In its penultimate meeting of 2024, the Federal Open Market Committee (FOMC) unanimously voted to lower the federal funds rate by 25 basis points to a target range of 4.50%-4.75%.

In its penultimate meeting of 2024, the Federal Open Market Committee (FOMC) unanimously voted to lower the federal funds rate by 25 basis points to a target range of 4.50%-4.75%. Progress on disinflation and recent employment data supported the decision to move toward a more neutral policy stance, although possible robust incoming economic data or fiscal policy shifts could decelerate the pace of future cuts.

The statement language was tweaked but remained largely consistent in messaging:

- “Job gains have slowed” was changed to “Since earlier in the year, labor market conditions have generally eased” likely in reference to oscillating monthly payroll figures and declining job openings.

- The word “further” was removed in the line “Inflation has made further progress toward the Committee’s 2 percent objective” as disinflationary progress has somewhat plateaued above 2% with the latest CPI report coming in slightly above expectations.

- The phrase “has gained greater confidence that inflation is moving sustainably toward 2 percent” was also removed, an omission that Powell justified since this “confidence” was a condition required to commence an easing cycle that has now begun.

- Finally, the phrase “In light of the progress on inflation and the balance of risks” became a pithier “In support of its goals” likely reducing the emphasis on inflation alone as labor market data comes to the fore.

In the press conference, Chair Powell tried to evade political questions and redirect prognosticating on the December rate decision. Powell did not want to comment on the contribution of the fiscal backdrop to the recent rise in yields, but he did note that while the election has no near-term impact on monetary policy decisions, fiscal policy shifts could be factored in over time.

Looking ahead to December, Powell also commented that now is not an appropriate time for forward guidance given the high level of uncertainty. Markets are pricing in a 68% probability of a rate cut in December, although forthcoming inflation and labor market data will be the key determinants. Beyond December, the Committee could be put in an increasingly difficult position if possible future tariff and tax policies reignite inflationary pressures. However, Powell noted that the Committee is prepared to adjust the pace and destination of future cuts.

In response to the rate decision, 10-year Treasury yields continued to slide while equities rallied. As the dust settles on the election, investors ought to focus not on policy uncertainty but rather economic realities: disinflation, above-trend growth, a healthy labor market, and solid earnings growth, all of which should be supportive for equities. Fed cuts should translate to falling yields, but the recent rise in yields provides attractive income and presents a compelling entry point for bonds.

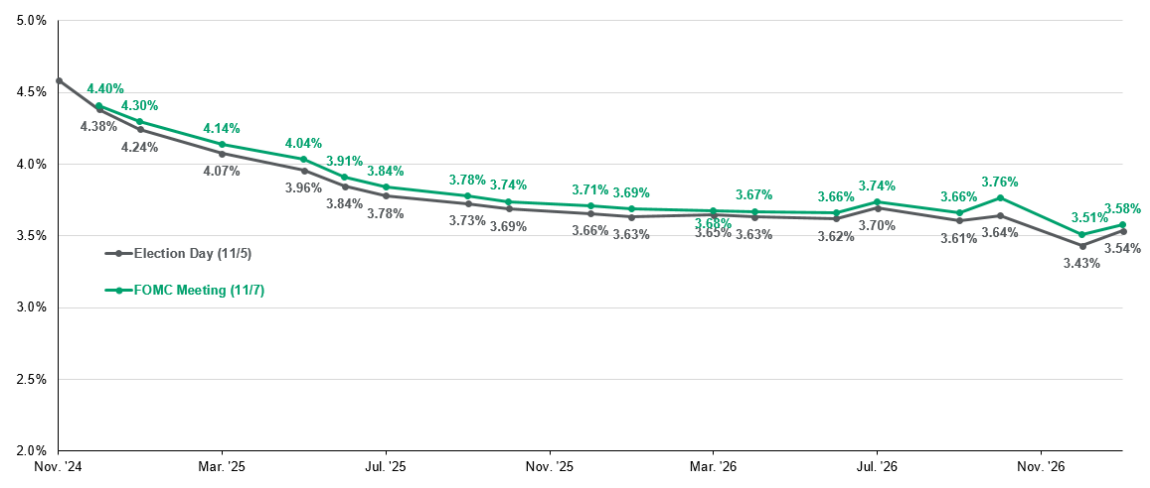

U.S. implied policy rates

Federal funds futures

Source: Bloomberg, J.P. Morgan Asset Management. Data are as of November 7, 2024.

Source: Bloomberg, J.P. Morgan Asset Management. Data are as of November 7, 2024.