The pricing of equity options incorporates two essential elements: an estimate of the future value of the underlying shares at the maturity of the option contract and the volatility of the shares over the life of the contract. The positive expected value that results can be monetized by the sale of call options. This creates an interesting opportunity for investors: Instead of simply holding stocks and waiting to see what the uncertain future may bring, they can sell a portion of the potential upside in exchange for immediate income. Done systematically, this mechanism can transform historically volatile, low income equity allocations into a hybrid asset class with higher income and lower volatility.

The value of hybrid investments

Assets classes with high expected returns are generally characterized by significant volatility and low levels of current income. Although this may suit long-term investors that are focused on total return, many seek greater balance in their portfolios. Historically, this balance was obtained by pairing more volatile assets, such as equities, with low volatility, negatively correlated assets, such as bonds. For the past few decades, this pairing has worked well, and—as an added benefit—these fixed income portfolios have provided safety, diversification, income and positive returns.

But no more. As low yields and limited return potential constrain the ability of bonds to offset the volatility of stocks, the effort to reduce portfolio volatility with traditional fixed income strategies has become increasingly costly. Earnings from traditional fixed income sectors have dwindled. Against this backdrop, investors ought to consider hybrid investment strategies that don’t rely on risk management from other allocations within the portfolio but instead offer a mix of return, risk, income and liquidity that meets the investors’ long-term objectives. We recently outlined the potential for capital structure to offer this type of investment profile via the use of mezzanine debt. Here, we focus on an entirely different pathway—optionality—to arrive at a similar result.

Combining prudent, disciplined call writing with an active equity portfolio can solve a number of potential needs. The pairing can serve as a low volatility equity substitute, a yield-generating replacement for credit or a component of a more diversified income generation strategy. We refer to this approach as an equity premium income strategy. The strategy involves complexity, and skill is required to implement it, but—as we will demonstrate below—the net result is a unique and potentially valuable tool.

Selling volatility in the options market

Current high equity valuations and low bond yields offer diminished prospects for generating returns from traditional beta sectors and a higher likelihood of negative total returns if markets normalize. Selling a portion of potential future upside increases the probability of positive returns at the expense of a lower possibility of very high returns. This combination of a long equity position and a short option position, with income included, also results in a less volatile investment overall.

Over longer horizons, equity valuations and market volatility will shift, and the value of selling options will change as well. But investors can use a variety of techniques to improve the performance of the basic approach, as outlined below.

Sell call options on higher volatility equities, own lower volatility equities for downside protection

There is no rule that requires the index on which the options are sold and the underlying portfolio to be identical. Although any differences between the two constitute a form of basis risk, this risk can be well contained and tilted in the investor’s favor. Here’s how to think about the process:

- The deepest and most liquid options markets exist for major market benchmarks, such as the S&P 500. Sellers of options will want to focus their activity on these instruments because they allow for more timely and sophisticated forms of programmatic option sales (more on this aspect in a moment).

- These market cap-weighted benchmarks also tend to embed a relatively high level of volatility compared with other active or factor-based equity strategies. This structure is a feature, not a bug! The premium realized from option sales will be higher as a result.

- Downside risk is contained entirely within the underlying equity portfolio. Investors can use active management to optimize this portfolio for low overall volatility and allow the value of the option to monetize the projected upside and volatility of the market benchmark.

A specialized form of active, low volatility equity is needed

Relative to passive market cap-weighted benchmarks, which tend to increase exposure to higher volatility companies and sectors, an actively managed equity portfolio can be designed specifically for the purpose of reducing volatility and downside risk. Simple factor-based benchmarks focused on value or dividend income are not adequate substitutes. The customized construction of such a portfolio involves the following key steps:

- First, a seasoned active management team with proven valuation skills applies fundamental bottom-up analysis to identify a diversified portfolio of high quality individual equities that offer attractive return and risk characteristics.

- Second, the manager runs this pool of equities through a top-down screening process to identify those with the lowest earnings and price volatility, further tilting the portfolio toward more stable and resilient business models in sectors with higher barriers to entry for competitors.

- Third, as a consequence of the overall strategy—which generates its income from option sales—the team no longer needs to prioritize high dividend equities that may have less attractive fundamentals; dividends are an asset to the equity portfolio but not the first priority.

The final result is an equity portfolio with a beta of approximately 0.8 relative to the broader market. We can think of this lower beta, and the lower downside capture that accompanies it, as being akin to owning a market portfolio with a tailored hedge program. In a traditionally hedged equity portfolio, purchasing put options provides explicit downside protection at a particular strike price. Across time, the mark-to-market value of the combined equity portfolio and put options will exhibit lower downside capture than the portfolio alone. Such strategies can be subject to the decay of the options’ value over time, however, and include the possibility of having to fully absorb losses up to the level of the option strike. Using a defensive equity portfolio with lower beta can achieve a similar level of downside protection without the idiosyncrasies of put options.

Optimizing the option program

A common challenge in option-selling strategies is navigating the trade-off between maximizing an option premium and retaining a meaningful level of underlying market exposure. After all, investors own equities primarily because they want the potential gains. Selling options with long maturities and low strike prices can produce very high levels of income but removes most (if not all) of the upside. Selling options with short maturities and more distant strike prices will allow investors to retain market exposure, but generates little in the way of income. Although these relationships are largely immutable, there are some techniques that can be deployed to improve the payoff structure (Exhibit 1).

Achieving a desired level of income requires a thoughtful approach to option selling

Exhibit 1: Options overlay: As volatility increases, so does the potential for realizing incremental income

Source: Bloomberg, CBOE and J.P. Morgan Asset Management. Data as of August 31, 2021. For illustrative purposes only. The graph above illustrates the upside opportunity of selling rolling monthly out of the money 30-delta calls.

Maintaining the consistency of option value across time is helpful. Market conditions—specifically, market volatility—will change in due course, and the value of options with identical maturities and strike prices will change as well. Investors seeking steady income will benefit from selling options with a consistent value that reflects changing market conditions by recognizing current volatility levels and adjusting accordingly. All else being equal, increased volatility allows for the realization of greater incremental income, since options get more expensive when volatility rises—a net benefit for options sellers.

Time diversification of option sales is also key. If investors have to choose between less frequent sales of options with higher notional values and more frequent sales of options with smaller notional values, we prefer the latter. This frequency allows the portfolio to adjust to markets across time and avoids turning the selection of option sale and maturity dates into a risky game of market timing.

Portfolio implications

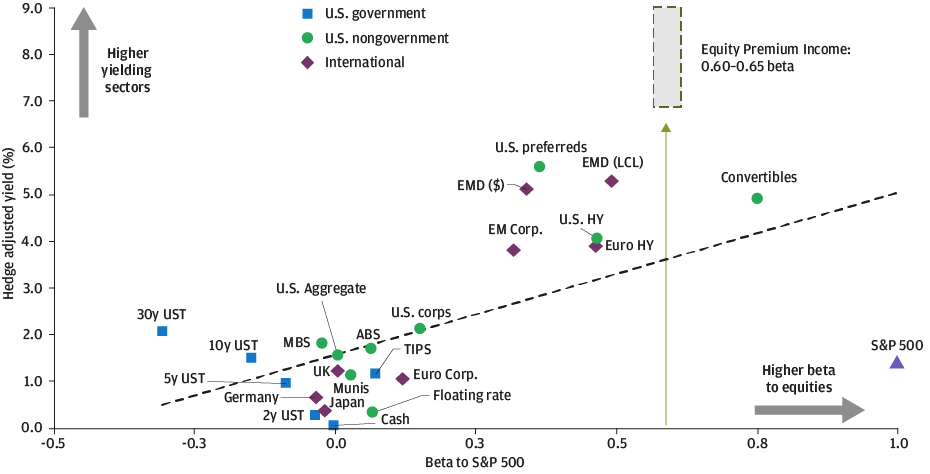

Many total return-focused investors have been looking for alternatives to low yielding, duration-sensitive core fixed income; their searches have naturally led them to more credit-sensitive sectors, such as high yield debt, bank loans and preferred equities. Moving out of fixed income and into this hybrid asset spectrum may seem radical, but it is not particularly risky. As Exhibit 2 makes clear, the level of additional beta risk from moving to an equity premium income approach is modest. The strategy also delivers significant yield enhancement with effectively no duration risk, offering greater investment resilience in a period of rising inflation and interest rates. A smaller allocation to an equity premium income strategy can replace a larger portfolio of lower yielding bonds, freeing up capital for other low volatility approaches.

Moving from a traditional equity allocation to an equity premium income approach introduces modest additional beta exposure while delivering significant yield enhancement

Exhibit 2: Balancing income and equity exposure is essential to portfolio construction

Source: Bloomberg, FactSet, ICE, J.P. Morgan Asset Management. Sectors are Bloomberg indices except for EMD and ABS – U.S. Aggregate; MBS: U.S. Aggregate Securitized - MBS; U.S. Preferreds: S&P U.S. Preferred Stock Index; U.S. corps: U.S. Corporates; Munis: Muni Bond; Cash: 1-3m Treasury; U.S. HY: Corporate High Yield; TIPS: Treasury Inflation-Protected Securities (TIPS); Floating Rate: U.S. Floating Rate; Convertibles: U.S. Convertibles Composite; ABS: J.P. Morgan ABS; EMD ($): J.P. Morgan EMBIG Diversified; EMD (LCL): J.P. Morgan GBI EM Global Diversified; EM Corp: J.P. Morgan CEMBI Broad Diversified; Euro Corp.: Euro Aggregate Corporate; Euro HY: Pan-European High Yield. Convertibles yield is based on the U.S. portion of the Bloomberg Barclays.

Global Convertibles. Country yields are represented by the global aggregate for each country. Yield and return information based on bellwethers for Treasury securities. Correlations are based on 15-years of monthly returns for all sectors. International fixed income sector correlations are in hedged U.S. dollar returns except EMD local index. Yields for all indices are hedged using three-month LIBOR rates between the U.S. and international LIBOR and are as of September 30, 2021. Guide to the Markets – U.S. Data are as of September 30, 2021.

We have also observed many liability-focused investors reducing their exposure to equity as part of a broader de-risking glide path. Currently, much of this capital is destined to land in historically low yielding, long-duration credit portfolios that offer a close fit to liabilities but little hope of meaningful positive performance going forward. Reducing equity beta while increasing income may be a far more efficient alternative to liability-driven investing in this market environment. Pension sponsors looking to reduce risk should consider shifting from a traditional equity strategy to an equity premium income strategy and, if further de-risking is needed, wait for a better entry point to de-risk with long-term bonds.

Conclusion

Many investors regard income generation and total return performance as divergent objectives that can only be achieved by using different asset classes. This dynamic may well hold true for traditional market betas but investors also have the ability to look beyond common market sectors for investment strategies that combine these attributes in a more balanced way. An equity premium income strategy, like other hybrid investment categories, can transform traditional equity beta into a more attractive mix of higher income and lower volatility. In so doing, it diversifies the strategic asset allocation lineup, provides greater flexibility to return-seeking investors and allows liability-hedging programs to avoid inefficient de-risking.