Weekly Market Recap

Tired of waiting for you

11/04/2022

Week in review

- China PMI services declines to 42.0

- U.S. ISM non-manufacturing rose to 58.3 in March

- RBA no longer patient on rate hikes

Week ahead

- Australia business and consumer confidence

- Australia labour market report

- U.S. CPI inflation

Thought of the week

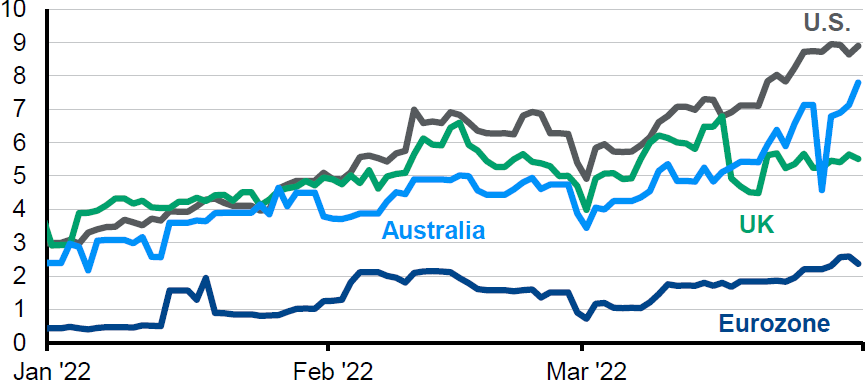

The RBA may have had a Churchill moment as changing facts led to changing views. The RBA is no longer prepared to wait for wage growth move materially higher, shifting back toward forecast based rate hikes instead. This makes the June meeting a prime candidate for the start of the rate hike cycle as the RBA will have fresh inflation figures and a better indication of where wage growth is heading. However, the RBA may not follow other central banks with a string of rate hikes each meeting, preferring to move in line with its own projections released in the quarterly Statement of Monetary Policy. If this is the case, then there is scope for three rates hikes this year and a cash rate of 0.75% by year end, assuming the first move is from 0.10% to 0.25%. This may seem low compared to the rate of inflation but would mean the cash rate is back to pre-pandemic levels. Market pricing prior to last weeks meeting was calling for as many as eight hikes this year. A pace which would be much too fast given the still high levels of household leverage and the potential risks to growth that remain.

Number of rate hikes implied by market pricing

Expected number of rate hikes by 31 December 2022

Source: Bloomberg L.P., J.P. Morgan Asset Management.

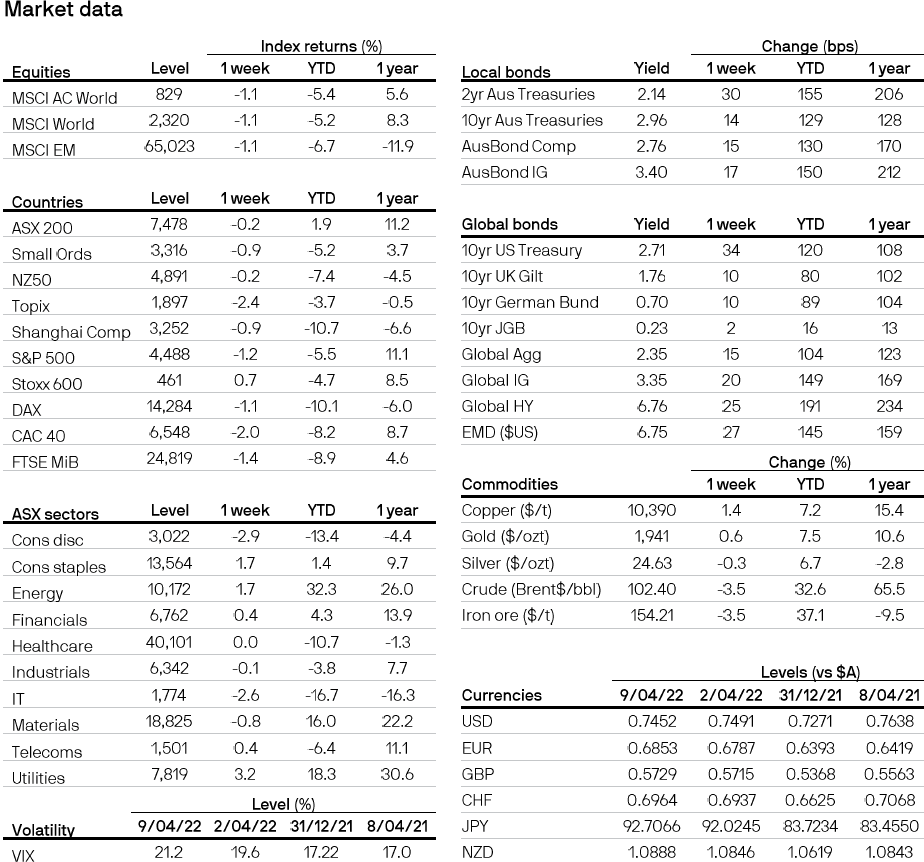

Data reflect most recently available as of 08/04/22.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467a72