Week in review

- Australian economy expands by 0.2% q/q in 1Q23

- RBA lifts rate 25bps to 4.1%

- Chinese inflation 0.2% y/y in May

Week ahead

- U.S. Federal Reserve rate decision

- Australia consumer and business confidence

- Australia labour market report and unemployment rate

Thought of the week

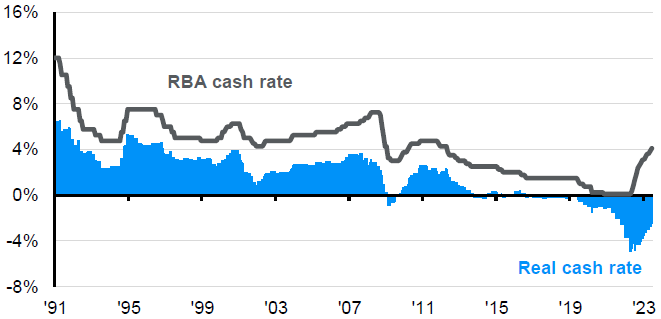

The RBA lifted the policy rate by another 25bps last week and painted a hawkish picture claiming inflation pressures are not receding. The official cash rate has risen by 400bps in the last 14 months from virtually zero at a time when inflation has only just passed its peak. This means that real rates are still negative. Historically, the RBA or any other developed market central bank has not stopped increasing the cash rate when the real policy rate is negative. In a 2022 paper, the RBA estimated that the R*, or the neutral interest rate that is neither restrictive or stimulatory on the economy is 1% in real terms. Adjusting the cash rate for the RBA’s preferred measure of core inflation shows that the real rate is close to -2.5%, some way from neutral and the restrictive level needed to cool inflation. There are two paths forward, further rate hikes to reach a sufficiently restrictive real policy rate, or inflation that falls faster as the lagged impact of prior tightening takes hold. It’s likely that we will see a mix of the two in the coming months. The hope is for inflation to fall faster as the consequence of further hikes is a rising risk of recession. The RBA is treading a very narrow path indeed.

Australia’s real policy rate is far from neutral

RBA policy rate and policy rate adjusted by the trimmed mean rate of inflation

Source: ABS, FactSet, RBA, J.P. Morgan Asset Management. Data reflect most recently available as of 09/06/23.

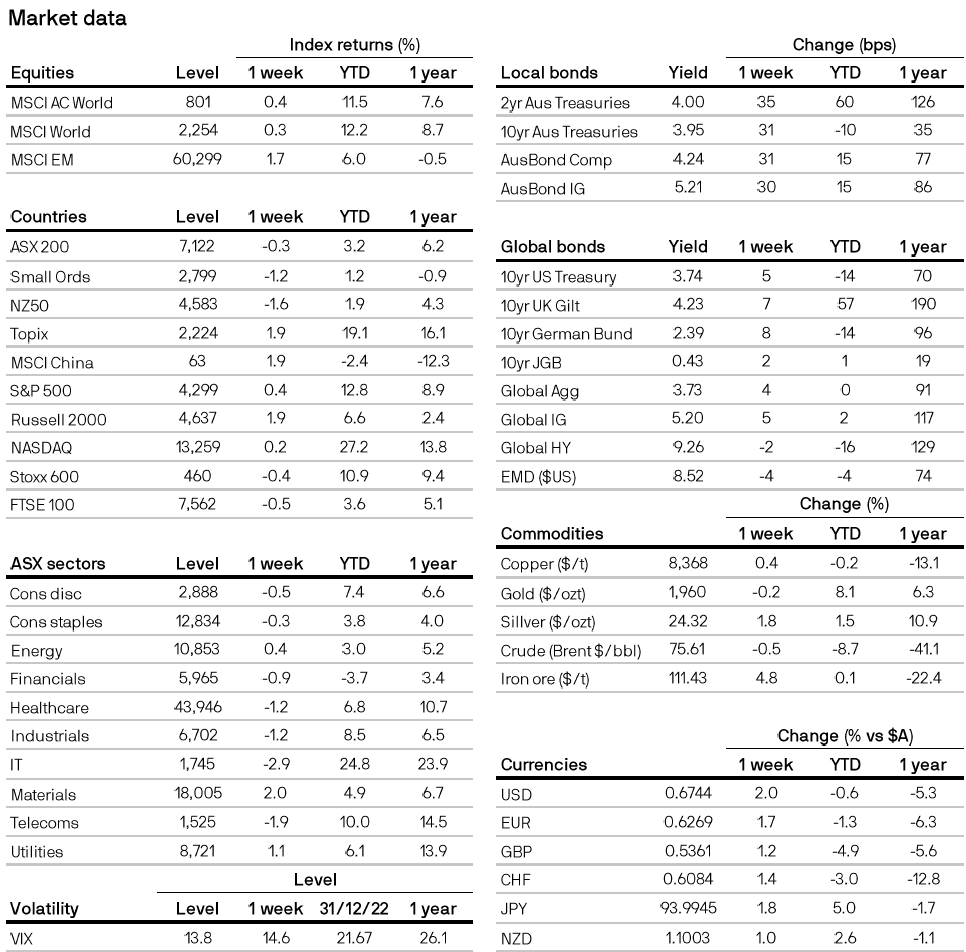

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5