Seeking opportunities for consistent income with lower volatility

November 2022

The rise in government bond yields in the last year means that investors may again be considering the bond market as a reliable source of income. However, it comes with a new set of trade-offs. Aggressive central bank tightening to combat inflation at multi-decade highs has generated significant volatility in an asset class often sought for its stability. Meanwhile, yields that are rising in response to higher inflation and higher interest rates are a double-edged sword, given inflation-adjusted yields are still largely negative around the world.

Further out on the risk spectrum, areas such as corporate high yield and emerging market debt come with their own challenges in today’s market environment. The weakening growth outlook and possible recession in Europe and the U.S. could see the value of these assets drop significantly. Credit is often viewed as a non-recessionary asset for a reason: it tends to do well when there isn’t one.

Today’s income investors face a tough choice – hold cash and core bonds paying low real rates or extend into higher-yielding markets with more risk and less liquidity. The actively managed JPMorgan Equity Premium Income ETF seeks to resolve the dilemma by pursuing opportunities for consistent monthly income and potential appreciation, with lower volatility than the U.S. stock market.

A lower volatility equity ETF seeking income as the outcome

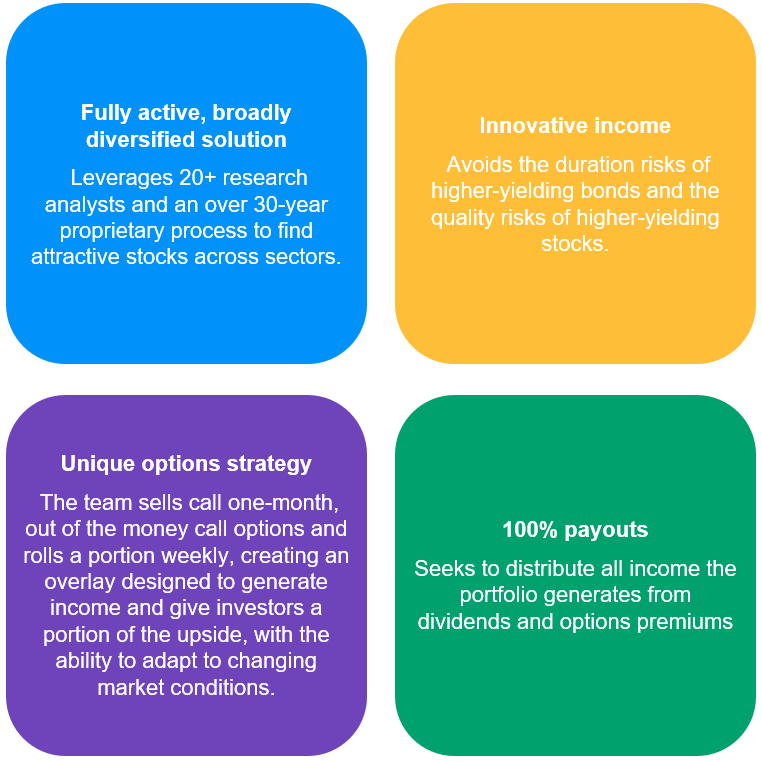

JEPI brings the same people, process and philosophy from an established mutual fund to a low-cost, liquid ETF vehicle with daily transparency. The strategy focuses on combining exposure to equities with options to strike a balance among yield, capital growth and managing risk. JEPI seeks to deliver a significant portion of the returns associated with the S&P 500 Index with less volatility, in addition to monthly income.

Here’s how it works: We use fundamental bottom-up research to build a higher-quality, lower-beta portfolio of U.S. large cap equities with less volatile earnings and share prices. We then sell index options against that long-only portfolio and use the premiums to generate income. The result is a lower volatility equity income strategy designed to manage downside exposure by forgoing some upside participation.

JEPI provides:

How JEPI can complement an overall portfolio:

Pursues consistent, attractive yields through changing interest rate and equity dividend environments.

Provides opportunities to deploy excess cash to ease back into equity exposure with lower volatility.

Could enable investors to manage downside risks in equity portfolios by locking in gains from dividend strategies and reinvesting the proceeds in a lower volatility equity portfolio seeking income as the outcome.

ETFs have fees that reduce their performance, indexes do not. Investors cannot directly invest in an index. The market price is generally determined using the official closing price of the Fund. Provided for reporting purposes only and should not be considered as offer, research, advice or recommendations to purchase or sell any particular security. Each individual security is calculated as a percentage of the net assets. The Fund seeks to achieve its stated objectives, there is no guarantee they will be met. Dividends or returns are not guaranteed. Returns assume that an investor purchased units at Net Asset Value and does not reflect the transaction costs imposed on the creation and redemption of units, brokerage or the bid ask spread where applicable that investors may pay to buy and sell units on the Australian Securities Exchange.

Provided to illustrate investment process, not to be construed as offer, research or investment advice. Investments involve risks, not all investments are suitable for all investors. Risk management does not imply elimination of risks. Diversification does not guarantee positive returns or eliminate risks of loss. The fund seeks to achieve its stated objectives, there is no guarantee they will be met. Dividends or returns are not guaranteed. Investors should refer to offering documents for further details.