Week in review

- Bank of England to buy GBP5bn of bond per day to steady market

- Australia retail sales 0.60% m/m

- China PMI for manufacturing

Week ahead

- RBA official cash rate

- Australia housing finance

- U.S. labour market report and nonfarm payrolls

Thought of the week

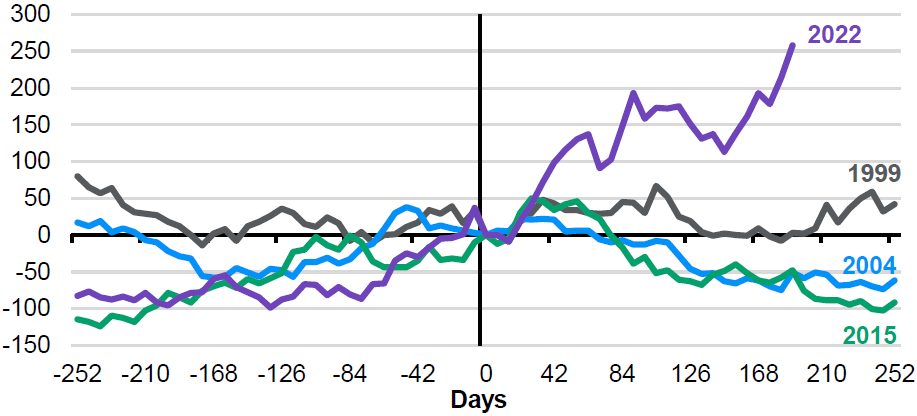

The swings in the markets in the last week have been extreme. The yield on the 30-year UK government bond moved by more than 100bps in one day last week as investors digested the institutional integrity of the UK government and the quick flip by the Bank of England from quantitative tightening to what is to be a brief period of further quantitative easing (although this is not its official title). However, what is really behind the market volatility has been the ramp up in rate expectations and tightening financial conditions as central banks double down on bringing inflation back to target. If this feels different to past rate hiking cycles its because it is. Since June central banks have embarked on most synchronized three-month period of rates hikes since the 1980s. This week’s chart illustrates just how different the change in financial conditions has been in the current rate hike cycle compared to prior cycles. It’s time like these that investors should evaluation the resilience of their portfolio is what are likely to be volatile times.

The tightness in U.S. financial conditions has been extreme

Change in financial conditions. Date of first rate hike = 0

Source: Bloomberg, Goldman Sachs, J.P. Morgan Asset Management. Data reflect most recently available as of 30/09/22.

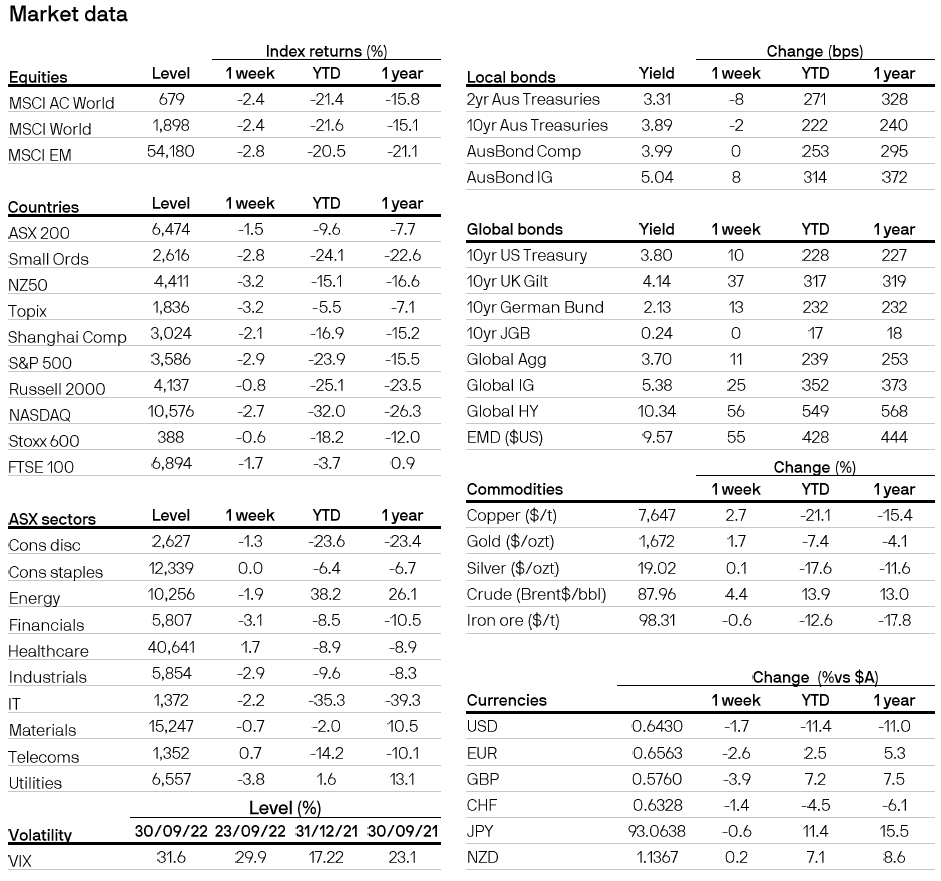

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5