Week in review

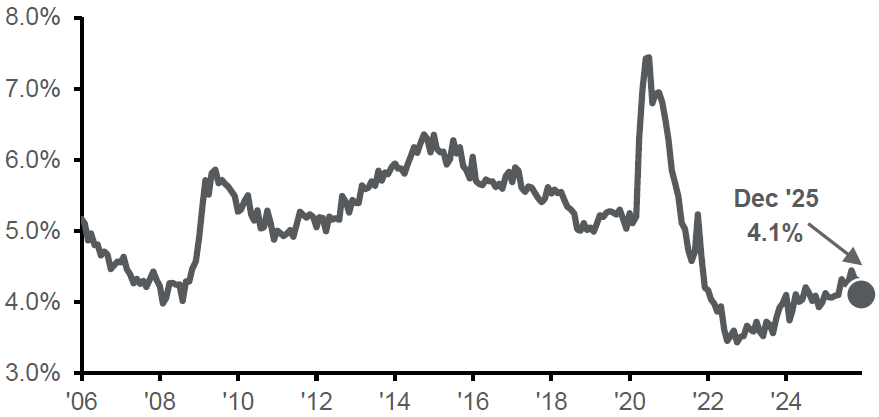

- Australia unemployment rate declined to 4.1% in December

- China 4Q GDP growth slowed to 4.5%

- China retail sales growth declined to 0.9% YoY in December

Week ahead

- Australia inflation rate, CPI and PPI

- U.S. PPI and Fed interest rate decision

- China NBS Manufacturing PMI

Thought of the week

Australia's December employment report delivered an unexpectedly strong performance, with 65,200 new jobs added, more than double the 27,000 consensus forecast. The unemployment rate dropped to 4.1% from 4.3%, defying expectations and falling well below the RBA's year-end projection of 4.4%. The composition was encouraging, with full-time positions rising by 54,800, though much of the unemployment decline was driven by the 15 to 24 age group, possibly reflecting seasonal holiday hiring in retail and hospitality. For the RBA, this data complicates an already delicate balancing act, as a resilient labour market combined with sticky inflation now raises the prospect of interest rate hikes rather than cuts. Markets have responded by pricing in a higher probability of a February rate hike, making next week's fourth-quarter CPI data crucial. If inflation proves persistent, a near-term hike becomes increasingly likely.

Unemployment rate in Australia

Seasonally adjusted

Source: ABS, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 22/01/26.

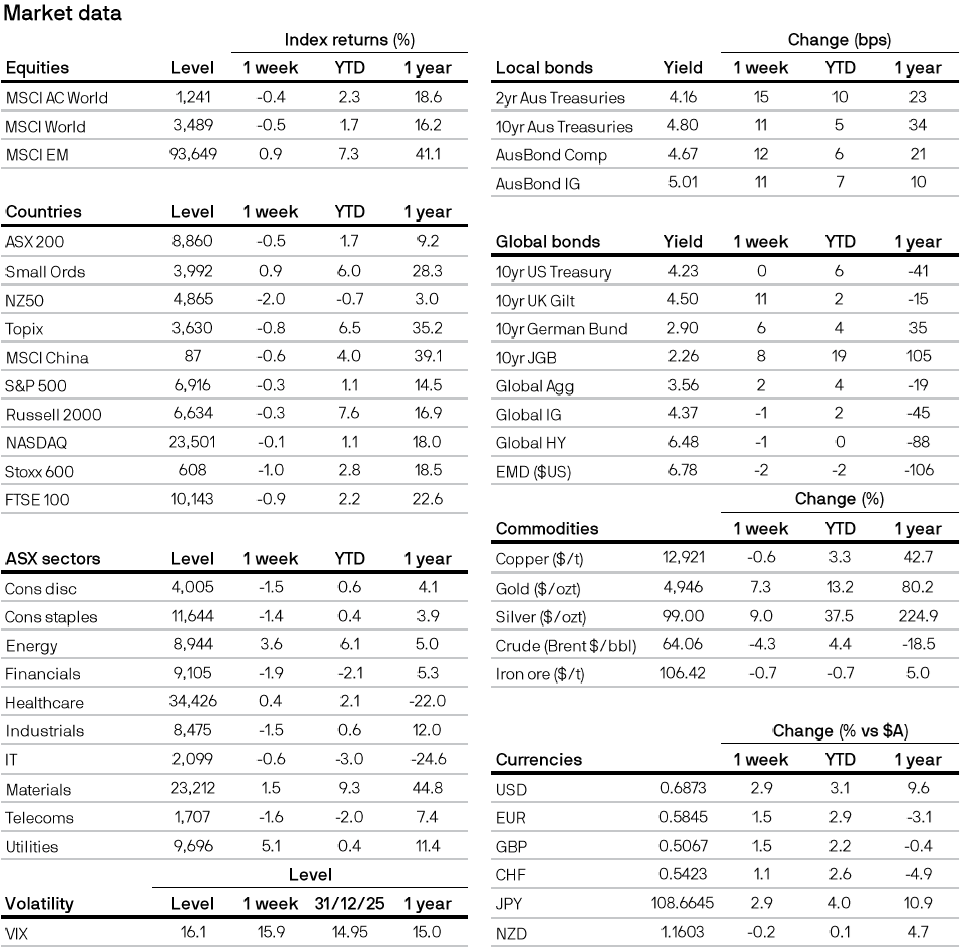

All returns in local currency unless otherwise stated.

Equity price levels and returns: Levels are prices and returns represent total returns for stated period.

Bond yields and returns: Yields are yield to maturity for government bonds and yield to worst for corporate bonds. All returns represent total returns. AusBond Comp is the AusBond Composite 0+ Yr, AusBond IG is the AusBond Credit 0+ Yr both provided by Bloomberg.

Currencies: All cross rates are against the Australian dollar. An appreciation of the foreign currency against the Australian dollar would be positive and a depreciation of the foreign currency against the Australian dollar would be negative.

Material ID: 95e655c0-f9d9-11e8-bfcc-8e0bde0598ff