Weekly Market Recap

Dealing with distortion

04/04/2022

Week in review

- Australia retail sales much stronger at 1.8% m/m in February

- China PMIs for services (46.7) and manufacturing (49.5) fall to contraction levels

- Australia private sector credit 0.6% m/m

Week ahead

- Australia RBA Official Cash Rate

- U.S. FOMC meeting minutes

- Eurozone retail sales for February

Thought of the week

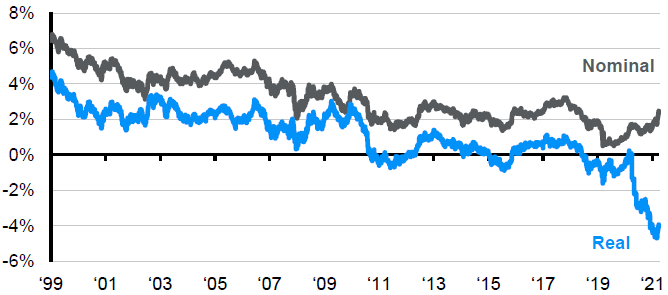

Government bond yields have surged in recent weeks as both inflation and rate expectations rise. The rise in yields caused the spread between the 10-year and 2-year bond yields to briefly go negative last week as the yield curve inverted, sending its own dire signal about the future of the economy. However, the yield curve and bond markets have been greatly distorted by central bank policies. Even with the rise in nominal bond yields, real yields are extremely depressed at a time when economic growth is robust and the rate inflation is running very hot. This means that the U.S. Federal Reserve is likely to maintain the hawkish tones and may not push back on expectations for a faster pace of rate normalization. Market expectations for 50bps increases in the Fed Funds Rate at both the May and June Fed meetings are steadily rising. The U.S. 10-year bond yield at close to 2.5% may be enticing to some investors, but it’s likely that yields will continue higher from here, even if the rise isn’t as pronounced. This keeps us with a moderate underweight to government bonds and duration within a portfolio.

Diverging nominal and real 10-year yields

Real yield is nominal yield adjusted by the core rate of U.S. inflation

Source: BLS, FactSet, J.P. Morgan Asset Management.

Data reflect most recently available as of 01/04/22.

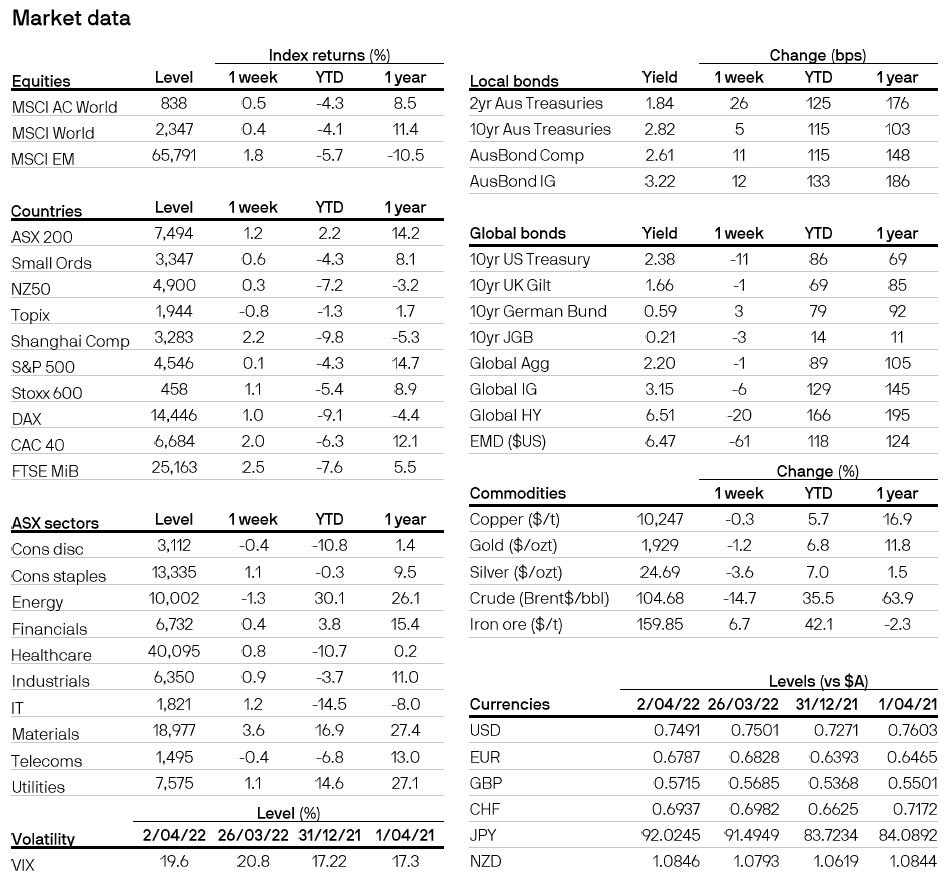

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467a72