Weekly Market Recap

False start for recession

21/03/2022

Week in review

- U.S. Fed increases interest rate to 0.25-0.50%

- Bank of England increases interest rates to 0.75%

- Australia unemployment rate falls to 4% for February

Week ahead

- Eurozone consumer confidence

- Eurozone PMI for services and manufacturing

- U.S. PMI for services and manufacturing

Thought of the week

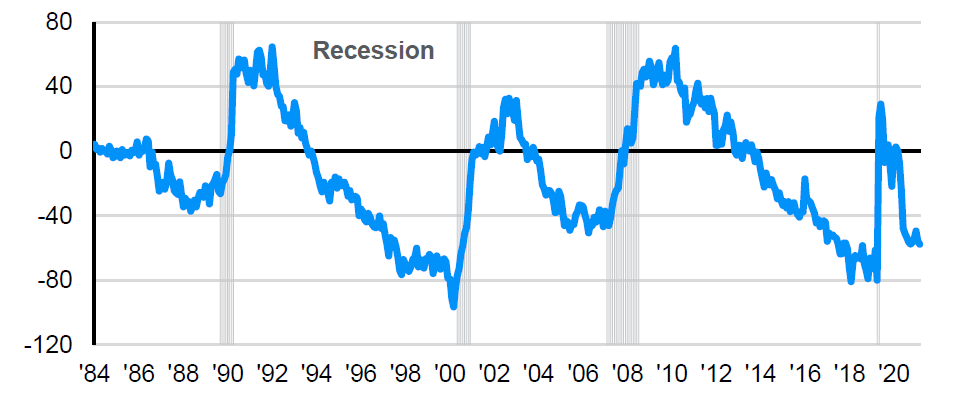

The flattening of the yield curve signals a weakening economy, and if it inverts, investors may start to utter the “R” world again. However, a recession so quickly after the last one would be unlikely given low interest rates and support from higher levels of household net wealth. Moreover, the yield curve strength as a signal of the economy may have diminished given central banks have extended their use of the balance sheet to implement monetary policy. In other words, the yield curve is whatever central bank wants it to be. Another nefarious indicator closely aligned with the recession threat is the gap between current and future conditions in U.S. consumer confidence. This gap has historically fallen to very low levels just prior to a recession. Today the spread is in decline but not yet at the levels associated with the height of the COVID pandemic. While consumers may be concerned about inflation, home prices and uncertainty in the economy, they are also enjoying the tightest job market and fastest wage growth in years. Like the yield curve, this warning sign may be one to ignore, at least for now.

U.S. consumers less than happy about the future

Spread between future expectations and present situation, index, pts

Source: FactSet, U.S. Conference Board, J.P. Morgan Asset Management.

Data reflect most recently available as of 18/03/22.

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

0903c02a82467a72