These trade tensions have the potential to impart a stagflationary impulse to this investment environment, boosting inflation and interest rates while dragging on growth and profits.

In brief

- On Saturday, February 1st the White House announced the imposition of heavy tariffs on goods exported from Mexico, Canada and China, and all three nations announced their intention to retaliate. These tariffs threaten to raise prices and slow economic activity across all four countries.

- While the end game of the trade tensions remains uncertain, it has the potential to impact bonds, stocks and exchange rates.

- For investors, regardless of the early market reaction, the reality of the trade tensions suggest the need for broad diversification, including allocations to real assets and international assets.

The U.S. President’s actions and foreign reactions

The actions taken by U.S. President Trump were in the form of three executive orders. While Congress should normally be involved in setting tariffs, U.S. President Trump claimed the right to do so using emergency authority to combat the flow of illicit drugs. The executive orders specify 25% tariffs on all goods imported from Mexico, 25% on all goods imported from Canada, with the exception of energy products where the tariff rate is 10%, and 10% additional tariff on all goods imported from China. The tariffs come into effect at midnight on the evening of Monday, February 3rd.

Canada, Mexico and China have all responded. Canadian Prime Minister, Justin Trudeau, announced 25% counter-tariffs on CAD 155billion of U.S.-made goods starting with levies on CAD 30billion worth of goods starting on Tuesday and ramping up to the full amount after 21 days. Provincial premiers and politicians vying to replace Trudeau as Prime Minister also expressed support for retaliatory action.

Mexican President Claudia Sheinbaum announced that she is readying both counter-tariffs and other measures in retaliation. Meanwhile, the Chinese Commerce Ministry also pledged to take countermeasures.

The economic impact of tariffs

The tariffs announced by U.S. President Trump, along with retaliatory actions by our trading partners, could both raise prices and slow economic growth.

With regards to inflation, the first question is how much might tariffs reduce consumption of goods imported from these three countries, and the second is how much of the import tax would end up being paid by consumers.

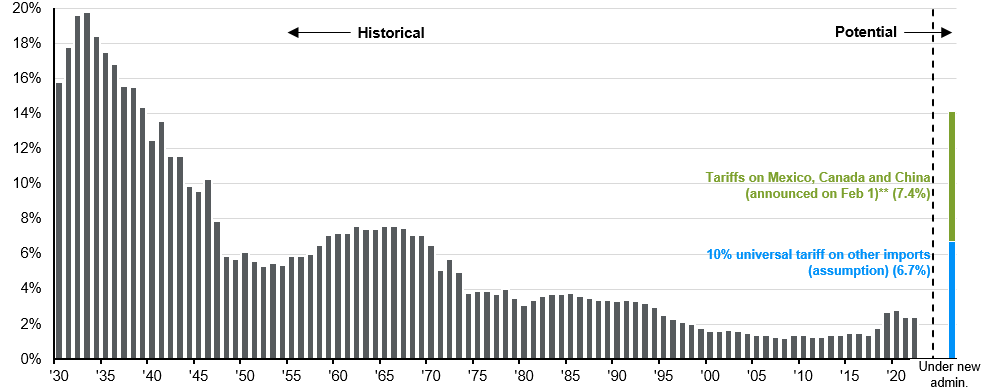

Exhibit 1: Average tariff rate on U.S. goods imports for consumption*

Duties collected / value of total imports for consumption

Source: United States International Trade Commission, U.S. Department of Commerce, J.P. Morgan Asset Management. *Imports for consumption: goods brought into an economy for direct use or sale in the domestic market. Includes all current official revisions for 2010-2020 as of July 2021. **On Feb 1, the White House announced 25% tariffs on all goods imported from Mexico, 25% on all goods imported from Canada, with the exception of energy products where the tariff rate is 10%, and 10% additional tariff on all goods imported from China. The current tariff rate on Chinese imports according to the U.S. International Trade Commission is 11.4%. May not be updated as of the latest announcements regarding tariffs and U.S. trade policy and is subject to change. Forecasts are based on current data and assumptions about future economic conditions. Actual results may differ materially due to changes in economic, market and other conditions. Data reflect most recently available as of February 3, 2025.

We estimate that the U.S. imported USD 1.36trillion in goods from Canada, Mexico and China last year and that the tariffs announced by the U.S. President would have implied an additional average import tax of 19% on those goods, on top of current tariffs against China. Under the crude assumption that a 19% increase in prices results in a 19% decline in purchases (either through lower consumption or substitution of other goods or suppliers), the tariffs announced could have raised USD 206billion. Last year, total nominal U.S. consumer spending was USD 19.8trillion. So if all of the price increases were passed on to U.S. consumers, it could be expected to increase the U.S. consumer price index by just over 1%. This, of course, assumes that foreign manufacturers, importers or retailers don’t absorb some of the cost. However, it also ignores the potential knock-on effects of retailers trying to maintain their percentage margins in the face of lower volumes, compensating wage increases or the impact of tariffs on other countries, regions and locations that U.S. President Trump has threatened.

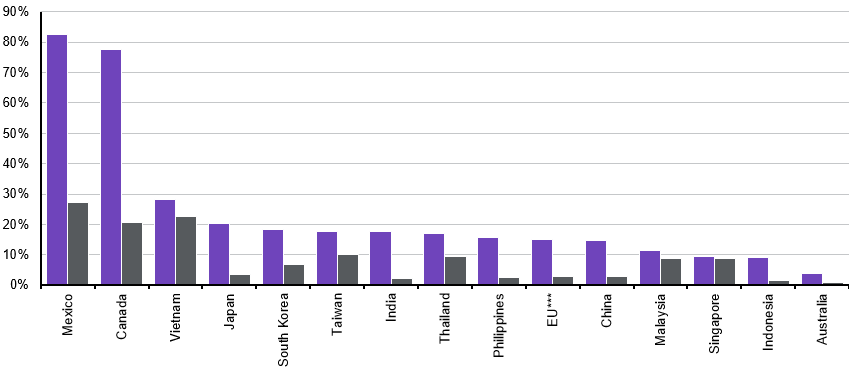

Tariffs would also lower economic activity. The U.S. exported roughly USD 760billion in goods to Canada, Mexico and China last year and slower economic growth in these countries, combined with the effect of retaliatory tariffs, could significantly reduce those exports. The effects would be more severe for Canada and Mexico than the U.S., however, as exports to the U.S. account for a much larger share of GDP in Canada and Mexico than the other way around. It is also worth noting that both Canada and Mexico had less momentum entering 2025 than the United States, with the most recent GDP readings showing year-over-year growth of 1.5% and 0.6%, respectively, compared to 2.5% in the U.S.

Equally serious, the uncertainty caused by the recent trade tensions could stall production and investment – no company will want to pay a tariff this week if it could avoid it by waiting until next week. No company could make a plan on whether to build a plant in Canada, Mexico or the United States without having some idea of the tariffs that could be levied upon it.

It is quite possible that Trump’s administration will seek to compensate exporters that will be hurt by these trade tensions, reducing any net revenue benefit for the U.S. federal government. Slower economic growth would also, of course, reduce revenue. Moreover, the prospect of higher inflation from the trade tensions would probably further delay any further U.S. Federal Reserve easing and possibly boost long-term interest rates. In this context it is worth noting that a 1% increase in U.S. Treasury interest rates across the board would eventually add USD 300billion to the annual interest paid on the U.S. federal debt.

Exhibit 2: Exposure to U.S. trade

2023

Source: FactSet, United States International Trade Commission, U.S. Department of Commerce, J.P. Morgan Asset Management. *EU represents European Union, with total exports excluding intra-EU trade. Data reflect most recently available as of February 3, 2025.

Trade tensions end game

As this is being written, it is completely unclear what the end game of these recent trade tensions could be. It may be that, over the course of negotiation, tariffs on Mexico and Canada are scaled back to 10%. However, tariffs could also be broadened to include Japan, Europe and other trading partners. One small restraining factor is that U.S. President Trump intends to use tariffs as a revenue source in paying for part of the extension of the 2017 tax cuts and other tax cuts that he promised on the campaign trail. It is possible that, as the big tax bill is being negotiated, he will want to settle on an amount to pencil in for tariff revenue and stick to it. However, experience from his first term and the first two weeks of his second suggest that policy uncertainty could persist.

It is also worth considering that other countries will tend to maintain tariffs to match the U.S. levies and could target particular U.S. companies as a way of concentrating their retaliatory fire power, with U.S. technology companies probably the most exposed to trade revenge.

Investment implications

In the meantime, investors have every reason to be concerned about the trade tensions. Last week’s GDP report on January 30th showed that the U.S. economy entered 2025 with plenty of momentum, and this should be further confirmed by the U.S. jobs report on February 7th. However, U.S. equity markets continue to carry high valuations both overall and particularly among mega-cap technology stocks. These trade tensions have the potential to impart a stagflationary impulse to this investment environment, boosting inflation and interest rates while dragging on growth and profits.

If this scenario unfolds, U.S. equities with the highest valuations are likely the most vulnerable while non-U.S. assets and real assets could provide ballast to portfolios. Most of all, investors should ensure that they are well diversified and balanced as we head into much stronger and uncertain trade winds.