The expected weakening of the U.S. dollar this year provides a tailwind for Asian hard currency debt, FX and equities.

In brief

- The possibility for policy easing by the Fed in response to the softening in inflation, rather than recessionary risks, could be seen as a driver for emerging markets local returns this year.

- Indeed, the retreat of the dollar and declining U.S. treasury yields into the new year have led to strong capital inflows into the Asia.

- The combination of a U.S. soft landing and inflation returning to the target in most Asian economies is likely to open the room for central banks in the region to cut rates, with the Bank of Japan as a stand-out.

- A weaker dollar environment could benefit Asian currencies. While Asian IG corporate spreads remain tight, current elevated yields provide cushion in the event of market volatility.

Fed delivers, emerging markets receive

After the Federal Reserve (Fed) hinted last December at the possibility of monetary policy rate cuts, markets are keenly watching incoming data for guidance on the timing of these cuts. As it stands, markets are expecting more rate cuts than indicated by the latest Federal Open Market Committee (FOMC) dot-plot. This implies that there could be some volatility across various asset classes over the coming months as repricing of Fed cuts gets underway. It is worth noting that these cuts are not in response to a sharp slowdown in U.S. economic growth, but rather the gradual decline of inflation towards the Fed’s target. A soft landing for the U.S. economy implies that growth differentials could move in favor of Asia, particularly with signs of a tech lift underway. Such a macro environment is set to be a driver for emerging markets (EM) local returns this year.

A conducive macro backdrop for Asian assets

The next few months could see some volatility in the long-end treasury yields owing to market’s repricing of the timing of rate cuts which could erase recent gains. Indeed, the 10Y treasury bonds have sold off with yields creeping up to 4.1% and the dollar gaining 2.1% since the start of the year, at the time of writing. Over the next 12-18 months, however, we expect long-end bonds to rally which implies that 10Y treasury bond yields could move lower. This is akin to December’s move when 10Y yields fell to 3.8% following October’s peak of 4.98%. The yield differential between the U.S. and Asia is thus set to narrow, making the latter more attractive and prompting capital inflows into the region. Moreover, the concomitant softening of the dollar could result in stronger Asian equity and local FX returns. Asian central banks are likely to begin to ease monetary policy as soon as early 2H24, providing a tailwind for Asian fixed income assets.

Real policy rates remain elevated across (most of) Asia

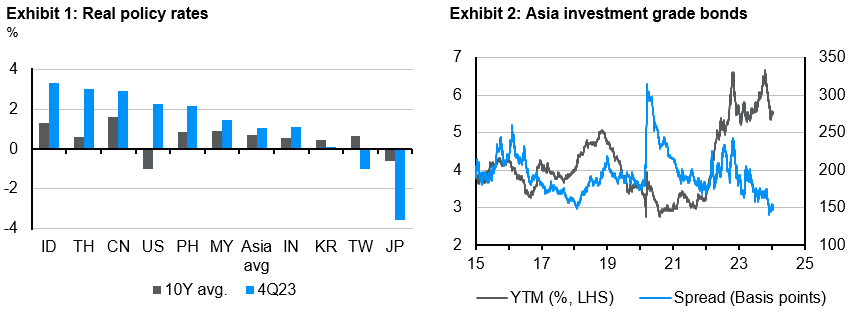

Faced with mounting inflationary and FX depreciation pressures, Asian central banks have raised policy rates albeit not to the same extent as other EMs. Real policy rates, defined as nominal policy rate less headline inflation, have risen above the 10Y historical average across most pockets of the region (Exhibit 1). Indonesia’s real policy rate is currently the highest in the region at 3.3% at the end of 2023 (vs. the 10Y average of 1.3%). Meanwhile, real policy rates are lower than the 10Y average in Korea, Taiwan and Japan.

Source: FactSet, CEIC, J.P. Morgan Asset Management. 10Y avg. covers 2010-2019 period (LHS). Data reflect most recently available as of 31/12/23.

Source: FactSet, CEIC, J.P. Morgan Asset Management. 10Y avg. covers 2010-2019 period (LHS). Data reflect most recently available as of 31/12/23.

This then raises the question if Asian central banks can cut policy rates in the near term, particularly as Developed Markets (DM) central banks are poised to embark on their easing cycles. Given the stabilization in external financial conditions, Asia may be on the cusp of a policy rate cutting cycle this year. This is underscored by the return of inflation to central banks’ target range, a relatively constructive growth backdrop and lower fiscal deficits across the region. However, Asian central banks are not in a hurry to kick off easing cycles given the considerations around the resurgence of inflationary pressures. As it stands, headline inflation remains above the official target range in Korea, Taiwan and the Philippines. In the case of Korea, the central bank this month stressed the need to remain vigilant on inflation. Meanwhile in Japan, the gradual increase in inflationary pressures lays the ground for the eventual end of negative interest rates, a process that is already underway with the relaxation of the Bank of Japan’s yield curve control (YCC) last year.

Borrowing costs set to lower for Asian issuers

Faced with high borrowing costs in recent years, governments and corporates in Asia have reduced bond issuances amid uncertainties around the future rate path. Fiscal positions were tightened while corporates deferred spending plans. The prospect of lower interest rates in DMs, however, could see a renewed rise in Asian bond issuances as borrowers flock to lock in lower yields. Borrowers are also likely to seek opportunities for refinancing of their debt. Last month alone, emerging market (EM) bonds, both in hard and local currency, rallied 7.8% and 3.5% respectively. Meanwhile, the J.P. Morgan Asia Credit Index (JACI) delivered returns of 5.0% in the same month. This comes as markets late last year were pricing in a higher chance of Fed policy rate cuts in 1H24. Against the backdrop of a weaker dollar and a more accommodative monetary policy stance, Asian bonds could deliver attractive returns following the performance in recent years.

Tight spreads, but yields are compelling

Akin to the U.S, the JACI credit spread squeezed tighter last month to 214 basis points (bp), below the 10Y average of 231bp. The credit spreads are pointing to a relative constructive macroeconomic outlook even as global interest rates could arguably stay high for longer in the coming months. However, investors should be cognizant of the risks around the baseline growth outlook for a soft landing. This includes a material slowdown in the Chinese economy, a sharper deceleration in U.S. growth and the potential spillovers from geopolitical tensions. Yet, we believe the starting point of relatively higher yields in Asia provides a cushion for potential volatility in U.S. Treasuries which may emanate from a more negative growth outturn. The JACI, for instance, is trading near the post-GFC highs at 6.5% yield to maturity (YTM), higher than the 2010-19 average of 4.8%. More specifically, JACI investment-grade (IG) yield currently stands at 5.4% YTM, with spreads near recent lows (Exhibit 2). Furthermore, the IG credit fundamentals of state-owned enterprises (SOEs) will be buoyed by continued funding in focus areas. The additional support in sectors such as high-end manufacturing would in turn lead to margin expansion, bolstering the credit quality of these corporates.

Investment implications

The expected weakening of the U.S. dollar this year provides a tailwind for Asian hard currency debt, FX and equities. The inflation deceleration in Asia inflation which opens the prospects of monetary policy easing by central banks in the region will be supportive for local currency bonds. While credit spreads are arguably tight, the elevated yields provide a cushion should market volatility arise stemming from risks to the growth outlook. With lingering growth uncertainties, Asian IG appears attractive for investors.

09oq242301060643