Week in review

- RBA rises cash rate by 25bps to 2.60%

- U.S. job-openings surprisingly falls by 1.1 million

- U.S. ISM for manufacturing falls to 50.9

Week ahead

- Australia business and consumer confidence

- U.S. Federal Reserve FOMC meeting minutes

- U.S. CPI inflation

Thought of the week

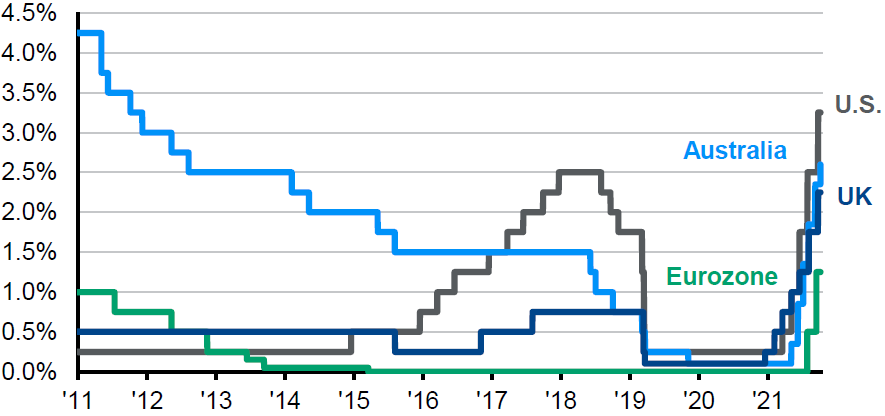

The word ‘pivot’ is becoming one of the most overused in the financial lexicon. Last week the RBA surprised the market by ‘only’ hiking interest rates by 25bps rather than the expected 50bps. Markets were quick to extrapolate this move to other central banks and expectations that they would pivot to a slower path of rate hikes and soon pass the peak in hawkishness. This would undoubtedly be a positive for risk assets if it were the case. However, monetary policy works with a lag and the RBA has already hiked interest rates by 225bps since May, blowing past pre-COVID levels, and would not doubt be eager to see how the economy is going to react. By the RBA’s own assessment, the neutral interest rate, the level that is neither stimulatory or restrictive on the economy, lies somewhere between 2.50-3.50%. With the acceleration to neutral now done the RBA can shift to more ‘normal’ 25bps rate hikes. While the path may have changed the destination is the same and it’s very likely that the RBA will continue to hike rates this year into restrictive territory.

Rates path: No longer the need for speed?

Central bank target policy rates

Source: Bank of England, European Central Bank, Reserve Bank of Australia, U.S. Federal Reserve, J.P. Morgan Asset Management. Data reflect most recently available as of 07/10/22.

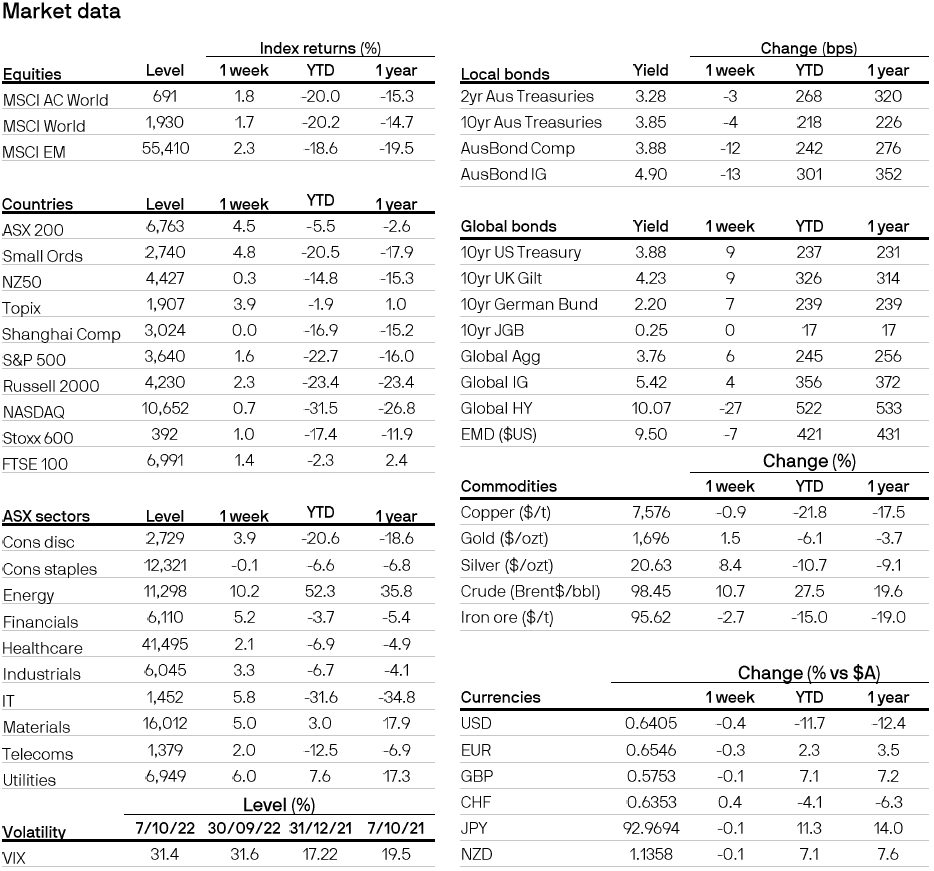

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5