Week in review

- Australia building approvals -8.1% m/m

- China PMI manufacturing falls to 48.8

- Australia monthly inflation rises to 6.8% y/y

Week ahead

- RBA policy decision

- Australia 1Q real GDP

- China CPI inflation

Thought of the week

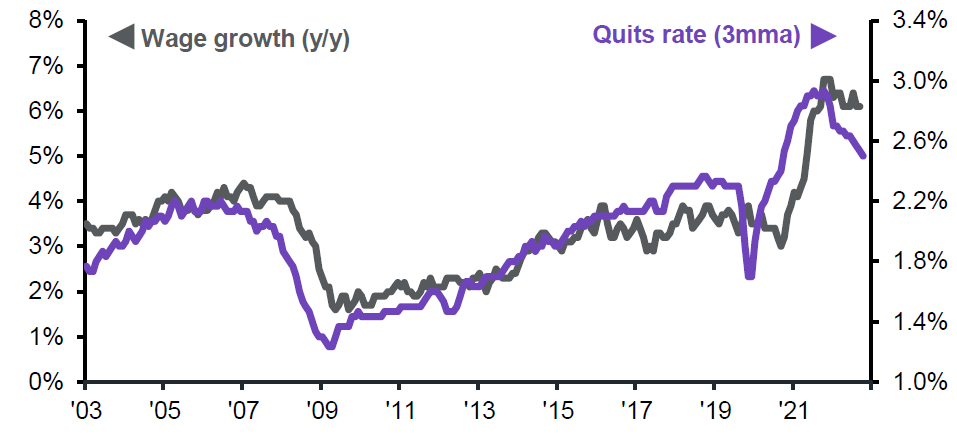

As the debt ceiling issue fades the market can get back to obsessing about the path for interest rates. The U.S. economy continues to bend rather than break., testing the patience of the U.S. Federal Reserve (Fed). Last week’s U.S. labour market data added to the prospect for another rate hike by the Fed in the coming months. There are a number of ways to assess ‘tightness’ of the labour market. One is simply the unemployment rate, but this is a lagging indicator of the economy. More cyclical measures are the quits rate and the ratio of vacancies to unemployed. The latter peaked at 2.0 during the pandemic meaning that there were two jobs for every unemployed person in the U.S. It has since fallen to 1.8 but remains well above what would be considered ‘loose’. The quits rate is also worth watching as workers are more likely to voluntarily switch jobs when prospects are better elsewhere or pay is higher. It declines when workers are more circumspect about their prospects and leads wage growth (see chart). This is important as lower wages would ease services related pressure in the U.S. economy and give the Fed some much needed breathing room.

U.S. quits tend to lead wage growth

U.S. quits rate and wage growth

Source: BLS, Federal Reserve of Atlanta, J.P. Morgan Asset Management. Data reflect most recently available as of 02/06/23.

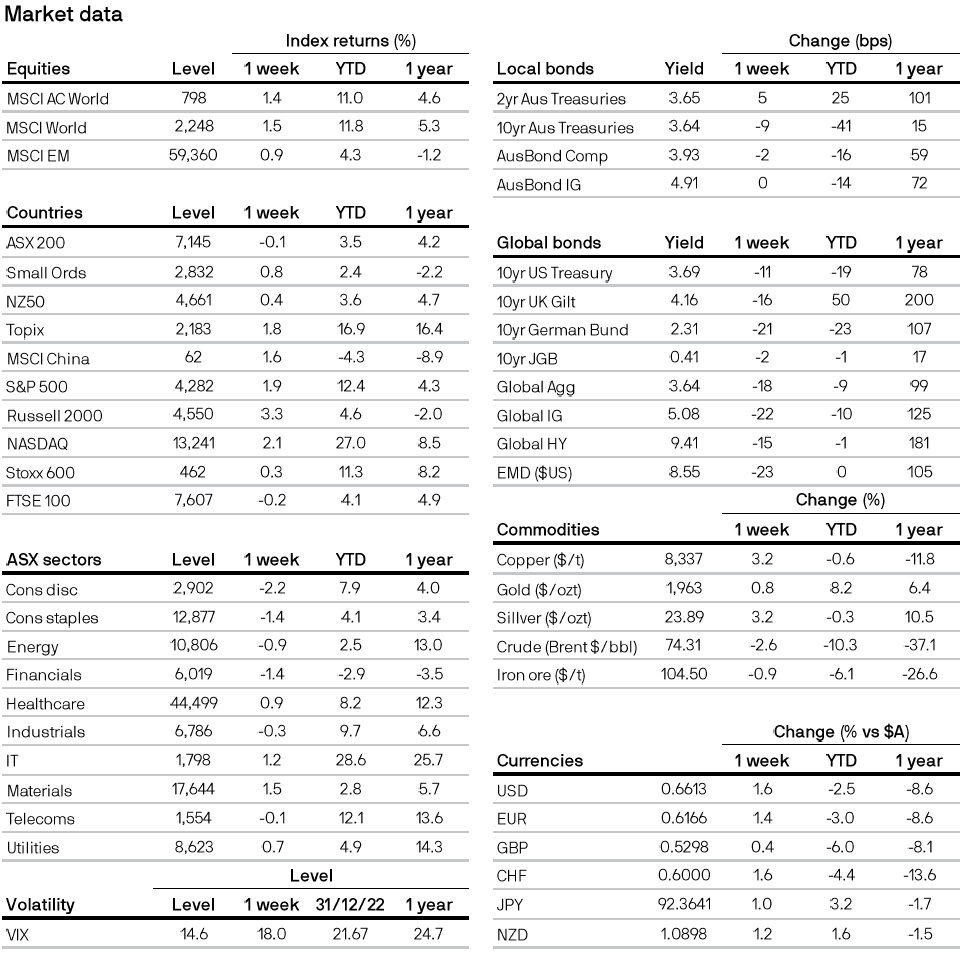

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5