Week in review

- U.S. CPI inflation 4.9% y/y, core inflation 5.5% y/y

- Australia business conditions dips 2pts

- Australia retail sales 0.4% m/m for April

Week ahead

- Australia consumer confidence

- RBA policy meeting minutes

- Australia labour market report

Thought of the week

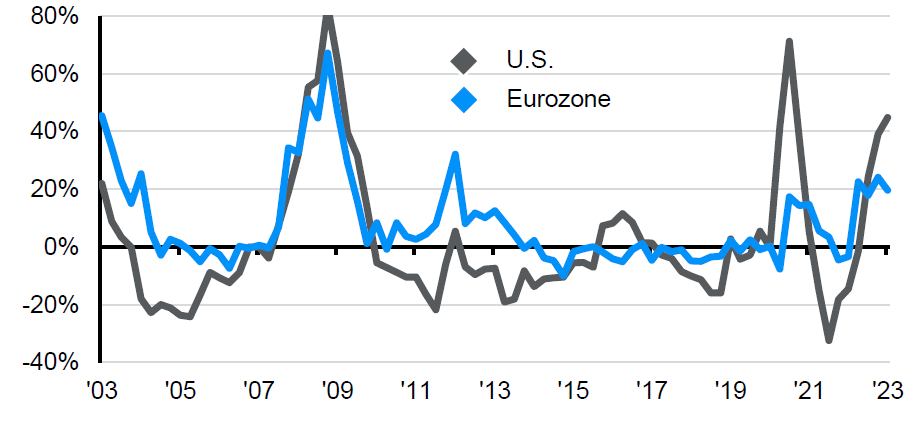

More evidence of the long and variable lags of the monetary policy tightening the past year appeared last week in the form of the Senior Loan Officer Opinion Survey (SLOOS) from the U.S. The updated figures captured the recent fallout in the regional banking sector and expectations were for a continued worsening in credit conditions. The survey indicates a tightening of lending conditions rarely seen outside of a recession. The details of the survey indicated that demand for loans had also plummeted and were corroborated by the small business optimism index which dropped to its lowest level in a decade in April. The further tightening in credit conditions and slowly but surely easing U.S. inflation suggests the Fed will not be forced to raise rates at its next meeting. While markets have moved to price out this rate hike, market pricing does reflect a rate cut as soon as September. This seems optically difficult when inflation will still likely be above target and the economy is not yet in recession at that point. Better news in the eurozone, where lending conditions have eased a little more recently having avoided the worst of the pain inflicted in the U.S., so far at least.

Net percentage of banks tightening lending standards

Loans for large and mid-sized companies

Source: ECB, U.S Federal Reserve, J.P. Morgan Asset Management.

Data reflect most recently available as of 12/05/23.

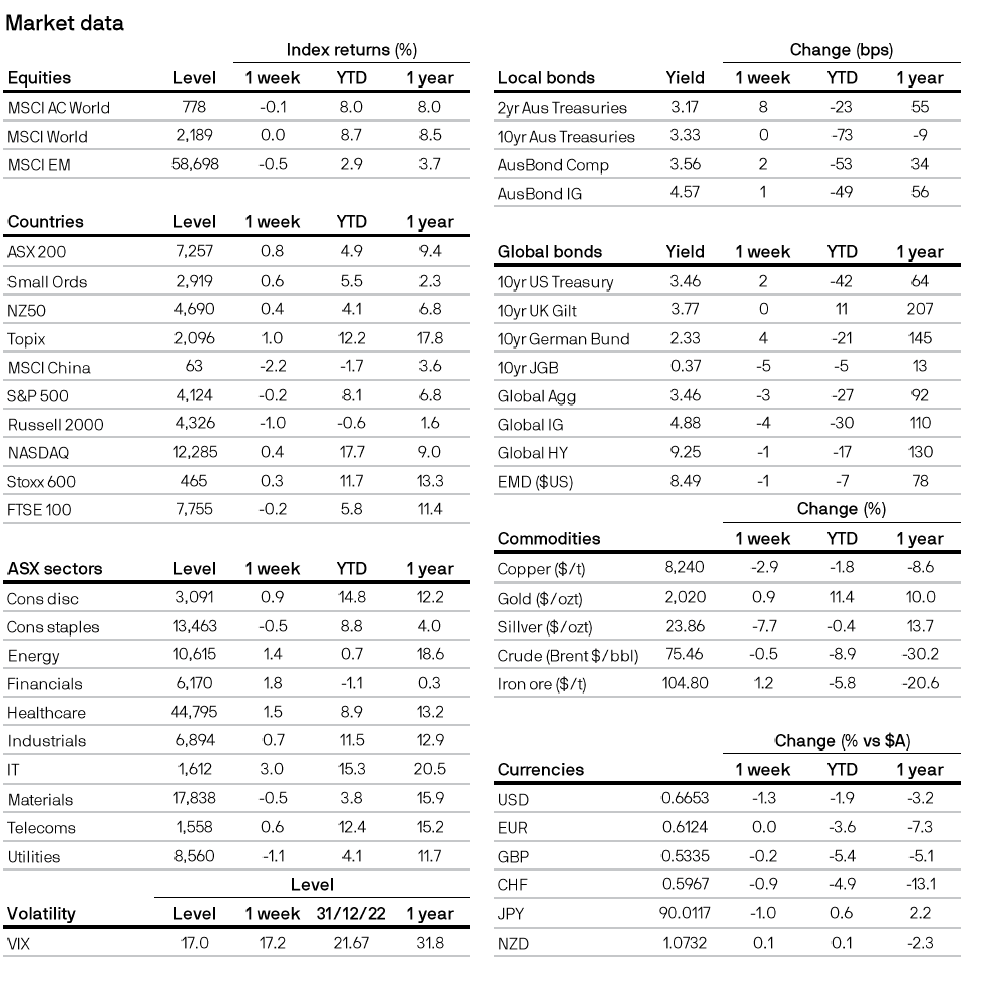

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5