Against a backdrop of healthy balance sheets of Asian tech companies, Asian high quality technology stocks could outperform, particularly those in Korea and Taiwan.

In brief

- The strong earnings and revenue performance delivered by the U.S. growth stocks underscores the sustained demand for Artificial Intelligence (AI) technologies such as generative AI.

- The structural boost for AI-related products and high-performance semiconductors could provide a tailwind for Asian tech manufacturers, in particular, Korea and Taiwan.

- Korea’s plans to improve corporate governance and shareholder engagement in the near-term could also enhance the earnings outlook.

- Healthy balance sheets of Asian tech companies, sustained demand for AI-related products and fair valuations of key markets could support Asian high quality technology stocks.

US tech earnings set the stage for Asian beneficiaries to shine

Amid the enthusiasm of AI, the Magnificent 7 delivered strong earnings and revenue performance last quarter. The bulk of the S&P 500 profit growth has been concentrated in these stocks outshining the rest of the benchmark. The divergence in the earnings between the Magnificent 7 and the remaining 493 companies underpins the relative outperformance of the former. The expectations of the sustained growth of the AI market fueled by demand for generative AI among other types of AI technologies will likely provide tailwind to the tech sector. Moreover, a falling yield environment is supportive for growth stocks e.g. technology stocks.

While the focus has remained on the U.S., the continued demand for AI technologies from the mega-cap companies is also expected to benefit Asian exporters that are involved in the regional tech supply chains. Korea and Taiwan, in particular, stand out given their dominance in the production of performance semiconductors and High Bandwidth Memory (HBM) chips. Moreover, the ambitious national plans to emerge as global chip leaders could raise global market share by these North Asian economies. Other Asian economies such as Malaysia that is heavily geared towards the Outsourced Semiconductor Assembly and Test (OSAT) are likely to benefit from the increased demand for AI technologies albeit to a lesser degree.

Taiwan: Taking cues from Asia’s tech bellwether

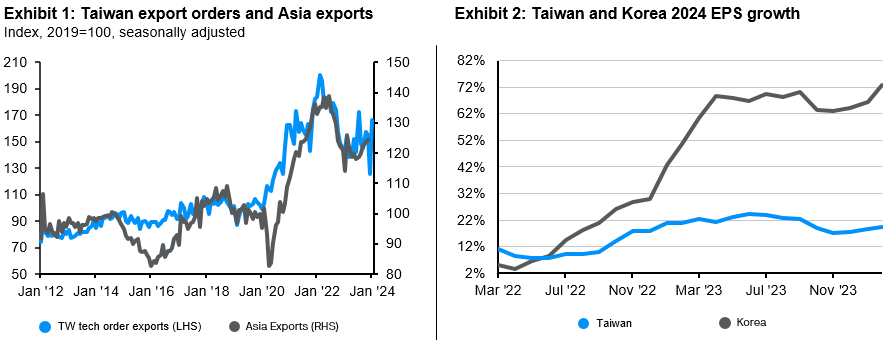

Taiwan stands as the epicenter of global semiconductor manufacturing, producing over 60% of the world's semiconductors and around 90% of advanced semiconductors. As a bellwether for the region’s tech cycle and global factory output more broadly, the export orders data from Taiwan is useful in signaling the posture of external demand. In that context, export orders last month staged a rebound, reversing the declines in November and December. The 30.3% month-over-month jump in tech export orders last month could point to the continued strong performance of Taiwan’s semiconductor suppliers related to the structural boost of AI-related products and high performing computing related demand.

Korea: Thank you for the memory (cycle)

Similarly, South Korea is experiencing an upswing in the tech cycle, concentrated around the growing demand for high performance semiconductors and HBM, a technology which provides higher computation ability. Leveraging on the existing dynamic random access memory technology, Korea’s HBM is increasingly pivotal in the generative AI space, through its use in Graphic Processing Units.

Source: FactSet, CEIC, J.P. Morgan Asset Management. Data reflect most recently available as of 28/02/24.

Incoming data continues to paint a constructive tech backdrop with the industry beginning to see a meaningful recovery in memory pricing and earnings, with additional tailwinds stemming from the build-up in customer inventories. Korea’s January exports rose 18.0%, affirming the solid underlying trend growth. In addition, a broader adoption of Generative AI will likely help broaden the performance to the rest of the Korean market.

Following Japan’s footsteps: Corporate governance program

As the tech cycle turns up, Korea is now seeking to improve corporate governance and shareholder engagement to reduce the long-standing Korean discount through a ‘corporate value-up program’, mirroring the ongoing Tokyo Stock Exchange corporate governance reforms. While details are scant at this juncture, the program plans to encourage companies to assess their relative low valuations and provide remedies, which may include enhancing shareholder disclosures, increasing shareholder returns through dividends, share buybacks, share retirement as well as improving operating performance. Based on the early success of these reforms in Japan, the impact on Korea’s market could be meaningful as nearly 70% of local companies are trading at a price-to-book ratio of below 1. We continue to expect continued positive announcements on the corporate governance front going into the Parliamentary election on April 10, especially amid the rising demand for governance improvements.

Investment implications

Against a backdrop of healthy balance sheets of Asian tech companies, Asian high quality technology stocks could outperform, particularly those in Korea and Taiwan. The ever-evolving landscape in AI implies the need to be selective when picking businesses with high quality growth.

As Taiwan continues to be a beneficiary from the strong AI and semiconductor demand, MSCI Taiwan is up 4.1% year-to-date, key contributing from IT sector, outperforming MSCI Asia ex-Japan. The booming demand for semiconductors, especially AI supply chain development, provided a more favorable backdrop for the Taiwan market. Analysts have been revising up the MSCI Taiwan 2024 earnings per share (EPS) growth to 19.4% from 17.4% at the end of last year. Valuations do not appear to be too stretched as the MSCI Taiwan 12m forward price-to-earnings (P/E) ratio stands at 16.57 times, just slightly above the 15-year average of 14.6 times.

Positive surprises in Korea’s earnings outlook could be on the horizons, buoyed by improving memory cycle, tech cycle upswing as well as the value-up corporate governance driver. The MSCI 2024 EPS growth has been revised up to 73.0% from 50.7% a year ago. Similar to Taiwan, Korea’s equity valuations appear fair with the MSCI Korea 12m forward P/E ratio at 11.4 times relative to the long-term average of 10.0 times.

Looking ahead, green shoots in tech export growth and solid tech earning report guidance should provide confidence that the semi downcycle is now behind us and offer opportunities in Korea and Taiwan. Considering recently bullish market sentiment, we still need to pay attention to a volatility rebound and the AI boom sustainability. Investors should remain mindful of the risks emanating from changes in regulatory environment that could impact earning potential of these Asian technology stocks.