Week in review

- RBA hikes cash rate 25bps to 2.85%

- U.S. Federal Reserve hike cash rate 75bps to 3.75-4.00%

- China PMI for manufacturing fell to 49.2

Week ahead

- U.S. mid-term congressional elections

- Australia business and consumer confidence

- U.S. CPI inflation

Thought of the week

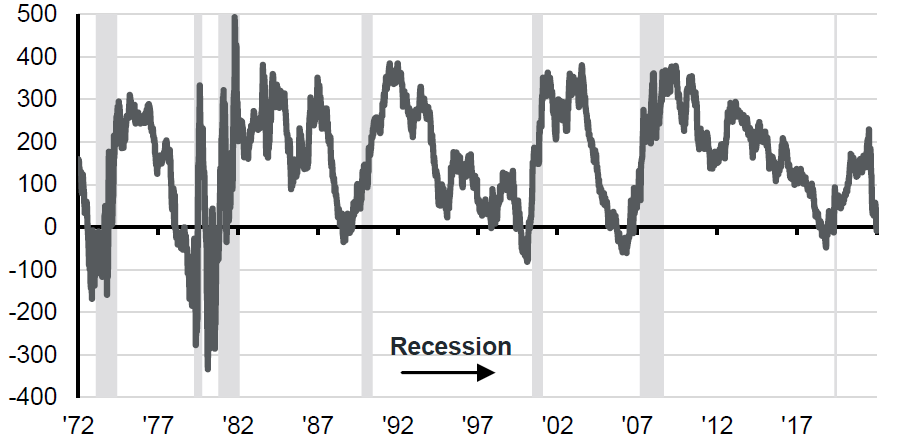

When Jerome Powell was confirmed as the Chair of the U.S. Federal Reserve, he was the first in more than 40 years who did not hold a doctorate in economics. This didn’t matter last week as he delivered a classic two-handed economist view. On one hand, the Fed raised the official cash rate by 75bps and indicated that future rate hikes would most likely be smaller in size given the cumulative tightening in so far this year and the lagged impact this would have on the economy. Good news for markets. On the other hand, Chair Powell indicated that inflation pressures were persistent and that the terminal level of the policy rate may have to be higher than indicated and perhaps higher than current market pricing. This keeps the risk alive of a policy error and increases the danger of a policy induced recession. Bad news for markets. The yield curve inverted further on this news but not just the 2-10 year curve. The 3m-10year curve has also now inverted for the first time since the start of the pandemic. This has been a more reliable indicator of recession.

The 3m-10y curve inversion is a reliable indicator of recession

Basis points

Source: FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 4/11/22.

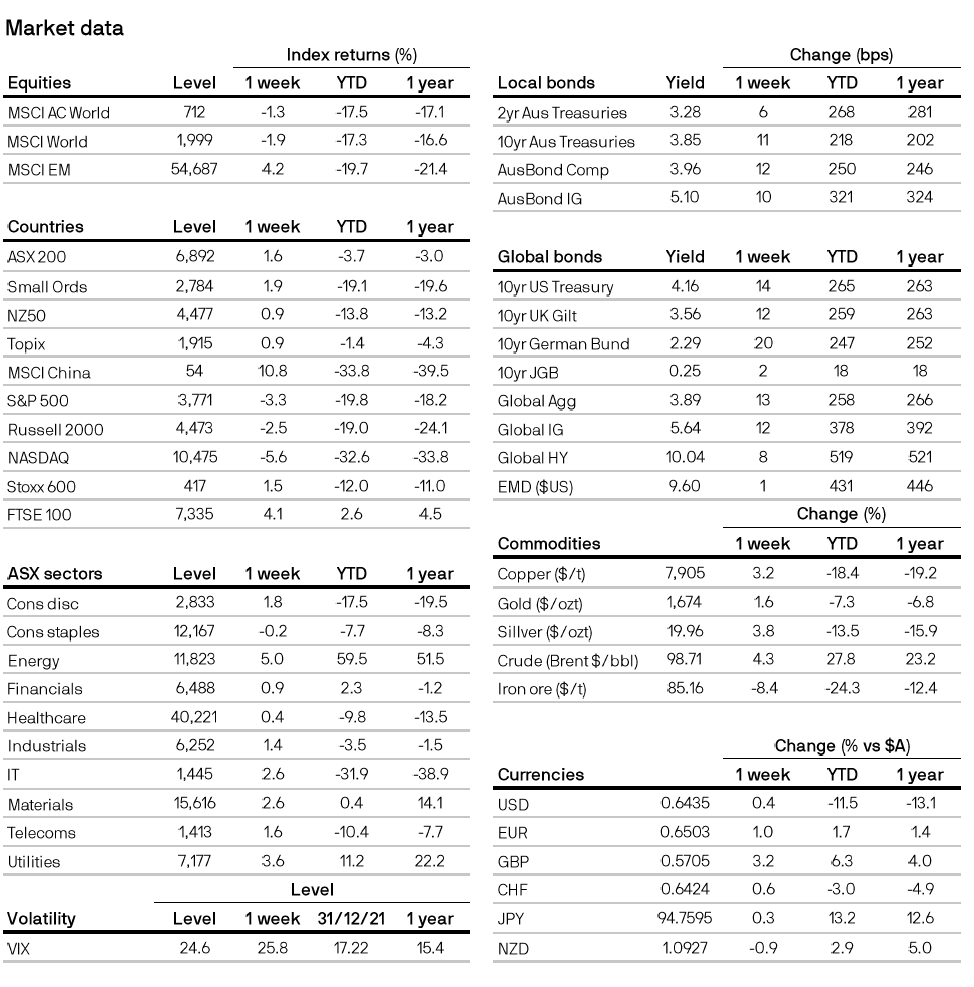

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5