Inflation is not truly defeated and therefore it is too early to discuss rate cuts.

In brief

- Central bankers disagree with the market’s expectation for prompt rate cuts in 2024, as the fight against inflation is not over.

- Although the market direction since October is in line with our 2024 market outlook, the speed and magnitude of decline in bond yields has been too fast.

- Lower bond yields and a more flexible Fed should also prompt investors to venture into high yield corporate debt and a broader allocation across sectors in U.S. equities.

Last week was pivotal for the global markets as the Federal Reserve (Fed) finally opened the possibility of policy easing. While the European Central Bank (ECB) and the Bank of England (BoE) both kept their policy rates unchanged, they were not ready to entertain the idea of rate cuts just yet. Nonetheless, the futures markets were indicating considerable policy rate reductions for all three central banks. Government bond yields have also dropped considerably to mirror this view. Are investors too optimistic about policy easing in 2024?

What are the market telling us?

As of the time of writing, the futures markets are expecting policy rates in the U.S., Europe and the UK to decline by 126 basis points (bps), 145 bps and 107 bps respectively. In steps of 25 bps cuts, that would be approximately 5 cuts, 6 cuts and 4 cuts for these three major central banks. Meanwhile investors are expecting one 25 bps hike in Japan over the next year. This re-evaluation of policy settings led to a sharp drop in government bond yields across the world. 10-year U.S. Treasury (UST) yield fell below 4% for the first time since August.

In the case of the U.S., a total decline in 126 bps in policy rate in 2024 is more than the forecast by Federal Open Market Committee (FOMC) members in the December Summary of Economic Projections, which indicated that the median forecast is for policy rate to drop by 75 bps, with majority of the FOMC members (16 out of 19) predicting a range of 50-100 bps cuts next year.

What are central bankers telling us?

Overall, the message from central bankers is that the market is getting ahead of itself in pricing in such aggressive rate cuts in 2024. Inflation is not truly defeated and therefore it is too early to discuss rate cuts. New York Fed President John Williams said after the FOMC meeting that the committee is not really talking about rate cuts at this point. A similar view was echoed by both the ECB’s president Christine Lagarde, who said “we should absolutely not lower our guard” against inflation pressure, and BoE’s governor Andrew Bailey, who said there was “still some way to go” before inflation hit its target. In fact, three out of the nine members from the BoE Monetary Policy Committee voted for another 25 bps rate increase in the December meeting.

Growth momentum in the eurozone and the UK is weaker than the U.S., yet their central bankers are still worried that a tight job market will keep wage growth high and inflationary pressures elevated. In Europe, a large proportion of the labor force is covered by collective bargaining and wage negotiations in 1H 2024 could bring fresh momentum in wage growth. In the UK, the labor supply recovery has lagged the U.S. and eurozone after the pandemic, which also translates into higher pay, and potential pass through to higher consumer prices.

What could trigger rate cuts?

While the average period between the last hike and the first cut has been around nine months, it would be too simplistic to expect the same this time. The Fed just went through the toughest fight against inflation in decades and the job market is still in solid shape. To justify the central bank to start cutting in March, a significant deterioration in economic data, or a sizeable financial shock, would be needed. For the ECB and BoE, despite their current hawkish position, the risk of being forced to make an early move due to weak growth dynamic is higher relative to the U.S.

A more probable path is for inflation to keep grinding lower and the impact from higher rates slows the economy naturally. This could point towards rate cuts starting in mid-2024 to prevent the real policy rate (policy rate minus inflation) from rising too much. Moreover, the recent drop in UST yields would have already helped to loosen financial conditions and raise the probability of a soft landing. This would also give the Fed more time to adjust its policy.

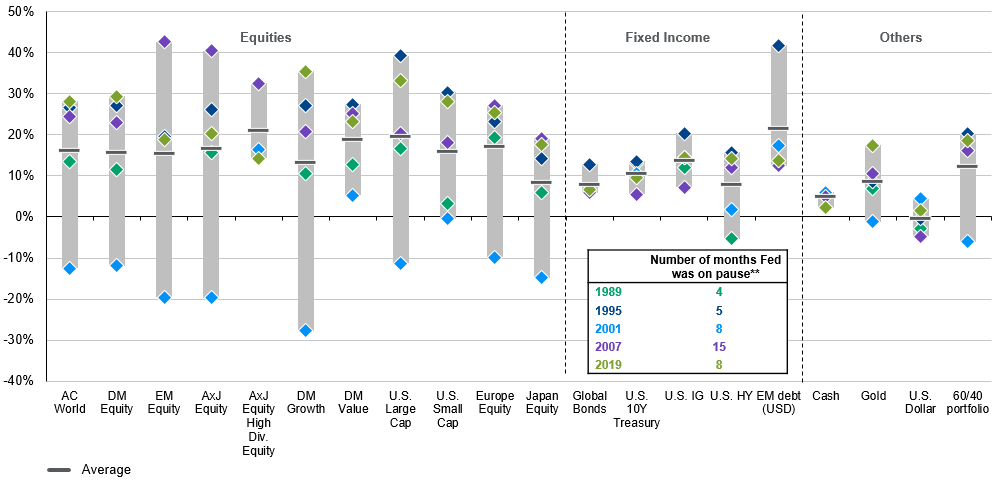

Exhibit 1: United States: Last rate hike and market performance

Asset class returns following the end of rate hikes

Average returns* a year after the past five rate hike cycles ended

Source: FactSet, U.S. Federal Reserve, J.P. Morgan Asset Management. Based on MSCI AC World Index (AC World), MSCI World Index (DM Equity), MSCI Emerging Markets Index (EM Equity), MSCI Asia Pacific ex-Japan Index (AxJ Equity), MSCI Asia Pacific ex-Japan High Dividend Yield Index (AxJ Equity High Div. Equity), MSCI World Growth Index (DM Growth), MSCI World Value Index (DM Value), S&P 500 Index (U.S. Large Cap), Russell 2000 Index (U.S. Small Cap), MSCI Europe Index (Europe Equity), MSCI Japan Index (Japan Equity), Bloomberg Global Aggregate (Global Bonds), Bloomberg U.S. Treasury Bellwethers 10Y (U.S. 10Y Treasury), Bloomberg U.S. Corporate Investment Grade Index (U.S. IG), Bloomberg U.S. Credit Corporate High Yield (U.S. HY), J.P. Morgan EMBI Global (EM Debt USD), Bloomberg U.S. Treasury Bills 1-3M (Cash), Gold New Spot price (Gold), U.S. dollar index (U.S. dollar), 60% AC World and 40% Global Bonds (60/40 portfolio). *Total returns in local currency are used, unless otherwise specified. **Refers to the duration between the last rate hike and the first rate cut, specifically Feb '89 - Jun ‘89, Feb '95 - Jul ‘ 95, May '00 - Jan ‘01, Jun '06 - Sep ‘07, Dec '18 - Aug ‘19.

Guide to the Markets – Asia. Data reflect most recently available as of 30/09/23.

Investment implications

Falling bond yields, a lower U.S. dollar and positive equity performance since mid-October are largely in line with what we expect following the end of the hiking cycle. We believe this could be the overall market direction in 1H 2024.

Given the speed and magnitude of adjustment, we could see some consolidation in the near term with UST yields rebounding, especially if there are upside surprises in inflation or job data. With the current level of UST yields, investors may choose to broaden their fixed income allocation to include high yield corporate debt. Despite the tight credit spreads, the high level of yield to maturity provides solid income opportunities. The fact that the Fed is willing to be more flexible with policy rates also helps to reduce the risk of the U.S. economy falling into a sharp recession, and a spike in default.

The same applies to equities. A falling yield environment should allow for more valuation re-rating for growth stocks and technology. The prospects of a sustained economic growth should allow investors to broaden their U.S. equity allocation across sectors. Meanwhile, a weaker U.S. dollar should also prompt greater inflow into Asian equities, especially into export-oriented markets, considering the recent improvement in export performance in the region.