The growth in AI, automation and digitalization could be supportive for the Asian tech sector and weather the projected slowing in the global economy next year.

In brief

- Some Asian economies have seen industrial production surprising to the upside in recent months, supported by the tech sector

- The tech inventory de-stocking trend by Asian manufacturers appears to be behind us, with incoming signs of inventory accumulation going into year-end

- Cyclical factors such as consumer demand reflecting the new smartphone launch and secular drivers such as demand for AI technology and High-Performance Computing (HPC) suggest that the tech cycle has bottomed

- High-quality Asian technology stocks could prove to be relatively resilient against a backdrop of weaker global growth next year, with gains in the Asian tech sector to proliferate into other sectors in the medium term

Green shoots in Asia’s tech sector

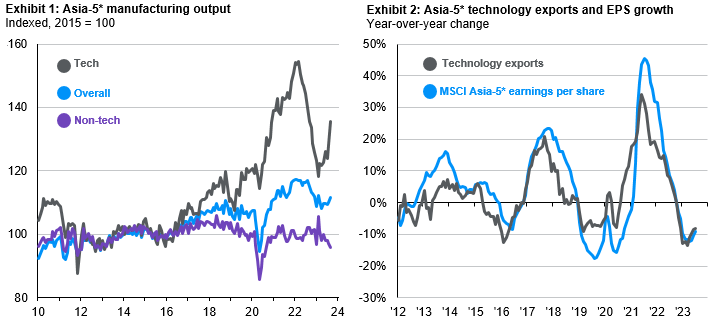

Asia’s tech sector has risen in prominence since 2016 with tech-related output outpacing non-tech. However, Asian tech-related production has slowed considerably after peaking in early 2022, in turn weighing on the region’s overall manufacturing sector. Asian tech manufacturers underwent inventory adjustments through the better part of this year even as the global cyclical backdrop had remained relatively resilient. In recent months, however, tech-related industrial output by key Asian producers have surprised to the upside, led by strong semiconductor production growth. Indeed, following the inventory overhang, there are signs of inventory accumulation, pointing to a more constructive near-term outlook by Asian tech manufacturers. Looking ahead, the tech-related sector will continue to support regional growth even as domestic demand could see some pullback into next year.

Source: CEIC, FactSet, J.P. Morgan Asset Management. *Asia-5 refers to South Korea, Japan, Singapore, Taiwan and Thailand. Data as of 11/28/2023.

Cyclical and secular drivers provide tailwinds for Asian tech bellwethers

The posture of the Asian tech cycle is underscored by both cyclical and secular drivers. The demand for consumer tech, such as smartphone launches and PC restocking, will likely support the near-term Asian tech outlook.

Our view of a more prolonged upturn in the tech cycle into next year, however, is premised on the ongoing structural shifts fueled by AI (artificial intelligence) and digitalization. Akin to the U.S. where developments in the AI space have arguably driven gains in the tech sector, in part due to policies such as the CHIPS and Science Act, AI demand growth has also provided tailwinds for Asian tech producers through the demand for high performance memory chips. With an existing network of high-end foundry technology, Asian tech giants are likely to benefit from expansions in AI and automation over the medium-term.

Focus on secular drivers: AI, digitalization & automation

The expansive world of AI from language model-based chatbot to predictive healthcare has made AI a priority in some Asian economies’ national growth roadmaps over the next decade. Back in 2019, Korea announced the “National Strategy for Artificial Intelligence”, outlining strategies and initiatives around establishing an AI ecosystem.

Fast forward a few years, the recent tech lift in Korea is concentrated around the growing demand for high performance semiconductors, High Bandwidth Memory (HBM), technology which provides higher computation ability. Leveraging on existing DRAM technology, Korea’s HBM is increasingly pivotal in the generative AI space, through its use in Graphic Processing Units (GPUs). Other Asian economies, albeit to a lesser extent, are also likely to benefit from the AI rally in the medium term.

China: Near-term AI headwinds

The enactment of the CHIPS and Science Act by the Biden administration has added a technological dimension to US-China relations more recently. China’s lack of investment in core AI technology thus far coupled with weak business sentiment could pose near-term challenges for the sector. While domestic policies could turn more accommodative, elevated tensions around intellectual property rights and protectionist policies in key economies continue to be a hurdle. However, Chinese equities remain an essential part of investors’ portfolio with opportunities to be found in emerging sectors such as renewable energy, electric vehicles and advanced manufacturing.

Positive signals in earnings’ growth next year

The combination of good earnings outlook at reasonable valuations (based on current depressed earnings expectations) presents some opportunities. Earnings growth in the information technology sector, which include major tech names, is set to stage a strong rebound next year following an estimated 50% decline in 2023. This is consistent with some Asian economies’ corporate earnings next year. Based on analysts’ earnings per share forecast for MSCI, earnings are expected to grow 63% in Korea, 17% in Taiwan and 8% in Japan.

From a valuation perspective, while Asia tech (ex-AI) price-to-earnings (P/E) ratios are running at one standard deviation above 10-year average levels, this is fairly justified given depressed earnings. On a price-to-book (P/B) basis, Asia tech (ex-AI) are trading at 10-year mean levels, with potential further upside earnings revisions and ROE improvement. Nonetheless, the bulk of the future upside in Asia tech should be primarily driven by EPS growth rather than an upward re-rating of P/E valuation from current levels.

Investment implications

The growth in AI, automation and digitalization could be supportive for the Asian tech sector and weather the projected slowing in the global economy next year.

Against a backdrop of healthy balance sheets of Asian tech companies, Asian high quality technology stocks could outperform. That said, we are mindful of the risks emanating from changes in regulatory environment that could impact earning potential.

The ever-evolving landscape in AI implies the need to be selective when picking businesses with high-quality growth. While key Asian tech businesses could see gains at the start, the proliferation of these technologies into other sectors could reveal opportunities in infrastructure and predictive healthcare.

09f6232811062300