Weekly Market Recap

Not yet the house of pain

27/06/2022

Week in review

- UK CPI inflation rises to 9.1% y/y

- Eurozone composite PMI falls to 51.9

- U.S. composite PMI falls to 51.2

Week ahead

- Australia retail sales

- Australia private sector credit

- China PMI manufacturing

Thought of the week

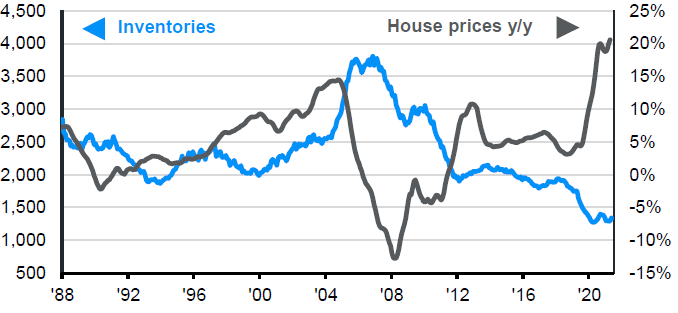

Economic data out of the U.S. continues to indicate the slowdown in activity. The June PMIs for manufacturing and services both dropped sharply over the month, while consumer confidence has hit a record low. The fall in consumer confidence may seem obvious as U.S. households face the squeeze from rising food costs and the average price of petrol is at a record high. Higher interest rates are likely also part of the problem. The average 30-year fixed rate for mortgages is nearing 6%, up from 3% at the end of last year. However, in the U.S. context higher mortgage rates only matter for those getting new mortgages as there is no compulsion for existing homeowners to refinance at higher rates. Higher rates will deter activity in the housing market and home sales have slowed in recent months, but it’s the low level of inventory that is likely to keep upward pressure on house prices. This should mitigate a repeat of the 2008 experience and the severe negative wealth impact on the consumer, perhaps creating a milder recession when it does come.

Surging U.S. home prices reflect declining inventories

Inventory of single family homes for sale and y/y change in U.S home prices

Source: FactSet, National Association of Realtors, S&P/Cash-Shiller, J.P. Morgan Asset Management.

Data reflect most recently available as of 24/06/22.

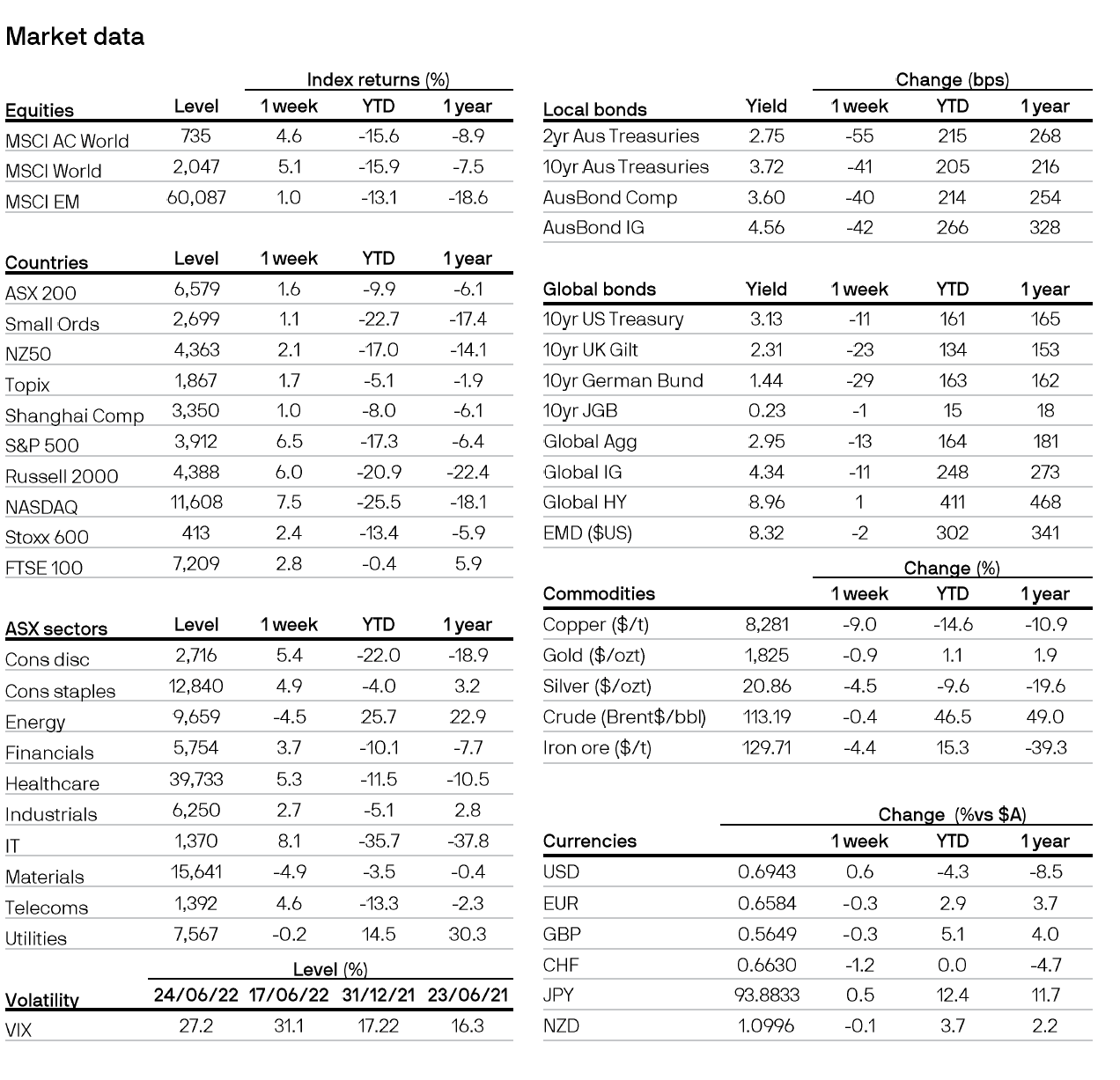

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5