Week in review

- Australian inflation 7.8% y/y in 4Q23

- Eurozone composite PMI rises to 50.2

- Australian business conditions fell 8pts to 12

Week ahead

- Australia retail sales

- U.S. Federal Reserve meeting

- U.S. nonfarm payrolls

Thought of the week

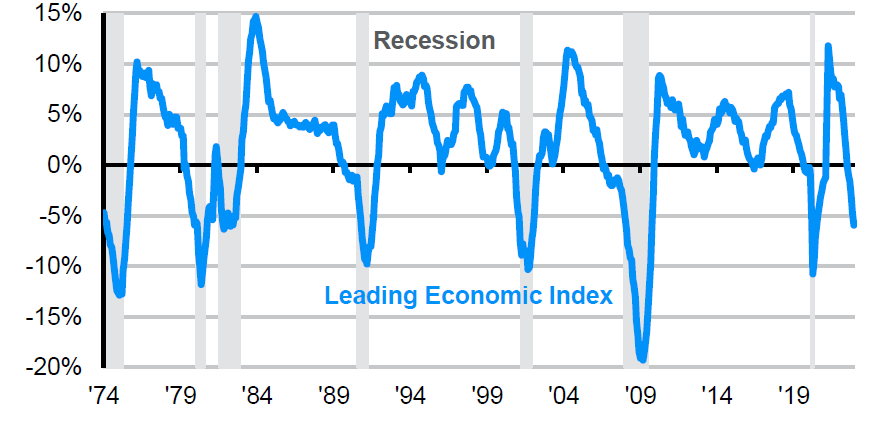

The momentum in the U.S. economy is slowing and is at risk of falling into a mild recession. However, the performance of the equity market this suggests something different. Fading fiscal support, a stretched consumer and weaker housing and corporate investment activity, all suggest that economic momentum will continue to decline, and recession is around the corner. But none of the cyclical sectors of the U.S. economy are showing signs of large imbalance, which suggest any downturn would be mild. Hard to have a bust without the boom. Still the risk of recession is not insignificant and data such as the U.S. Leading Economic Index (LEI) is in line with periods of recession in the past. In fact, the LEI has never been so negative on a year-on-year basis without a recession occurring. A starting precedent for the economy. Even without a recession, the U.S. economy is likely to be on a path of sub-trend growth. As far as a recession goes for this year, investors should really ask themselves if this time is any different.

U.S. Leading data suggests recession is around the corner

Year-on-year

Source:FactSet, The Conference Board J.P. Morgan Asset Management.

Data reflect most recently available as of 27/01/23.

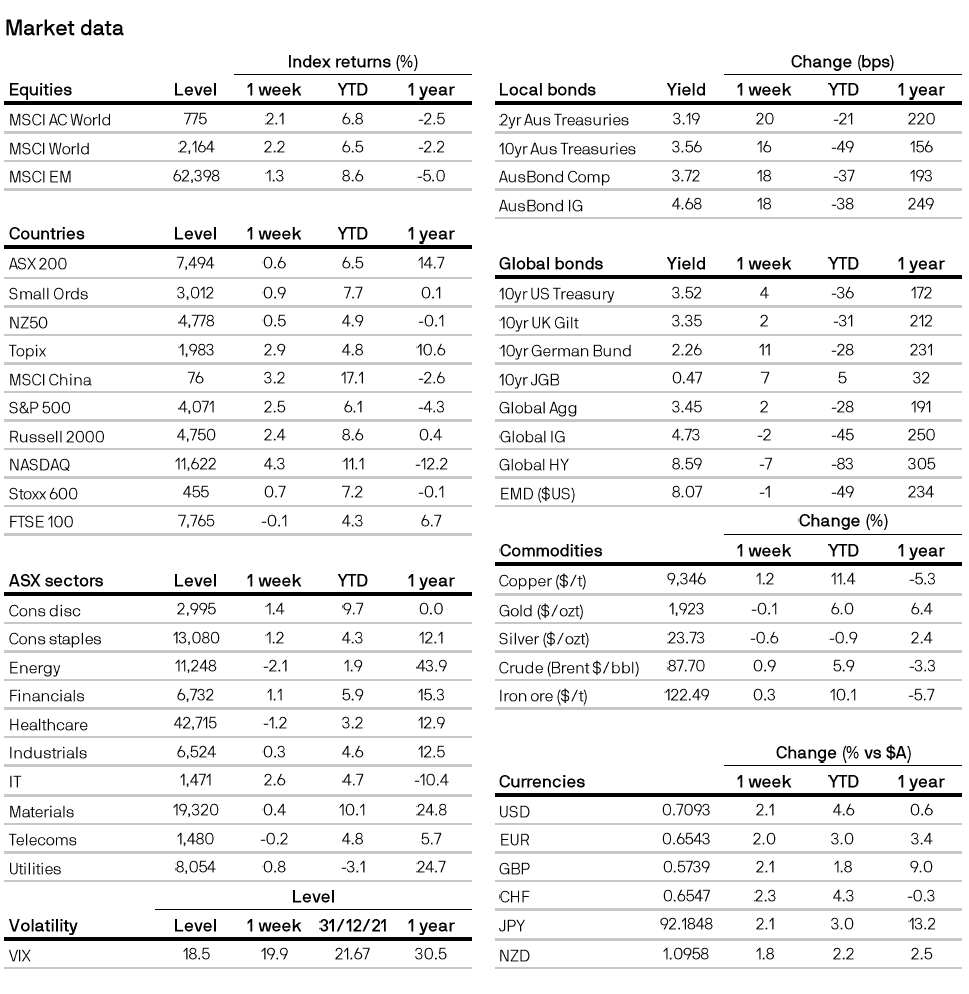

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5