

Week ahead

- Australia monthly CPI inflation

- Australia retail sales

- China PMI manufacturing

Thought of the week

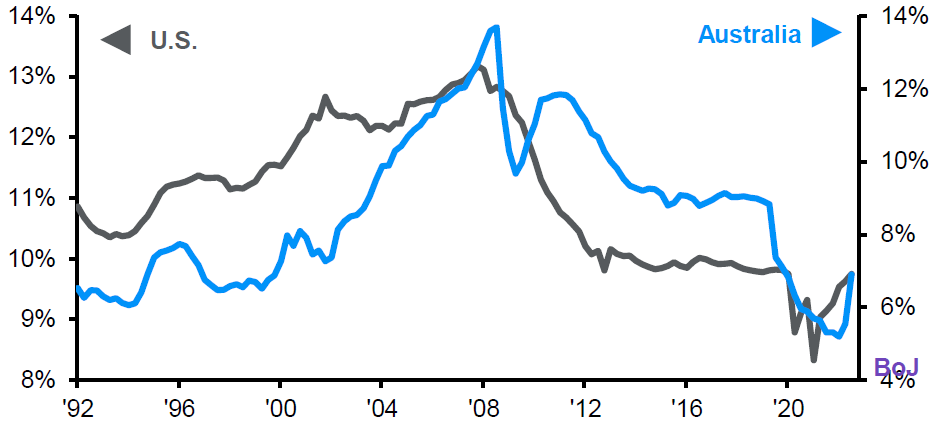

As the end point for central bank policy rates continues to move higher, households are facing stricter lending standards and higher debt servicing costs. While the data is lagged, it is clear the trajectory is higher for the U.S. and Australia (see chart) but is unlikely to reach pre-2008 levels. A higher cost of debt servicing is mitigated by the lower levels of overall debt in the U.S. where household balance sheets are in a better position given the sharp deleveraging that took place after the global financial crisis. The same is not true for Australia, where debt levels have continued to rise. The impact of higher rates will be felt more quickly in Australia relative to the U.S. (and many other developed economies) given the lower relative use of fixed rate mortgages and shorter duration of those fixed periods. However, households are both payers and earners of interest and higher rates should increase both. The ratio is likely to be tilted towards the interest paid rather than received, suggesting a greater drag on consumer spending as borrowers have a higher propensity to consumer than lenders.

Household debt service ratios are beginning to squeeze

Interest payments to household disposable income, seasonally adjusted

Source: ABS, BEA, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 23/06/23.

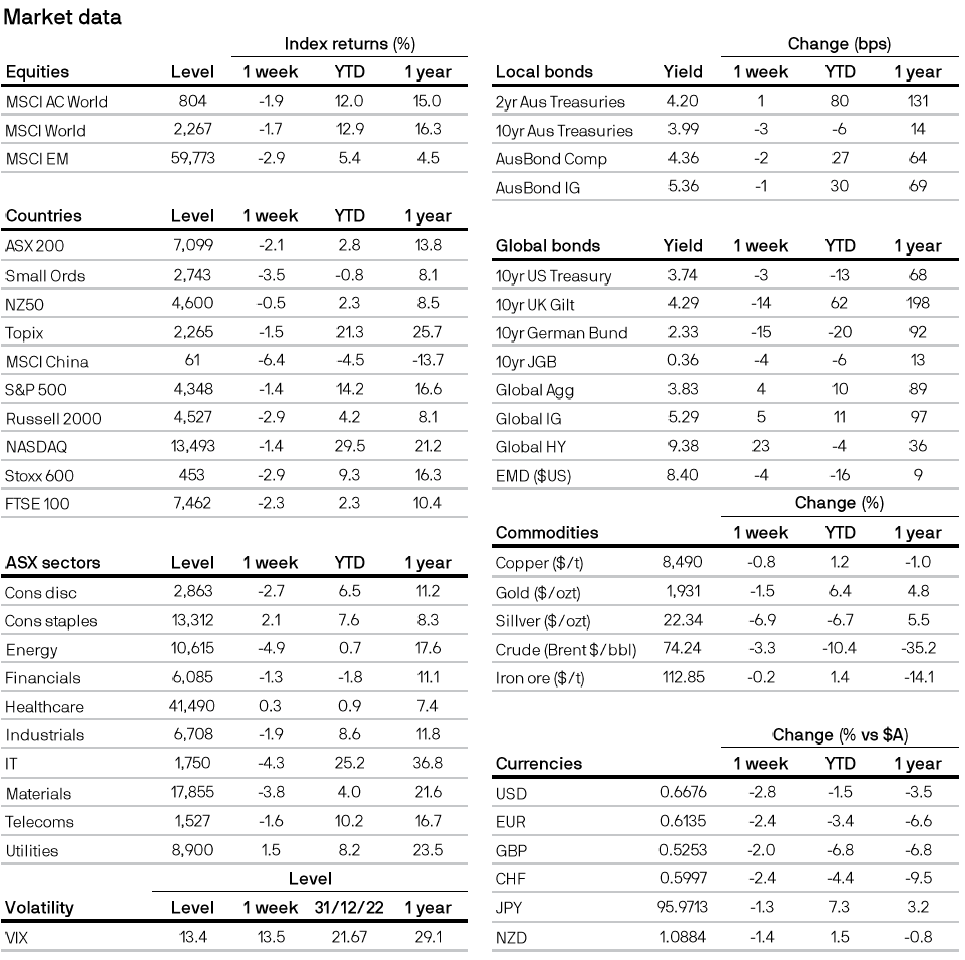

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5