Weekly Market Recap

Stuttering not stopping

30/05/2022

Week in review

- Australia capex spending declines 0.3% q/q in 1Q22

- Australia retail sales 0.9% m/m for April

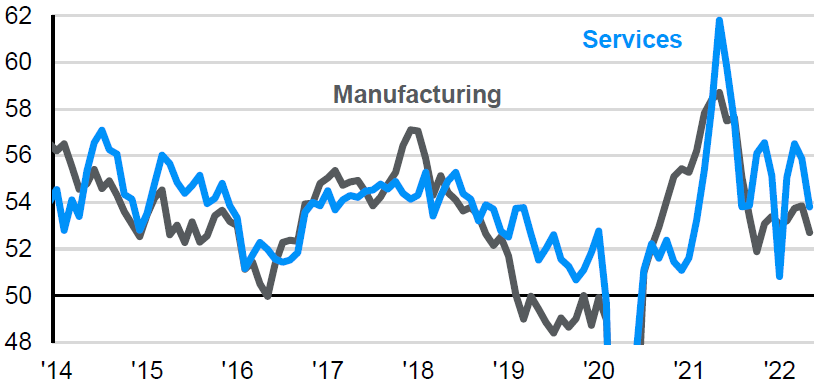

- U.S. and eurozone composite PMIs fall to 53.8 and 54.9 respectively

Week ahead

- Australia 1Q22 real GDP

- China PMI for manufacturing

- U.S. nonfarm payrolls

Thought of the week

The economic data continues to point towards a slowing rather than stalling of the global economy. Commentary around the risks of a recession have tended to overlook the resiliency in the economy and the consumer in the face of mounting headwinds. This leaves us with the view that while many economies will see growth rates decline over the course of the coming quarters, most will escape falling into outright recession. The latest batch of Purchasing Managers’ Indices reinforce this view. The decline in the manufacturing index is not surprising given the headwinds weighing on the goods sector, we expect to see a greater rotation towards services as the global economy continues its path of repair and re-opening. There were other bright spots amongst the release as the employment indicator rose and there was little evidence of further damage to supply chains from the restrictions in China. This data does not suggest that growth outlook is improving, but that the downshift in growth is not yet as severe as markets make out..

Developed market PMIs show slowing rather than stalling growth

Index, level above 50 indicates expansion

Source: J.P Morgan Securities, J.P. Morgan Asset Management.

Data reflect most recently available as of 27/05/22.

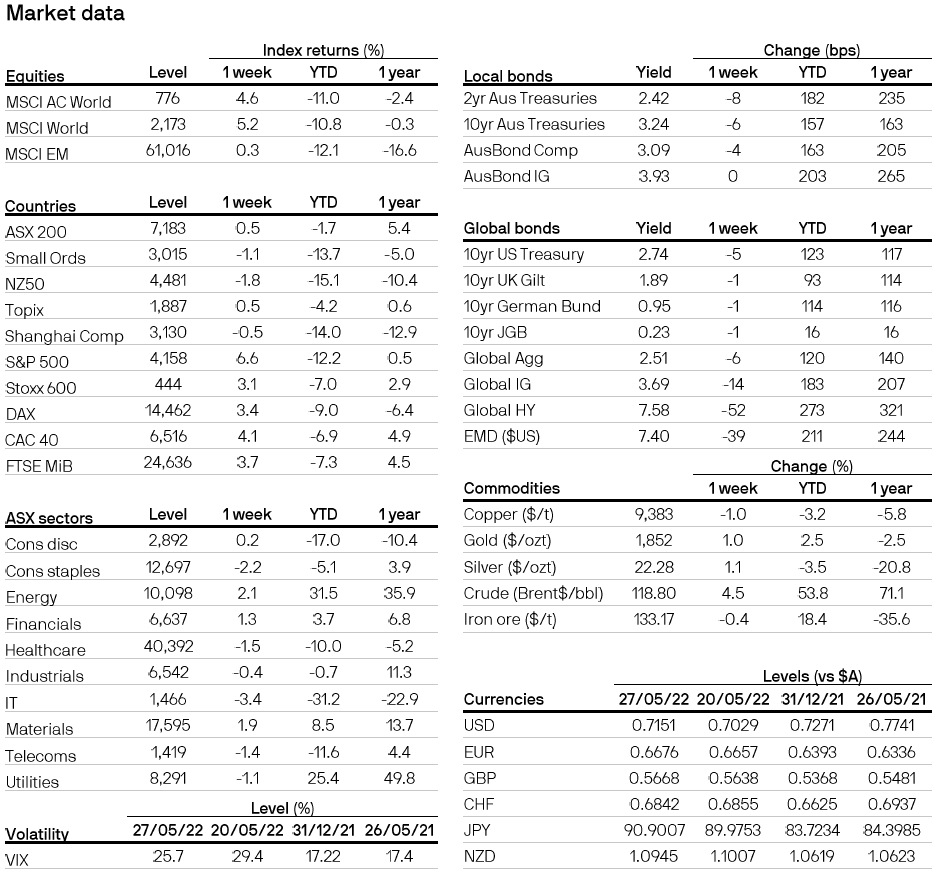

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467ab5