In brief

- U.S. economic growth may be slowing, but earnings are still growing.

- Only 56% of companies have beat on revenues, compared to an average of 60% over the last four quarters.

- This quarter, for the first time since 2022, the S&P 493 is set to experience positive year-over-year (y/y) earnings growth of 5.7%.

- Once again, the information technology (IT) sector is on track to contribute the majority of y/y earnings per share (EPS) growth at 17.5%, though this would represent a 2.3% decline from the last quarter.

- As momentum unwinds, investors need to think carefully about how to manage this active bet in their passive exposure.

U.S. equity markets were defying gravity. From the beginning of 2023 through the first quarter of 2024, despite widespread calls for a recession, the S&P 500 returned 40% with 6% earnings growth. There is just one problem. If you strip out seven stocks1, the numbers fall to a 19% return with a -2% contraction in earnings.

However, this earnings season officially welcomes the eagerly anticipated broadening as earnings growth for the 493 inflects to positive. Economic growth may be slowing, but earnings are still growing. With 344 companies (63% of market capitalization) reporting, our current estimate for the 2Q24 S&P 500 pro-forma earnings per share (EPS) is USD 59.74. If realized, this would represent y/y earnings growth of 9.6%, and quarter-over-quarter (q/q) growth of 5.7%.

Not only are earnings growing, they are also growing faster than expected. 75% of the companies who have reported so far beat EPS estimates, compared to an average of 74% over the last four quarters. This beat rate is especially impressive given analysts lowered their estimates by less than usual heading into the earnings season.

Amid slowing headline growth, the revenue story is less supportive. Only 56% of companies have beat on revenues, compared to an average of 60% over the last four quarters. On the bright side, IT has continued to clear sky high expectations with a revenue beat rate of 81%, and the healthcare sector is coming in much stronger than expected with a revenue beat rate of 80%. Nevertheless, it is getting harder to impress investors. The reward for beating expectations is far less than the punishment for those who have missed.

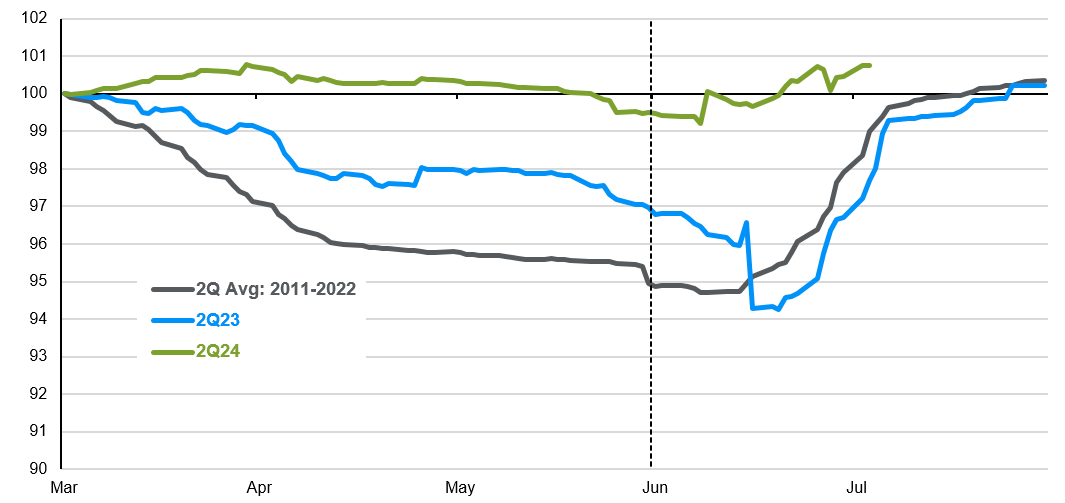

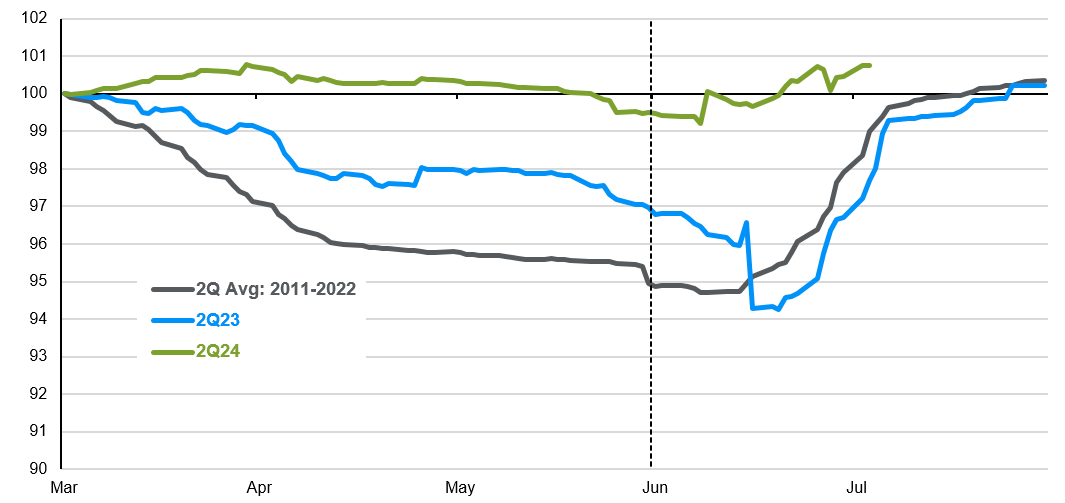

EPS estimates were revised down by less than usual

Indexed to 100 on 31/3 of the prior year

Source: FactSet, Standard & Poor's, J.P. Morgan Asset Management. Data reflects most recently available as of 31/07/24.

Don’t count out the 493

This quarter, for the first time since 2022, the S&P 493 is set to experience positive y/y earnings growth of 5.7%. Additionally, 8 out of 11 sectors are expected to contribute positively. Many of these companies are finally seeing margins growth after the earnings recession of 2022 as macro uncertainty, inflation, wage growth and supply chain issues moderate. On the flip side, a cautious consumer and muted manufacturing activity are making revenue growth harder to come by.

Looking at the three main sources of EPS growth, revenues, margins and share count are expected to contribute 2.0, 8.2, and -0.6 percentage points respectively to y/y growth. While excitement around artificial intelligence (AI) has fueled sales and margin growth in tech+ names, the outlook in the rest of the sectors is mixed, as consumer and industrial activity slow with the broader economy.

At the S&P 500 index level, sales increased 4.6% y/y and 2.4% q/q, though growth has been decelerating since the COVID peak. Every sector saw growth, except materials and real estate, which represent a combined 5% of the S&P 500. Margins were down -1.7% y/y, but up 0.8% from last quarter. Profitability in healthcare, financials and consumer staples is still sitting below historical 10-year averages, indicating room for improvement.

There is more to tech

Once again, the IT sector is on track to contribute the majority of y/y EPS growth at 17.5%, though this would represent a -2.3% decline from last quarter. Quarterly earnings growth in semis over the past year has averaged around 50%, but this is relative to four consecutive quarters of contraction from 3Q22 to 2Q23. Shipments are finally recovering from depressed levels as customers in the industrial, auto, PC, and smartphone end-markets digest bloated inventories. Also, of course, there are significant tailwinds as hyperscalers continue to build out AI infrastructure. Semi analysts expect around 20% y/y earnings growth plus positive revisions to last well into 2025. The accelerated computing cycle should also drive a recovery in semi-cap equipment in the second half of 2024. Similarly, the hardware industry is still experiencing muted EPS growth as customer spending has yet to rebound from pullbacks amid the cautious macro backdrop of 2022. However, the AI upgrade cycle has pulled demand forward, particularly across servers and phones. Segments of hardware closely tied to the cloud like networking and optics should see a strong recovery at the end of 2024. The software and hardware industries house some of semi’s and the cloud’s biggest customers as well as companies that supply components needed for datacenters, but they haven’t seen the same upwards revisions to EPS. The ongoing revenue recovery and an expanding understanding of how AI will affect the sector as a whole should support EPS growth well into 2026

…and more Magnificence

On top of the recovery in the rest of tech, we do not think we have heard the last of the Magnificent 7. They have grown earnings by over 30% y/y for the past four quarters and are expected to grow 29% in 2Q24. On a q/q basis, however, this should be the second quarter of contraction before growth reaccelerates in the second half of this year.

Earnings growth has been impressive and is expected to remain so, but a greater portion of returns this quarter were driven by valuation expansion, urging caution. Should earnings estimates be revised downwards, valuations will likely contract as well, making for a steep tumble.

Indeed, investors have expected nothing less than perfection from the Magnificent 7 names that have reported so far. For the broad market, companies that beat on both EPS and revenue have had an average 1-day return of 0.8%. The Magnificent 7 names that have beat on both EPS and revenue so far have had an average 1-day return of -0.4%. Despite strong results, some companies had higher capital expenditure on AI with little tangible revenue benefit, spooking investors. Nevertheless, Magnificent 7 valuations are lower now than they were at the start of the year, and their advantages in the AI transformation are compelling.

Investment Implications

Things look pretty good for U.S. earnings. A slowing but growing U.S. economy should continue to support growth, and a lot of companies are just getting started as they rebound from the 2022 earnings recession. Though companies driving the AI transition have already seen several quarters of robust earnings growth, we do not think they are going to slow down significantly anytime soon.

As the biggest names keep growing and the rest join in, the U.S. equity market fundamentals still look supportive of robust returns ahead. That does not mean there won’t be some short-term pain as the market unwinds some of the concentration in tech in favor of less-appreciated opportunities.

The rotation we have seen this month is a good reminder that though returns and earnings have been broadening, the Magnificent 7 still constitute 31% of the index, giving them extreme influence.

1 The Magnificent 7 (Mag 7) includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA, and TSLA. The S&P 493 (493) refers to the S&P 500 excluding the Mag 7.

09qe240808035001