What are ETFs?

Like mutual funds, ETFs pool investor’s money into broadly diversified, professionally managed baskets of stocks and/or bonds.

ETFs are bought and sold on exchanges, like stocks, giving investors access to markets and their money throughout the trading day.

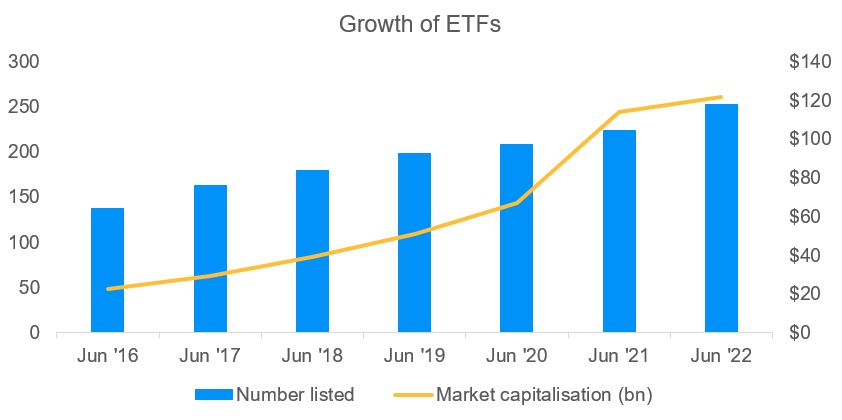

Why are ETFs growing so fast?

Efficient: ETFs allow investors to access professionally managed portfolios in a cost-effective way.

Tradable: ETFs can be easily traded throughout the day and turned into cash as needed.

Flexible: ETFs can provide access to virtually every market worldwide – with the flexibility to quickly move in and out of them as conditions change.

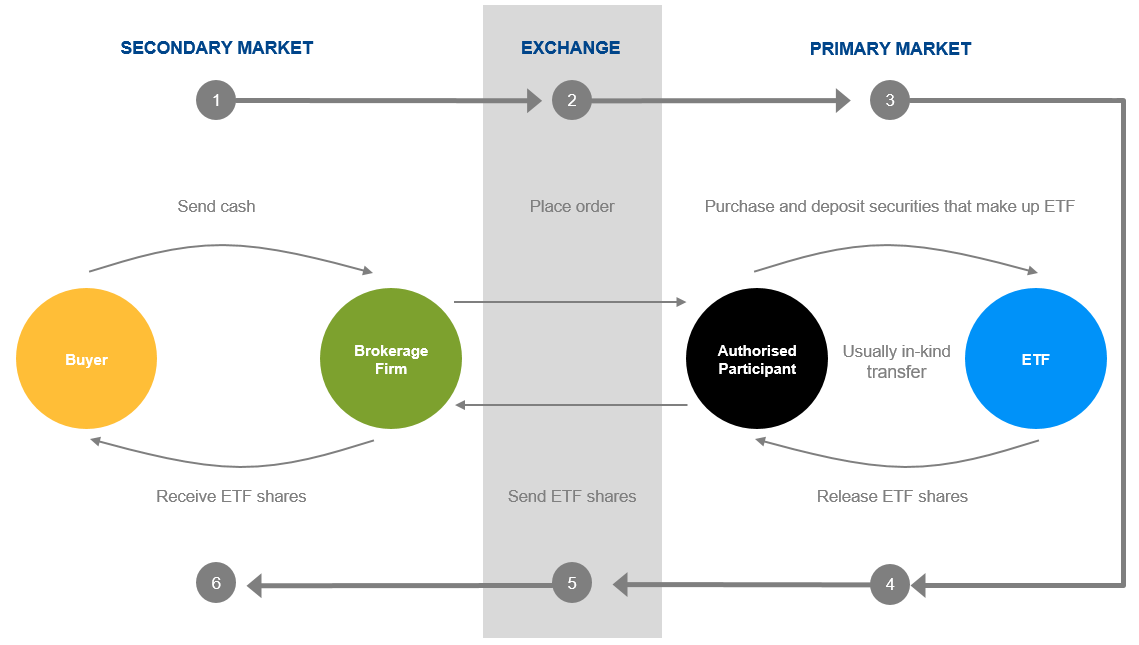

How does an ETF work?

The supply of an ETF’s shares can be increased or decreased to help its price reflect the value of its underlying portfolio holdings. Here is an example of how ETF shares are redeemed:

Market maker buys ETF shares

Shares are redeemed by sending them through an Authorised Participant (AP) to the ETF issuer, in exchange for the underlying securities

Market maker sells those securities

As ETF shares are created or redeemed from the market, it helps balance the trading price of the ETF in line with the value of the underlying portfolio. The process happens in reverse when more shares are needed to meet buyers’ demands.

This mechanism of creating and redeeming shares helps ETFs trade at prices close to the market value of their portfolio holdings

What types of ETFs are available?

On one end of the spectrum are purely passive ETFs tracking broad market indexes. Passive investing seeks to match the portfolio holdings and performance of a market benchmark index, providing an easy, cost-efficient way to add market beta.

In the middle are strategic or smart beta ETFs. They aim to track the performance of custom-built indices designed to enhance the return potential of market cap-weighted portfolios by distributing risk more evenly across regions, sectors and stocks.

On the other end of the spectrum are active ETFs, in which professional portfolio managers pick only those securities that they consider the most attractive to target a specific outcome—such as to generate an income or outperform a benchmark.

How are investors using ETFs?

The wide variety and versatility of ETFs allow them to play a variety of roles in an investor’s portfolio.

The ability of ETFs to mirror broad stock and bond indexes can make them good building blocks for a core portfolio.

ETFs targeting specific regions, sectors and strategies can be used in several ways to enhance diversification. For example, they can complement core holdings, fill gaps, realign an unbalanced portfolio or provide access to otherwise hard-to-reach markets.

Investors are also using ETFs as a more cost-efficient way of investing. And because ETFs can be traded quickly and easily throughout the day, they’re effective vehicles for moving in and out of markets as new opportunities and risks arise.

Investments involve risks, not all investments are suitable for all investors. Diversification does not guarantee positive returns or eliminates risks of loss.