Week in review

- Australia inflation 7.0% y/y, 1.4% q/q in 1Q.

- U.S. 1Q real GDP 1.6% y/y or 1.1% q/q annualised

- Australia private sector credit 0.3% m/m in March

Week ahead

- RBA policy rate decision

- ECB policy rate decision

- U.S. nonfarm payrolls and labour market report

Thought of the week

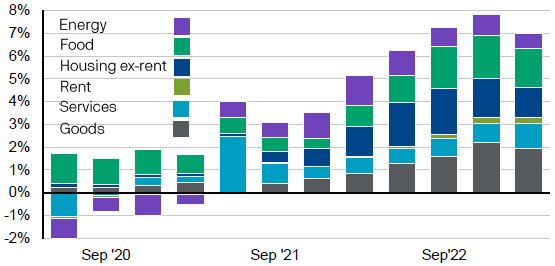

The quarterly inflation figures for the March quarter held few surprises. The headline rate of inflation dropped from 7.8% to 7.0% y/y. The good news is that Australia has passed the peak in inflation, something that was already confirmed in most other developed markets. However, just like in other countries there are some parts of the inflation basket where price pressures are still looking a bit persistent. Goods inflation is easing as both supply impediments have faded along with demand, but services-linked inflation is on the rise. Service inflation was 6.1% y/y in the first quarter, the highest rate since 2001. Some of the rise in services stems from prices that are reset annually and indexed to historical rates of inflation, such as education and some utilities. However, others such as rents are related to structural issues in the housing market and a supply and demand imbalance as migration increases. The rotation from goods to services driven inflation is a trend that will persist in Australia and the persistence of these less cyclical drivers of overall inflation implies only a gradual path back towards the RBA’s 2-3% target band.

Services new driver of Australian inflation

Contribution to year-on-year change in Australian inflation

Source: ABS, FactSet, J.P. Morgan Asset Management.

Data reflect most recently available as of 28/04/23.

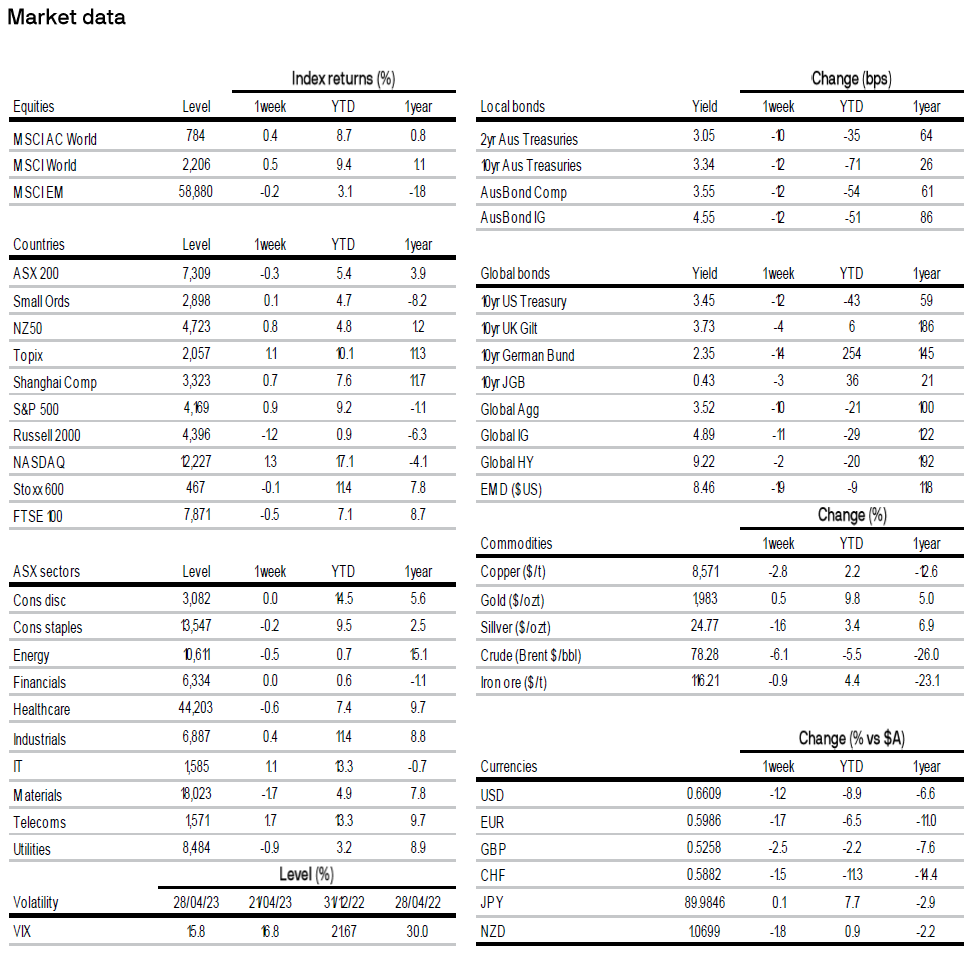

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5